- Sports 150

- Posts

- F1 Isn’t Just Quick, It’s a Growth Machine

F1 Isn’t Just Quick, It’s a Growth Machine

It’s Thursday and today we’re looking at the economic back-end and impact of F1 races, Sports infrastructure now vies with transit and energy for funding, using a mix of public, private, and hybrid financing, former Tennis super-star Cici Bellis is now playing the Venture Capital Grand Slam, and the MLB media business strategic play is on the table.

Good morning, ! It’s Thursday and we’re looking at the economic back-end and impact of F1 races, Sports infrastructure now vies with transit and energy for funding, using a mix of public, private, and hybrid financing, former Tennis super-star Cici Bellis is now playing the Venture Capital Grand Slam, and the MLB media business strategic play is on the table.

First time reading? Join thousands of investors and executives keeping pace with the business of sports by Subscribing Here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

DATA DIVE

F1 by the Numbers: Speed, Scale, and Serious Money

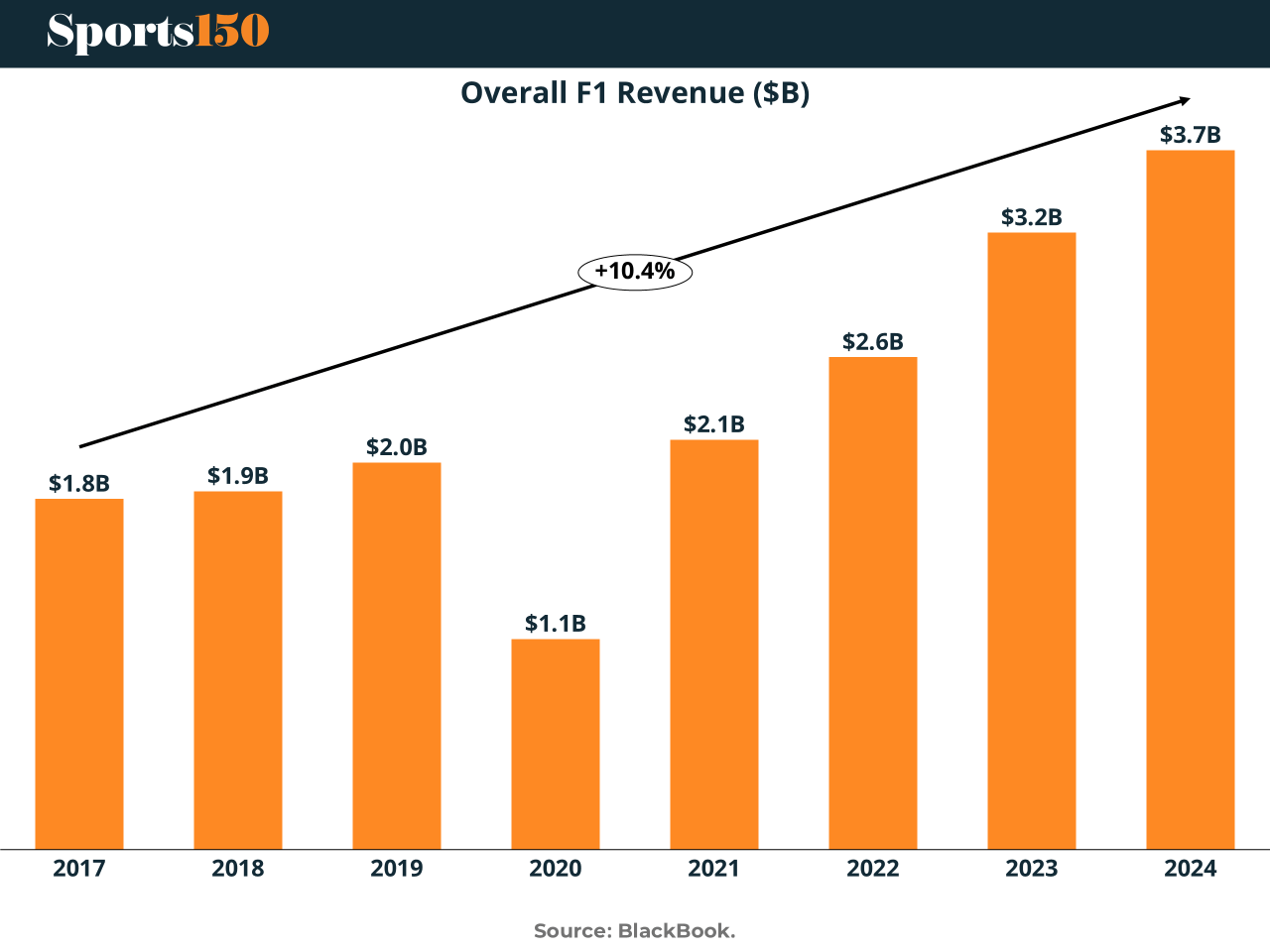

In 2024, Formula 1 revenue hit $3.7B, capping a 74.9% post-COVID CAGR in operating income. Hosting rights still dominate ($999M), but media rights are now neck and neck, up 81% since 2017. The U.S. fanbase has exploded—+10.5% in 2024, now topping 52M viewers—thanks to Netflix and Vegas’ neon blitz. Meanwhile, hosting a race costs up to $150M (plus $60M in fees). Why do it? Because Miami banked $449M in economic impact last year, and Melbourne packed in half a million fans. F1 isn’t a sport anymore. It’s a luxury asset class that just happens to drive in circles. (Read or Listen to Full Report)

