- Sports 150

- Posts

- Streaming Seniors, Token Tickets, and Stadium Tax Hacks Drive ROI

Streaming Seniors, Token Tickets, and Stadium Tax Hacks Drive ROI

Boomers embrace streaming, NFTs transform tickets into yield, and tax-smart stadium builds show where the next wave of sports ROI is headed.

Good morning, ! This week we’re diving into the tax incentives fueling a global stadium boom, why 50+ sports fans are now the fastest-growing streaming audience, how NFTs are reshaping ticketing as an asset, and what Europe’s fragmented gamer market means for eSports expansion.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

MEDIA & SPORTS

Sports Fans Aged 50+ Are Now Streaming—and Paying Attention

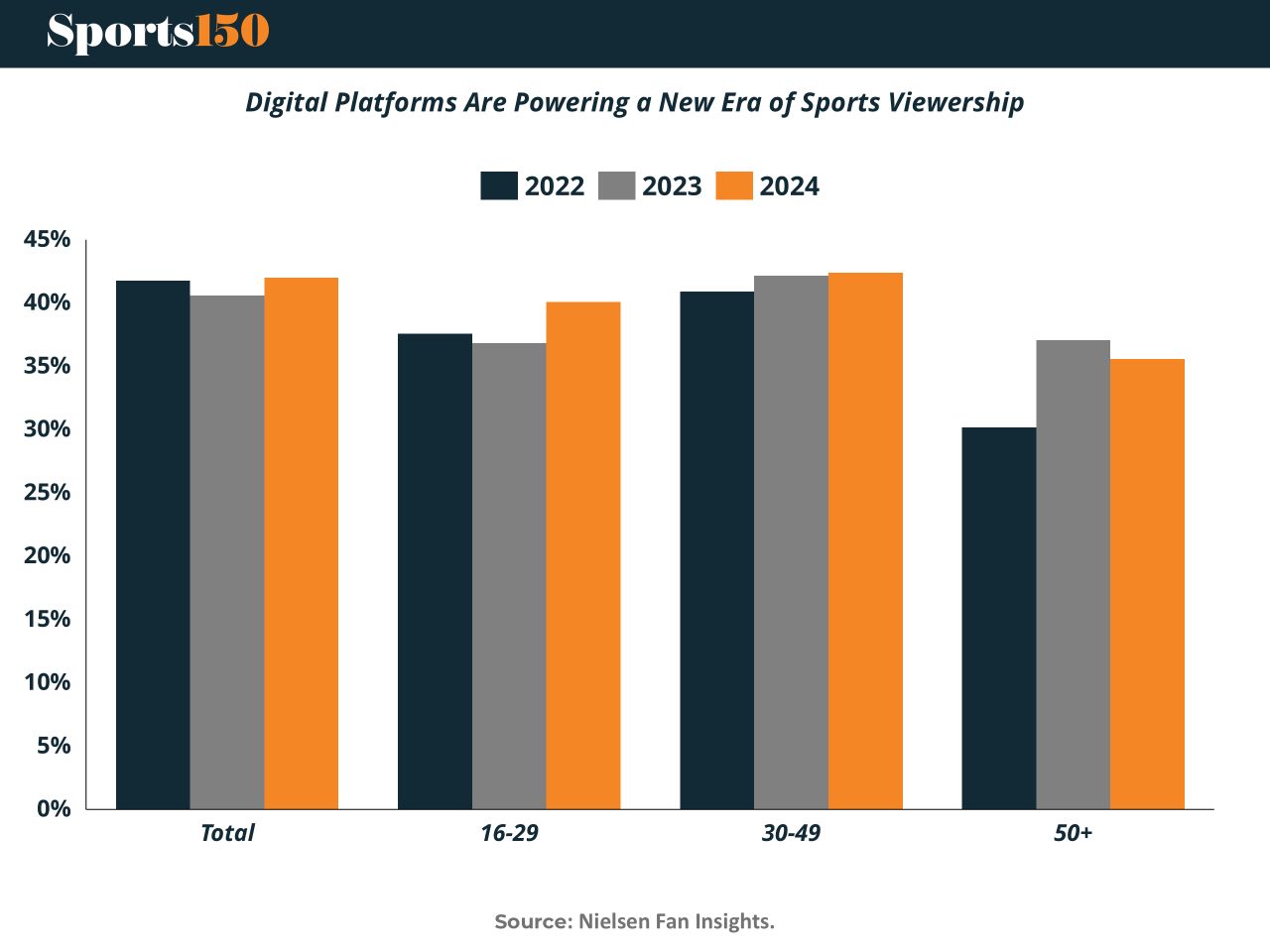

Digital platforms are no longer just Gen Z territory. From 2022 to 2024, streaming usage among sports fans aged 50+ jumped by ~20%, the sharpest gain across any group, per Nielsen. That closes a gap once thought unbridgeable.

