- Sports 150

- Posts

- From Broadcast Rights to Private Equity: The Business of Sport This Week

From Broadcast Rights to Private Equity: The Business of Sport This Week

MLB franchises outperform the S&P 500 and Zlatan joins RedBird Capital, while European media rights hit a growth ceiling.

Good morning, ! This week we break down the engines shaping global sports economics: European football’s media revenue machine, why MLB franchise returns continue to outperform the S&P 500, how esports viewership surged again in 2025 with the LCK on top, and why Zlatan Ibrahimović’s move into RedBird Capital Partners signals the next phase of athlete-led investing.

Want to advertise in Sports 150? Check out our ad platform, here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

MEDIA & SPORTS

European football’s media engine is still running, but the growth curve is flattening

Broadcast revenue for Money League clubs hit €4.7B in 2024/25, up 10% YoY and still representing 38% of total revenue. The problem is where that growth is coming from. Domestic rights in core markets are no longer expanding. Ligue 1 reset its rights base roughly 20% lower, while Serie A declined by around 3% excluding contingencies.

What’s propping up the numbers is international distribution and competition expansion. International Premier League rights now exceed domestic revenue, and the expanded FIFA Club World Cup delivered a 17% broadcast uplift for participating clubs. That upside, however, came with heavier calendars. Money League clubs averaged 57 matches, up from 51, raising long-term questions about sustainability.

The takeaway for executives and investors is simple. Media revenue remains the foundation, but it is no longer a reliable growth lever on its own. Future upside sits in global rights optimization, direct-to-consumer experimentation, and tighter integration between media distribution and commercial monetization. (More)