MEDIA & SPORTS

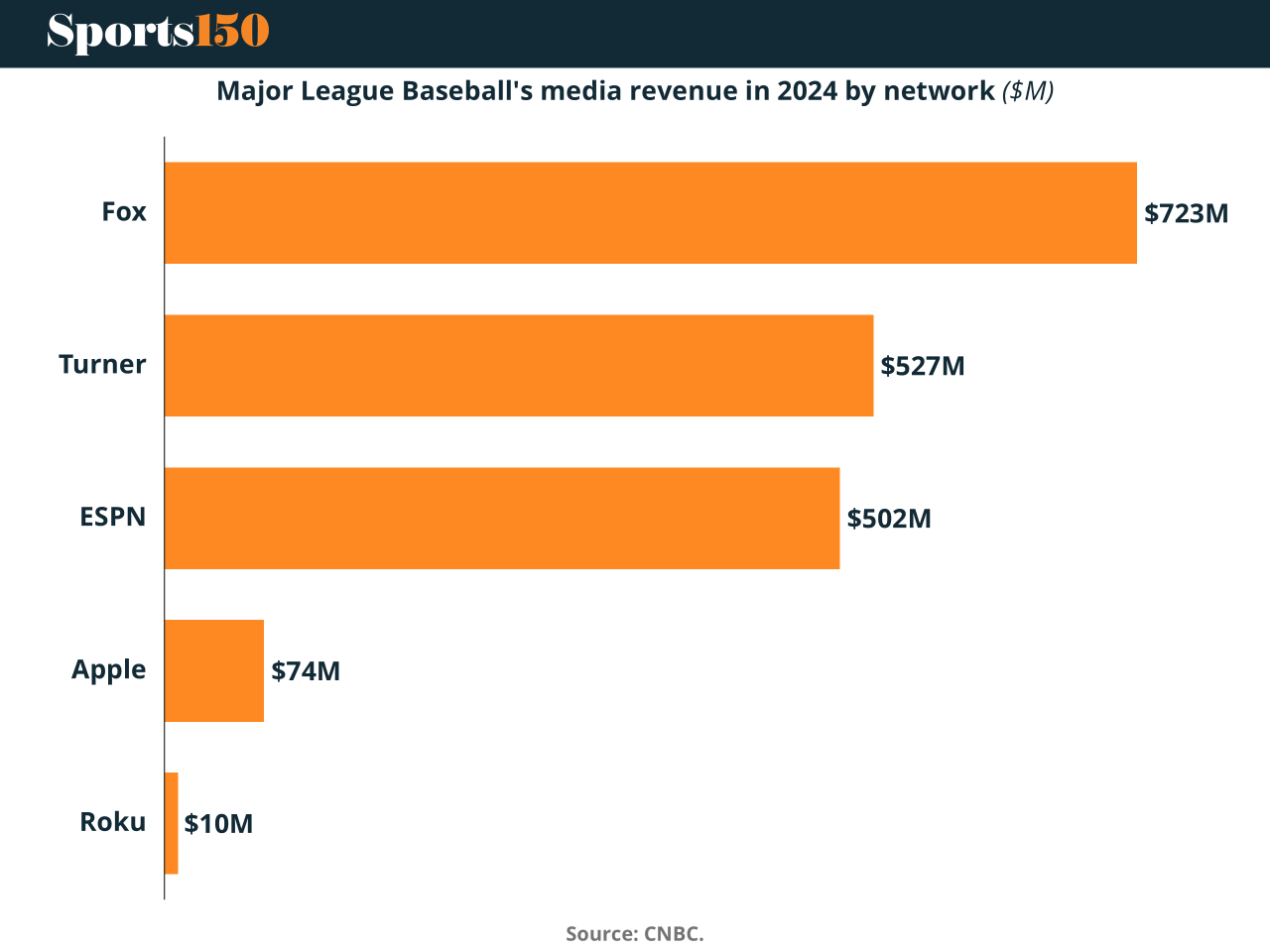

Curveball Economics: MLB’s Streaming Gamble

Major League Baseball is staring down a revenue doubleheader: soaring franchise valuations and a crumbling RSN model. In 2024, media rights still account for nearly 25% of team income, yet the league’s most stable cash cow—regional sports networks—is on life support. The Yankees’ $7.55B valuation looks great on paper, but the RSN collapse has clubs like the Reds scrambling for new lifelines. Commissioner Manfred is eyeing a streaming-first reboot in 2028, but he’s got a demographic dilemma: boomers still love cable, and Gen Z isn’t paying for baseball. Ad dollars remain strong locally, but the real play might be packaging regional rights into a national streaming bundle. That’s a bet on the future—and a departure from the past. The long-term franchise value of sports teams could hinge on whether this pivot hits or misses. (More)

PRESENTED BY BUILD WEALTH

WSJ Bestselling Author Walker Deibel’s BuildEnergy Fund Leverages 4-Decade Track Record (Over 80% Subscribed!)

BuildEnergy Fund I is officially open to accredited investors! This $100 million cashflowing fund offers family office terms and 30%+ IRR to its investors.

Why invest? Walker Deibel, the serial entrepreneur, WSJ bestselling author, and founder of Build Wealth sees this fund as hitting all facets of his Growth Predictor Framework:

Experienced Operating Team – A 4-decade / 6-fund track record of strong returns, including IRRs averaging 50%