The 30–49 cohort remains the most plugged in (43%), but even 16–29 year-olds have seen steady growth, rising to 40% in 2024. Across the board, sports is still one of the few appointment-viewing formats that scales across platforms and generations.

The lesson: legacy media doesn’t need to fear tech-powered leagues like TGL—they should build them. (More)

CAPLINK x PE150 PRESENT

Where Story Meets Strategy—and Capital Moves | US Open Series

This US Open, 150 Media will host a private, invite-only morning at the intersection of elite athletic brand power and modern private equity strategy. Two panels. One room.

The lineup includes some of the most influential figures behind the greatest athlete-brand partnerships of the past 25 years.

The focus? How reputation, narrative, and legacy can be transformed into durable equity value. How agents and founders structure long-term capital plays. And what PE can learn from the people who built brands that last a century.

A limited sponsor opportunity is available for a firm looking to align with this room of operators, agents, and allocators. Branding, thought leadership, and curated access—all structured around editorial integrity and audience trust.

If your firm is interested in being part of this conversation, reach out for details. (Limited to One Sponsor per Panel)

To inquire about partnership, contact: [email protected]

INVESTOR CORNER

NFTs Turn Season Passes into Multi-Asset Investments

In 2025, NFT-based season passes have evolved from novelty to business backbone. From Lazio to Kochi United, clubs are minting tickets as digital assets—offering VIP perks, exclusive content, and resale value.

For investors, this isn’t about collectibles—it’s about cash flow. Tokenized tickets enable recurring revenue through royalties, secondary sales, and fan engagement ecosystems. Even better? Blockchain-backed verification crushes fraud risk, while user-friendly platforms remove crypto complexity.

The result: a scalable, secure, and globally tradeable ticketing model. Welcome to ticketing-as-a-platform—and yes, it’s investable. (More)

