- Sports 150

- Posts

- Media Rights Still Anchor European Football, but the Growth Model Is Fracturing

Media Rights Still Anchor European Football, but the Growth Model Is Fracturing

For all the talk of diversification, European football remains fundamentally a media business.

Broadcast revenue still accounts for the single largest share of income for elite clubs, and international media rights continue to underpin valuations, financing structures, and competitive balance. But the latest Money League data shows that while media revenue remains essential, its growth profile is weakening, forcing clubs to rethink how broadcast fits into a broader monetization strategy.

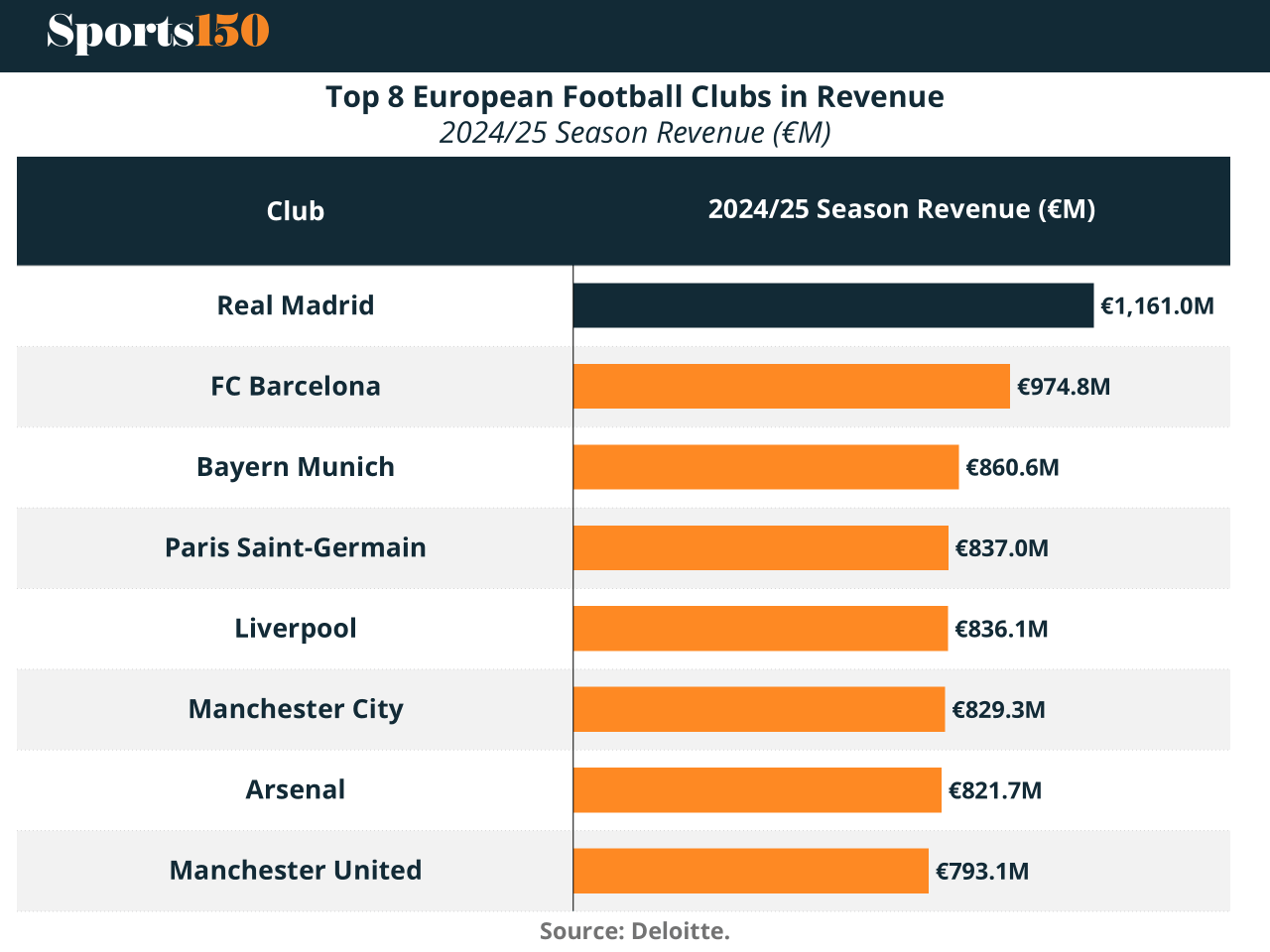

According to Deloitte, Money League clubs generated €4.7 billion in broadcast revenue in 2024/25, representing 38% of the €12.4 billion total. That figure is up 10% year over year, but the drivers of that growth matter. Unlike prior cycles, expansion is no longer coming from domestic league deals in Europe’s core markets. Instead, it is being propped up by tournament expansion, international distribution, and one-off competition effects.