Attractive Returns – Prior fund is already cash flowing 15% cash-on-cash, and estimated 35% IRR only 18 months in.

Institutional-Level Terms – Direct access to a $5M family office buy-in structure, reflecting a 7% immediate paper gain on a minimum $50,000 investment.

Focused Sector Approach – A strategic, supply / demand imbalance play, acquiring $100 million roll-up of oil wells during a buyer’s market.

If you’re an accredited investor, you can get access to the data room here:

For questions, reach out to Mike Brown, Head of Investor Relations: [email protected]

INVESTOR CORNER

Investor’s Corner: Ares Bets $2B on the Business of Sports

Ares is going all-in on the sports economy. The firm is raising $2 billion for its second sports-focused private credit fund, doubling down on a sector it sees as resilient, undercapitalized, and growing fast. The move comes as media rights, global fan engagement, and non-cyclical spending patterns make sports assets increasingly attractive to institutional capital.

Ares Partner Mark Affolter, who stepped away from co-heading direct lending to lead this strategy, calls it a $3 trillion total addressable market with structural tailwinds.From team finance and media production to youth sports gear, Ares is targeting the ecosystem, not just the front office.

Only 5% of its current sports-related portfolio faces tariff exposure, versus 15% across the broader platform, another point in favor of defensive positioning. Meanwhile, investors like the New Mexico State Investment Council are already on board, committing $150 million to the fund.