ENTREPRENEURS

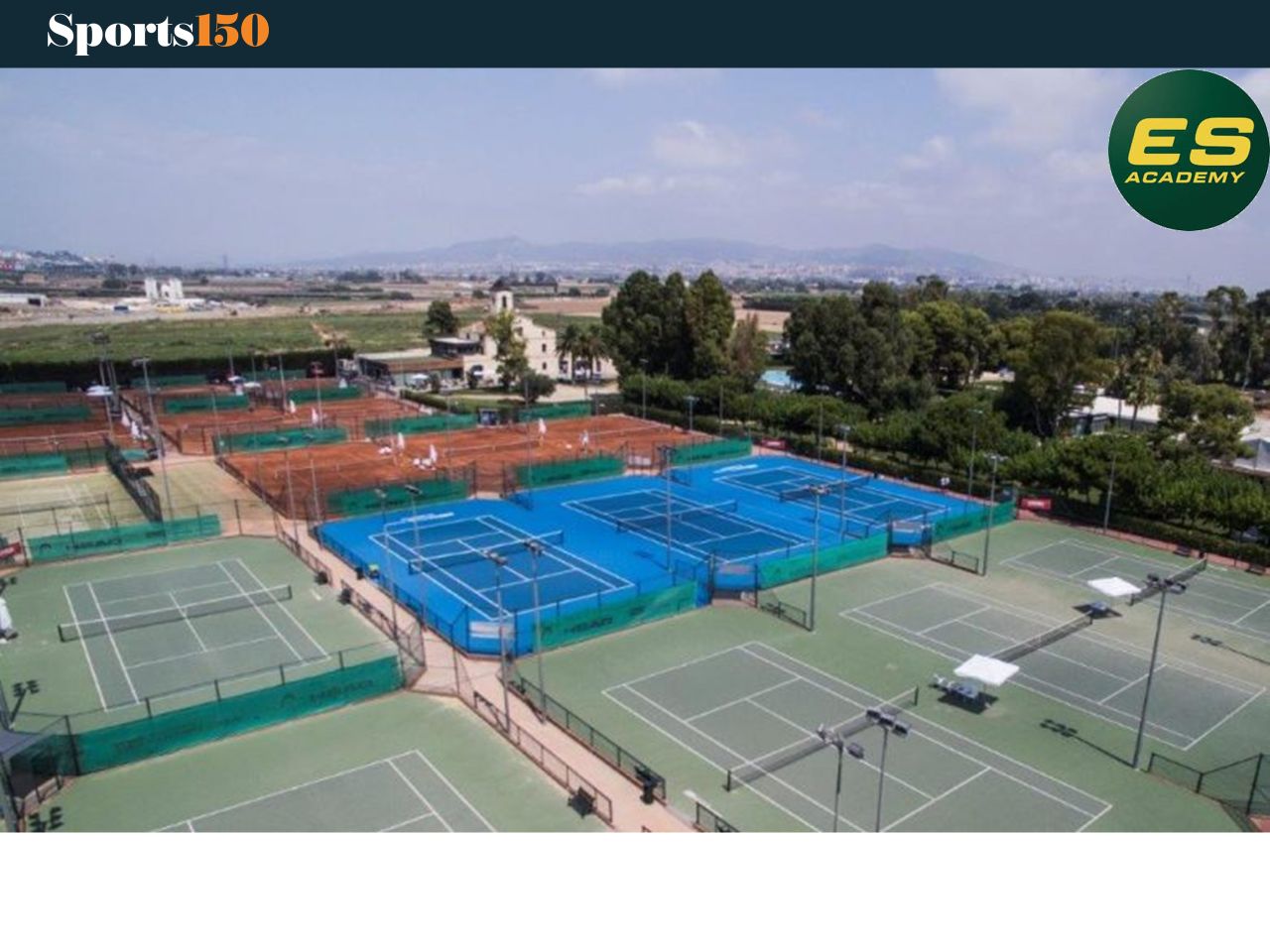

From Grand Slam to Grand Plans: an MBA case for Tennis Entrepreneurs

Emilio Sánchez Vicario didn’t just retire from tennis—he rebranded it. The Emilio Sánchez Academy (ESA) blends elite training with life prep across Spain, the US, and Dubai. Co-founded with doubles partner Sergio Casal, ESA’s “ES 360” system turns kids into pros (or CEOs). While rivals like IMG and Nadal Academy go for tennis glory, ESA markets a lifestyle—and charges accordingly: full-time programs can top €50K+ per year. Its global hedge? Diversified revenue, cultural consistency, and a training pyramid that’s part SAT prep, part serve-and-volley clinic. Mission-driven, scalable, and still led by Sánchez, ESA is a masterclass in turning sport into enterprise. (More)

COLLEGE ATHLETICS

Revenue Sharing, NIL, and the Rebirth of College Hoops’ Gray Market

The $2.8B House v. NCAA settlement officially ushered in the revenue-sharing era on July 1. But instead of bringing clarity, it's unleashed a regulatory gray zone that’s upending how talent flows through college basketball.

The new College Sports Commission (CSC), not the NCAA, now sets NIL enforcement—and it's cracking down. Its guidance: booster-backed collectives are no longer valid vehicles for paying players. That’s a seismic shift given that collectives accounted for 81.6% of NIL deal volume and $1.6B in value in 2024-25.

Enter Deloitte, now reviewing all deals over $600 via the NIL Go clearinghouse. Early signs point to friction: players stranded in NIL limbo, schools testing Deloitte’s algorithms, and agents hinting at open defiance. One SEC coach was blunt: “They’re going underground—but they’re not going away.”

The impact? Expect lawsuits, front-loaded deals (some schools prepaid $20M+ before July 1), and sharp drops in 2026 NIL valuations. Portal deals that averaged $600K in 2025 could shrink 10–20%. Meanwhile, high school recruiting is frozen, with only 5 of the top 50 Class of 2026 players committed.