INVESTOR CORNER

MLB Franchise Values Still Outrun Public Markets

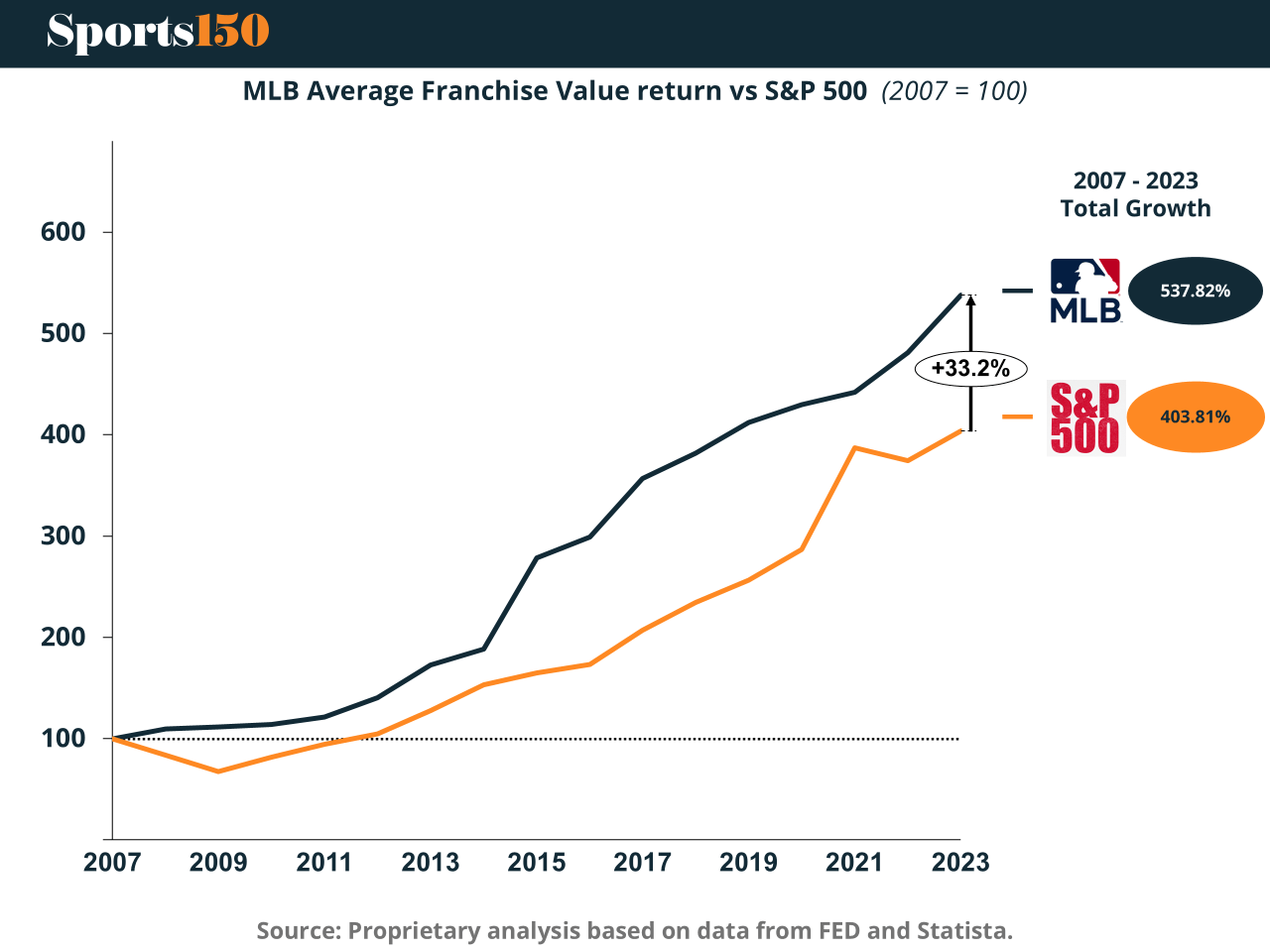

MLB franchise ownership continues to behave like a defensive growth asset. From 2007 to 2023, average MLB franchise values rose 537.82%, beating the S&P 500’s 403.81% and delivering a 33.2% return premium over public equities.

The economics are structural. Average franchise values climbed from $431M to $2.64B, an 11.09% CAGR, supported by scarce supply, long-term media rights, and a 162-game revenue engine that smooths cash flow across cycles. Unlike equities, valuations are anchored in local monopolies and community-embedded demand, not quarterly earnings volatility. MLB’s openness to private equity, now present in 10 teams, further reinforces its institutional appeal.

Bottom line: This is not about beating the market last cycle. MLB franchises remain inflation-resistant, cash-generative assets with asymmetric upside tied to media restructuring and real estate leverage. (More)

ENTREPRENEURS

Zlatan, the Capital Allocator

Zlatan Ibrahimović didn’t retire into golf and nostalgia. He retired into ownership, private equity, and institutional influence. With an estimated net worth of $180–200M (and $300–350M household), Zlatan has shifted from endorsement checks to capital deployment.

In 2023, he joined RedBird Capital Partners as an Operating Partner, plugging directly into a $10B AUM platform spanning sports, media, and entertainment. He also serves as a Senior Advisor to AC Milan’s ownership, focusing on brand strategy and enterprise value creation—not photo ops.

On the ownership side, Zlatan holds roughly 23.5% of Hammarby IF, a true equity stake, not a licensing deal. His portfolio extends into gaming, data analytics, and digital platforms, signaling a long-term, diversified approach.

Bottom line: Zlatan isn’t monetizing fame. He’s compounding it. (More)