Why it matters: This is more than a franchise play. It’s a strategic bet on sports as a cash-flowing, content-rich, global asset class. In a world of uncertain macros, few sectors combine cultural durability, scarcity value, and growing monetization channels quite like sports. (More)

ENTREPRENEURS

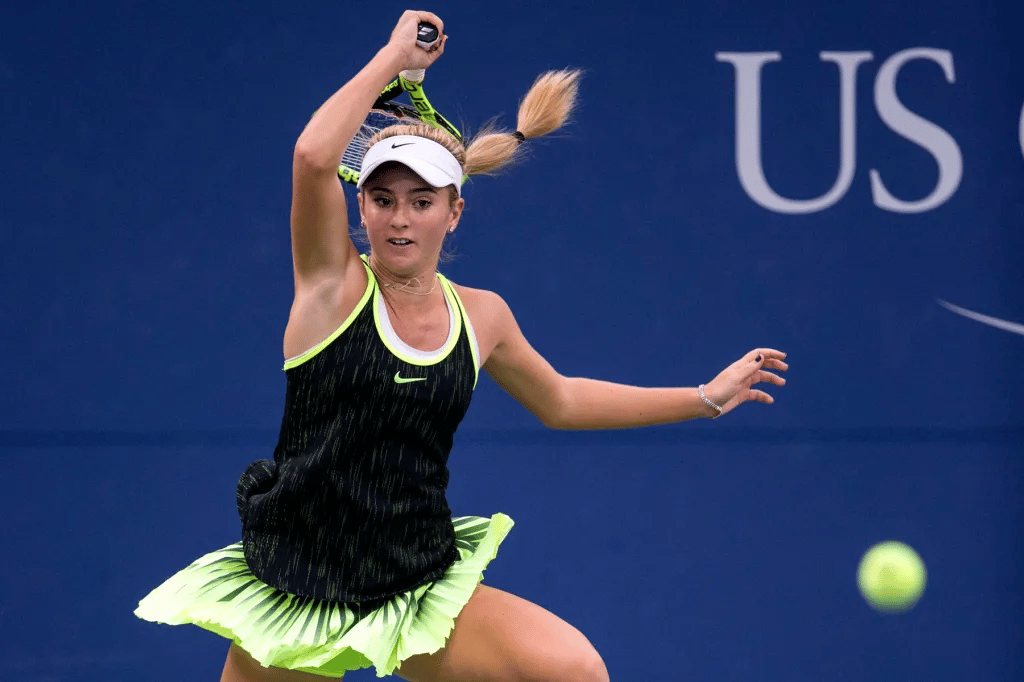

From Forehands to Founders

Cici Bellis, once a rising star on the WTA Tour, is now serving aces in venture capital. Since hanging up her racquet in 2022, she’s co-founded Cartan Capital, a $40M early-stage fund focused on sports, health tech, and wellness. Her playbook? Back founders solving the real pain points—many she faced firsthand. With names like Proto Hologram already in the portfolio, Bellis isn’t dabbling—she’s building. Her sharp shift from center court to cap tables isn’t just a post-career hobby; it’s a serious pivot with long-term ambition. The athlete-turned-allocator archetype is evolving—and Bellis is leading it.(More)

COLLEGE ATHLETICS

Texas A&M Signs the Largest MMR Deal in College Sports History

Texas A&M reset the market this year, inking a 15-year, $515M fully guaranteed multimedia rights deal with Playfly Sports—the largest in college athletics to date. The Aggies will more than double annual payouts, from $18M to $34M, plus collect $95M upfront in the first three years. This also marks the end of their partnership with Learfield. With AD Trev Alberts now at the helm—previously at Nebraska, another Playfly client—this was more chess than coincidence. Expect Playfly to leverage Kyle Field, NIL potential, and fan data activations across Texas' most valuable DMAs. In a crowded MMR landscape, Playfly just planted its flag deep in SEC territory. (More)

TOGETHER WITH REPUBLIC

Private Markets Aren’t Just for the 1% Anymore.

Institutions invest billions into private markets because they may provide superior market positions and steady cash flow, even in a shaky market–now you can too.

For the first time ever, elite private assets are available to all investors for as little as $500 with Hamilton Lane Private Infrastructure Fund.

*Source: Hamilton Lane data, Bloomberg as of January 2024. Past performance is not a guarantee of future returns.

All securities come with specific risks not limited to a total loss of your investment. Past performance is not indicative of future results. Please review the risks specific to this investment on the HLPIF deal page hosted on Republic.com/hlpif

TECH & INFRASTRUCTURE

Raising Roofs, Raising Capital: Inside the Cost of Sports Infrastructure

As aging stadiums like Montréal’s Olympic and IGA venues stare down billion-dollar renovation bills, $870M and $70M respectively, the question isn’t just how to rebuild, but how to pay for it.