The chart highlights a critical inflection point. Broadcast revenue has grown steadily since 2018, at a CAGR of 5.83%, but its trajectory is flatter than both commercial and matchday income in the post-pandemic period. This is not cyclical noise. Domestic broadcast markets in Europe are approaching maturity, with limited headroom for further price escalation.

Nowhere is this more visible than in France and Italy. Ligue 1’s most recent domestic rights cycle came in roughly 20% lower than the previous deal after a prolonged tender process, culminating in the early termination of its DAZN agreement. Serie A experienced a more modest but still meaningful decline, with domestic rights values down approximately 3% excluding contingent revenue-sharing components. These are structural signals, not anomalies.

As domestic growth stalls, international media rights have become the marginal driver of broadcast expansion. The Premier League crossed a symbolic threshold when international rights revenues exceeded domestic rights for the first time in the current cycle. This shift has profound implications. Media value is now increasingly driven by global fan acquisition, scheduling flexibility, and platform partnerships rather than local viewing habits.

Tournament expansion has temporarily masked some of this pressure. The expanded FIFA Club World Cup delivered a 17% uplift in broadcast revenue for participating Money League clubs, while UEFA’s revamped club competitions increased distributable funds to €3.3 billion, up roughly 22% year over year. However, these gains come at a cost. Money League clubs averaged 57 competitive matches in 2024/25, up from 51 the prior season, raising concerns around player welfare and long-term product quality. Media inventory growth is no longer free.

At the club level, broadcast revenue volatility is becoming more visible. Performance sensitivity remains high, particularly for clubs outside the very top tier. Liverpool’s return to the Champions League drove a 34% increase in broadcast revenue, propelling it to become the highest-revenue English club for the first time. Manchester United, by contrast, suffered a €52 million year-on-year decline in broadcast income due to weaker on-pitch results, despite growth in matchday and commercial streams.

The ranking underscores an important media dynamic. While Real Madrid and Barcelona sit near the top, their relative insulation comes not from broadcast dominance but from diversified revenue bases. For clubs ranked outside the top 10, broadcast revenue represents nearly 50% of total income, compared to roughly one-third for top-10 clubs. This creates a widening strategic gap. Media revenue remains essential, but dependence on it increases risk.

Looking forward, the broadcast landscape is fragmenting. Traditional linear broadcasters are no longer the sole price setters. Streaming platforms, digital-only bidders, betting-related video rights, and direct-to-consumer models are reshaping tender dynamics. The rise of OTT players such as Amazon, Apple, and regional digital platforms has expanded the bidder universe in some markets, but competition remains uneven. Where there are multiple bidders, rights values hold. Where there are not, they fall.

Ligue 1’s decision to launch a direct-to-consumer offering for the 2025/26 season marks a notable experiment. While the move will likely depress short-term broadcast revenue, it reflects a growing recognition that leagues may need to own customer relationships to unlock future value. Whether this model scales remains uncertain, but it signals a willingness to challenge legacy distribution structures.

The core takeaway is not that media revenue is declining. It is that its role is changing. Broadcast remains the foundation of European football’s financial system, but it is no longer sufficient on its own to drive growth. Clubs that treat media as a platform rather than a product, integrating global rights, digital engagement, and commercial activation, will be better positioned as the industry transitions from pure rights inflation to more complex value creation.

In the next phase of European football, media revenue will still anchor the system. But the winners will be those who learn how to build on top of it, not those who rely on it alone.

Sources & References

Deloitte. (2026). Deloitte Football Money League 2026. https://www.deloitte.com/uk/en/services/consulting-financial/analysis/deloitte-football-money-league.html

GLG Insights. (2022). The Outlook for European Football Media Rights. https://glginsights.com/articles/the-outlook-for-european-football-media-rights/

Libero, Football Finance. (2025). European Football Reaches Record High – But Challenges Are Mounting. https://libero-football-finance.com/europaischer-fusball-wachst-auf-rekordhoch-doch-die-herausforderungen-nehmen-zu/#:~:text=While%20broadcasting%20rights%20have%20long,7.1%25%20between%202014%20and%202019