TECH & INFRASTRUCTURE

The Quiet Giants Behind Modern Sport

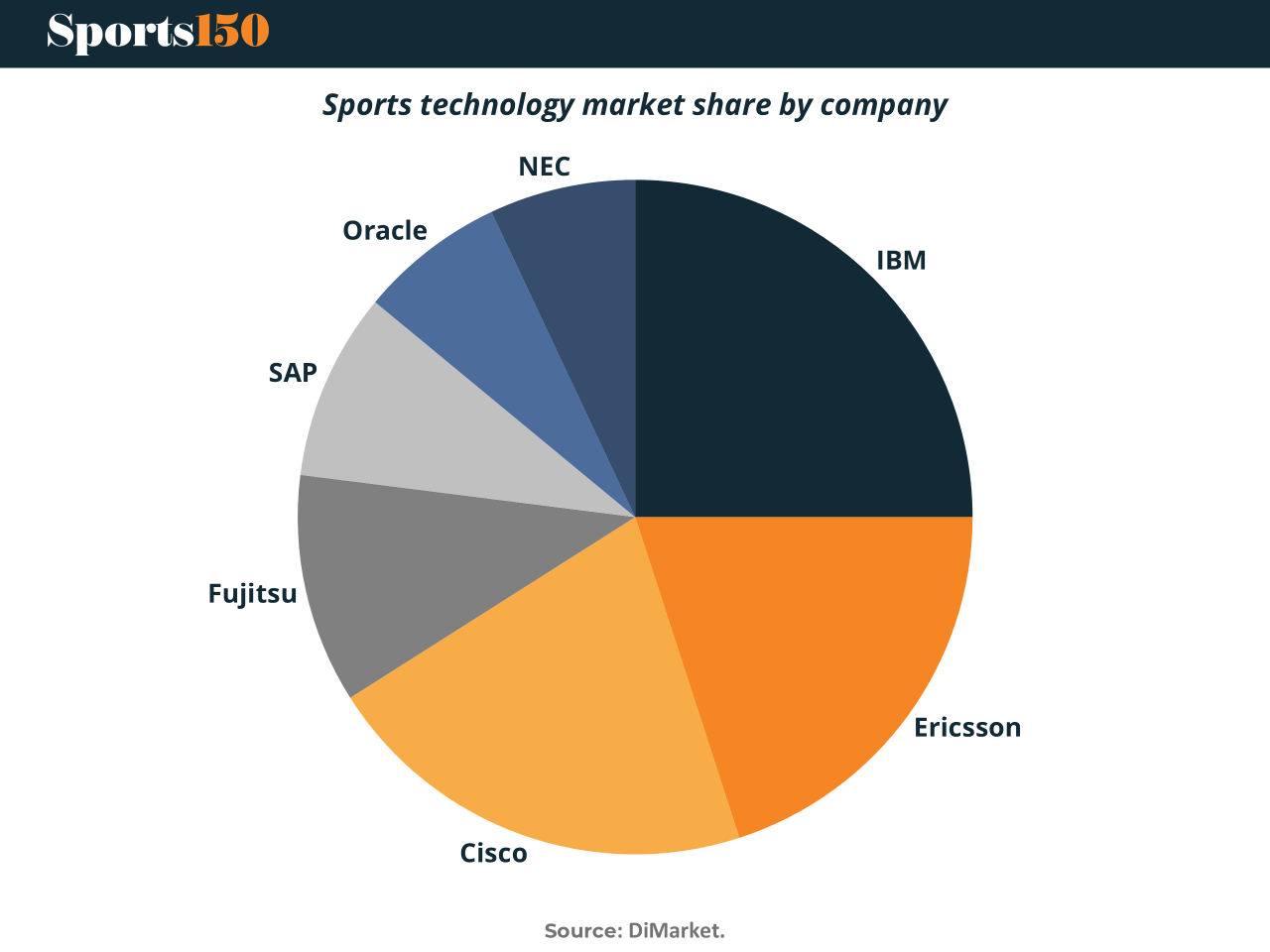

Sports tech’s biggest winners aren’t chasing fans—they’re wiring the building. The fastest-growing layer of the ecosystem is infrastructure, and it’s increasingly controlled by global enterprise incumbents, not startups.

IBM sits at the top, largely invisible but deeply embedded. Its data analytics, AI, and long-term league partnerships power everything from performance insights to event operations. Think less app, more operating system.

Right behind are Cisco and Ericsson, the connective tissue of modern sport. Cisco dominates networking, smart stadiums, and cybersecurity, while Ericsson underpins 5G, real-time broadcasting, and low-latency connectivity—critical as live sports become more data-intensive.

A second tier—SAP, Oracle, Fujitsu, NEC—fills in the enterprise stack with cloud, ERP, and mission-critical systems.

Bottom line: Sports tech is no longer about edge innovation. It’s about scale, reliability, and who can quietly keep the lights on. (More)