From city rinks to global arenas, sports infrastructure now competes with transit and energy for capital, relying on a complex mix of public, private, and hybrid financing models. Canada’s PAFIRSPA program, offering up to $20M per project, is just one example of how governments are backing recreation as a public good.

But financing isn’t a one-size-fits-all game. Ownership structure dictates the playbook: private owners lean on equity, bonds, and naming rights (hello, $800M Scotiabank Arena deal); public entities turn to municipal bonds and subsidies; and PPPs like France’s Stade de France blend both to deliver billion-dollar builds with reduced financial risk.

As the line blurs between civic pride and commercial payoff, the new game in town isn’t just played in the stadium, it’s how the stadium gets built. (More)

CONSUMER & SPORTS

Loyalty Goes Pro: How Sports Fans Are Reshaping Consumer Behavior

In the era of hyper-personalized everything, fan loyalty is becoming the next frontier in sports consumer engagement. While emotional connection remains the foundation, today’s sports loyalty programs are evolving into sophisticated ecosystems, mixing gamification, AI-powered profiling, and curated experiences. Per Euromonitor, 21% of consumers now expect loyalty efforts to be tailored to their tastes, pushing clubs and sponsors to pivot from point-perks to purpose-driven engagement.

From 6.2B+ global social media followers to $8.3B in top-tier sponsorships last year, the numbers reflect an industry leaning harder into loyalty as a business strategy, not just a retention tactic. Emotional resonance is still king: Marriott Bonvoy’s Old Trafford suite and Maple Leaf Sports’ AI fan customization are prime examples of how teams are now marketing memories and meaning, not just merchandise.

As digital touchpoints grow and expectations rise, the fan funnel is becoming more dynamic, and more profitable. For brands and rights holders alike, loyalty isn’t just about rewards; it’s about relevance. (More)

eSPORTS

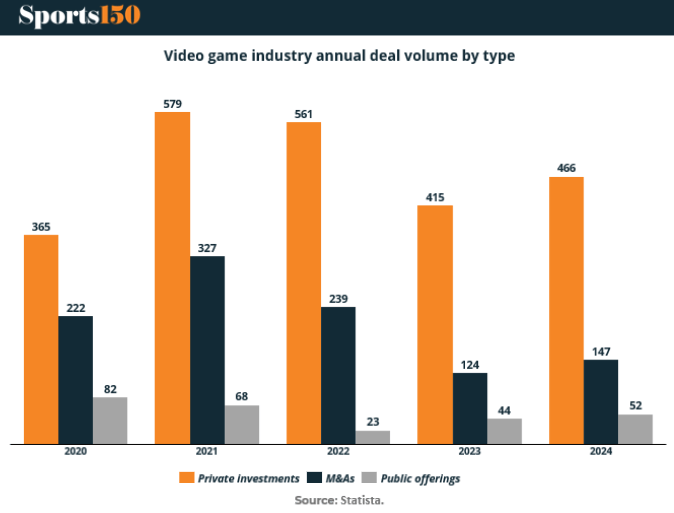

Gaming Dealflow Levels Up, But M&A Rage Quits Early

Deal activity in the video game industry remains high, but the mix has shifted dramatically. In 2021, M&A volume peaked at 327 deals, nearly catching up to private investments (579). But since then, the buyout buzz has faded,M&A deals dropped to just 124 in 2023 and hover at 147 so far in 2024. Meanwhile, private investments are still stacking points, with 466 deals in 2024, though below their 2021 high.

Public offerings? Barely respawning. After a brief IPO boom in 2020 (82) and 2021 (68), listings have all but dried up,just 52 so far this year. For investors, it’s a clear signal: capital is still flowing into studios, platforms, and tools, but exits are harder to come by, and consolidation is taking a breather.

Bottom line: The capital stack is shifting toward earlier bets and longer holds. Expect dealmakers to focus more on scalable content engines and cross-platform IP, as they wait out the public market cooldown and time their strategic exits more carefully.

INTERESTING ARTICLES

TWEET OF THE WEEK

LIV Golf’s parent company has upped its authorized share capital by $674.3M so far in 2025 & total funding could hit $1B by summer with another expected PIF injection.

LIV Golf Investments’ total authorized capital now stands at $4.58B.

Via @MoneyInSport

— Sports Business Journal (@SBJ)

5:30 PM • May 5, 2025

"The biggest challenge after success is shutting up about it"

Criss Jami