Bottom line: The toothpaste is out of the tube, and enforcement may struggle to catch up. Creative accounting—and possibly old-school cheating—are poised for a comeback. (More)

TOGETHER WITH TIMEPLAST

“Big Plastic” Hates Them

From water bottles to shrink wrap, Timeplast has a $1.3T market opportunity with its patented plastic that dissolves in water. But the clock is ticking to invest. You have until midnight, July 31 to become a Timeplast shareholder as they expand globally.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

TECH & INFRASTRUCTURE

How Tax Codes Are Quietly Financing the Sports Infrastructure Boom

Stadiums might be getting smarter, greener, and more fan-friendly—but behind the scenes, they're also getting more tax efficient. Across the U.S., Canada, and Europe, tax incentives are quietly becoming a critical lever for accelerating sports infrastructure investment.

The playbook includes deductions for construction and renovation, tax credits on capital investment, and exemptions on property and sales taxes—all designed to lighten the financial load for sports entities. The U.S. Tax Cuts and Jobs Act, for instance, allowed 100% depreciation on qualified sports infrastructure between 2018–2022, while Canada’s Community Infrastructure Program offers a 10% tax credit for eligible projects. In the UK, charitable sports entities avoid corporate tax altogether.

The economic rationale is clear: according to the IOC, every dollar invested in sports infrastructure yields $3 in local economic impact. That ROI makes tax relief not just a subsidy—but a strategy.

For investors and developers, understanding these incentives isn't optional. It's a foundational part of the capital stack—and one that’s increasingly shaping how and where new sports projects get built. (More)

eSPORTS

Europe’s Gamer Market Is Big—and Still Fragmented

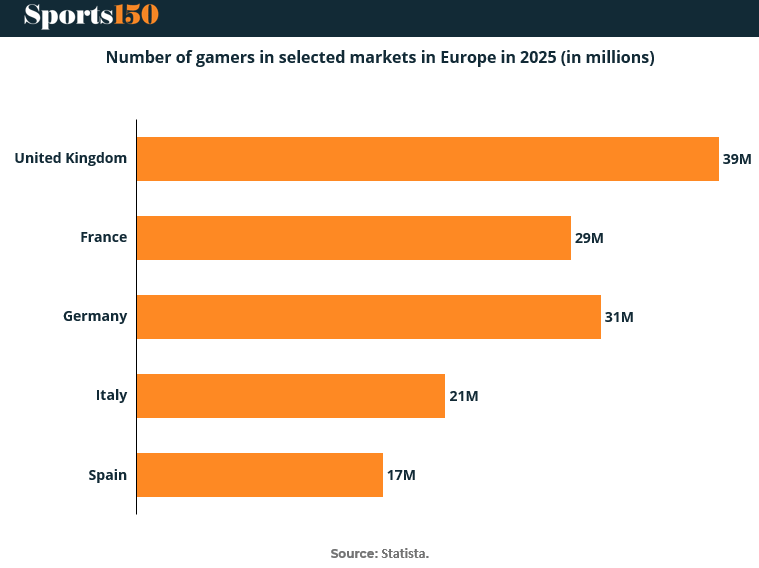

The eSports economy in Europe isn’t just growing—it’s stratifying. New Statista data shows the UK leads with 39 million gamers in 2025, well ahead of Germany (31M) and France (29M). Italy (21M) and Spain (17M) trail behind, underscoring an uneven playing field for audience scale across the continent.

Why it matters: market size is a proxy for viewership, ad revenue, and investment potential. Game developers, tournament organizers, and streaming platforms will follow the numbers—and the sponsors will follow them.

The fragmentation also signals that pan-European expansion strategies must be localized. What converts viewers in London may not scale in Madrid. For brands and investors betting on the next ESL, BLAST, or Valorant franchise league, this chart is a reminder: Europe is plural, not singular.

With nearly 140 million gamers across these five markets, the TAM is undeniable. The challenge is converting mass participation into profitable, scalable, and regionally tailored eSports ecosystems.

INTERESTING ARTICLES

TWEET OF THE WEEK

The $40 billion youth sports industry is catching the attention of private equity — a development that will raise costs and push youth sports out of reach for everyday Americans.

"To increase profits... these firms could raise fees for tournaments, rink time and other assets"

— American Economic Liberties Project (@econliberties)

3:01 PM • Jul 10, 2025

"In the middle of every difficulty lies opportunity."

Albert Einstein