eSPORTS

Why 2025 Is a League-First Year

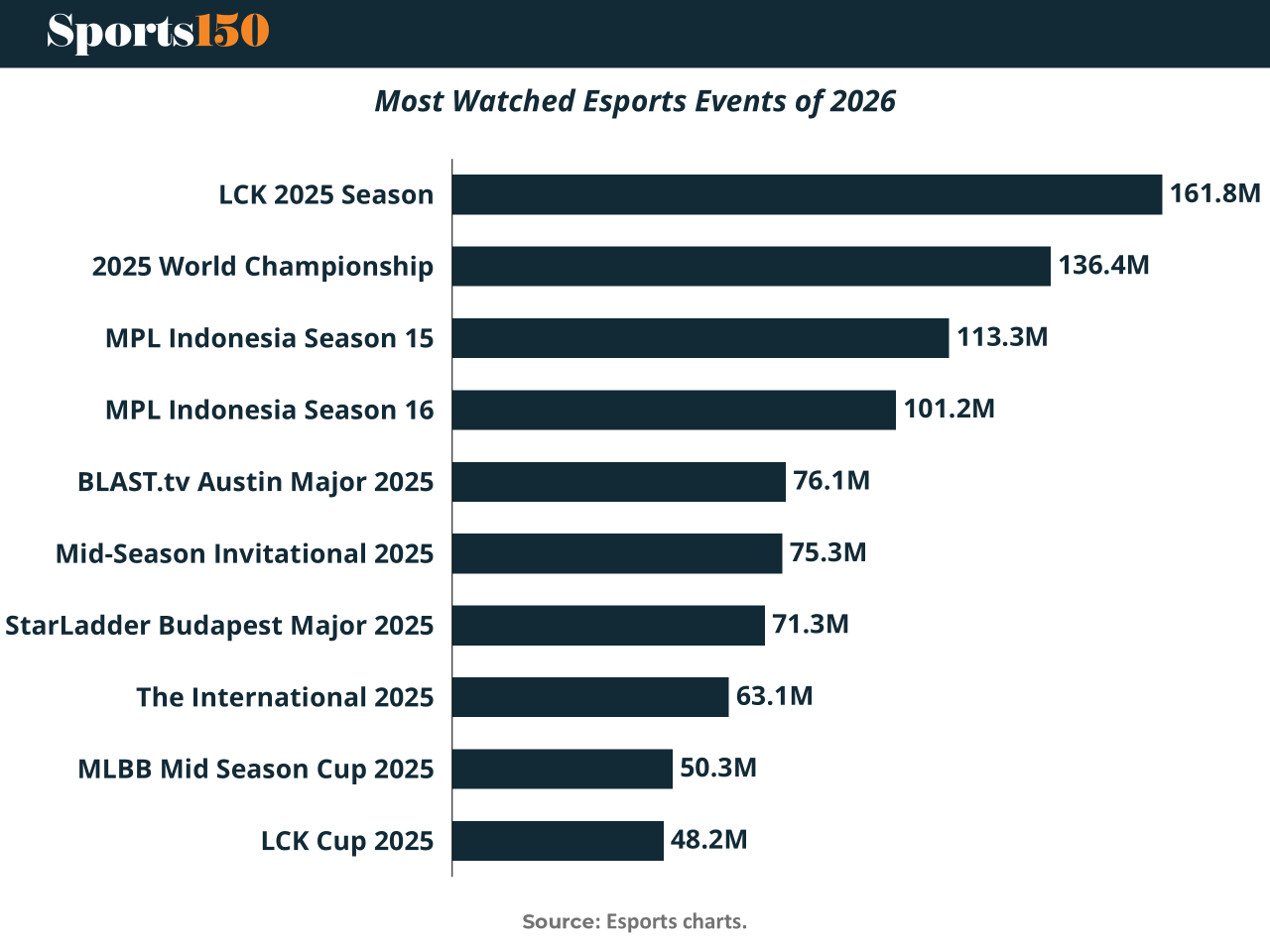

Esports viewership boomed in 2025—but not evenly. The biggest winner isn’t a one-off event; it’s league consistency.

The LCK 2025 Season leads all esports with 161.8M hours watched, reinforcing South Korea’s status as the gold standard for League of Legends. Close behind, Worlds 2025 logged 136.4M hours, still the most global event, but no longer the undisputed volume leader.

The real surprise is Southeast Asia. MPL Indonesia Season 15 (113.3M) and Season 16 (101.2M) signal a market that converts local fandom into sustained engagement, particularly in mobile esports.

Meanwhile, Counter-Strike and Dota 2 remain steady contributors via marquee events like BLAST.tv Austin Major and The International.

Bottom line: Esports growth in 2025 is being driven less by peaks—and more by always-on leagues. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

PUBLISHER PODCAST

No Off Button: The "Karmic Banker" theory of business

Champions don’t step away—they keep building. No Off Button is where Aram sits down with founders, operators, and creators who never needed an off switch to create real value. No startup mythology. Just the people who compound through discipline, relationships, and execution.

This week’s guest is Greg Topalian, Chairman of Clarion Events North America and founder of LeftField Media. Greg built New York Comic Con—the largest pop culture event in North America—without ever quitting his job. An intrapreneur by design, he scaled passion-driven communities inside large institutions, managed a $100M+ events portfolio, and learned the business fundamentals the hard way—selling food off a Sysco truck.

The conversation dives into intrapreneurship, enthusiast markets, and Greg’s “Karmic Banker” philosophy: the best operators give first, build relationships early, and let value compound over time.

Why it matters: this is a reminder that long-term wins come from operational grit, leverage, and human connection—not flashy exits.

"It is not the strength of the body that counts, but the strength of the spirit."

J.R.R. Tolkien