- Sports 150

- Posts

- The Changing Playbook of MLB: Media Revenue, Franchise Valuation, and the Battle for the Future

The Changing Playbook of MLB: Media Revenue, Franchise Valuation, and the Battle for the Future

Major League Baseball (MLB), one of America’s oldest and most tradition-rich sports leagues, is undergoing a quiet but critical transformation.

As the media landscape shifts under the weight of cord-cutting and rising streaming giants, MLB faces a twofold challenge: maintaining its media revenue while securing long-term value for its franchises. Amidst this, the league’s executives are developing new media strategies to support the financial bedrock that props up team operations. Revenue from media rights accounts for nearly 25% of most MLB clubs’ income, making it vital to address the evolving distribution landscape with urgency and foresight.

The current crossroads comes at a time when franchise valuations are soaring, even as traditional media income starts to wobble. Based on recent data from Forbes and Statista, many MLB teams continue to see remarkable growth in their valuations, which remains largely untethered to short-term revenue fluctuations. However, that may not last forever.

Team Revenue and Franchise Values: A Telling Snapshot

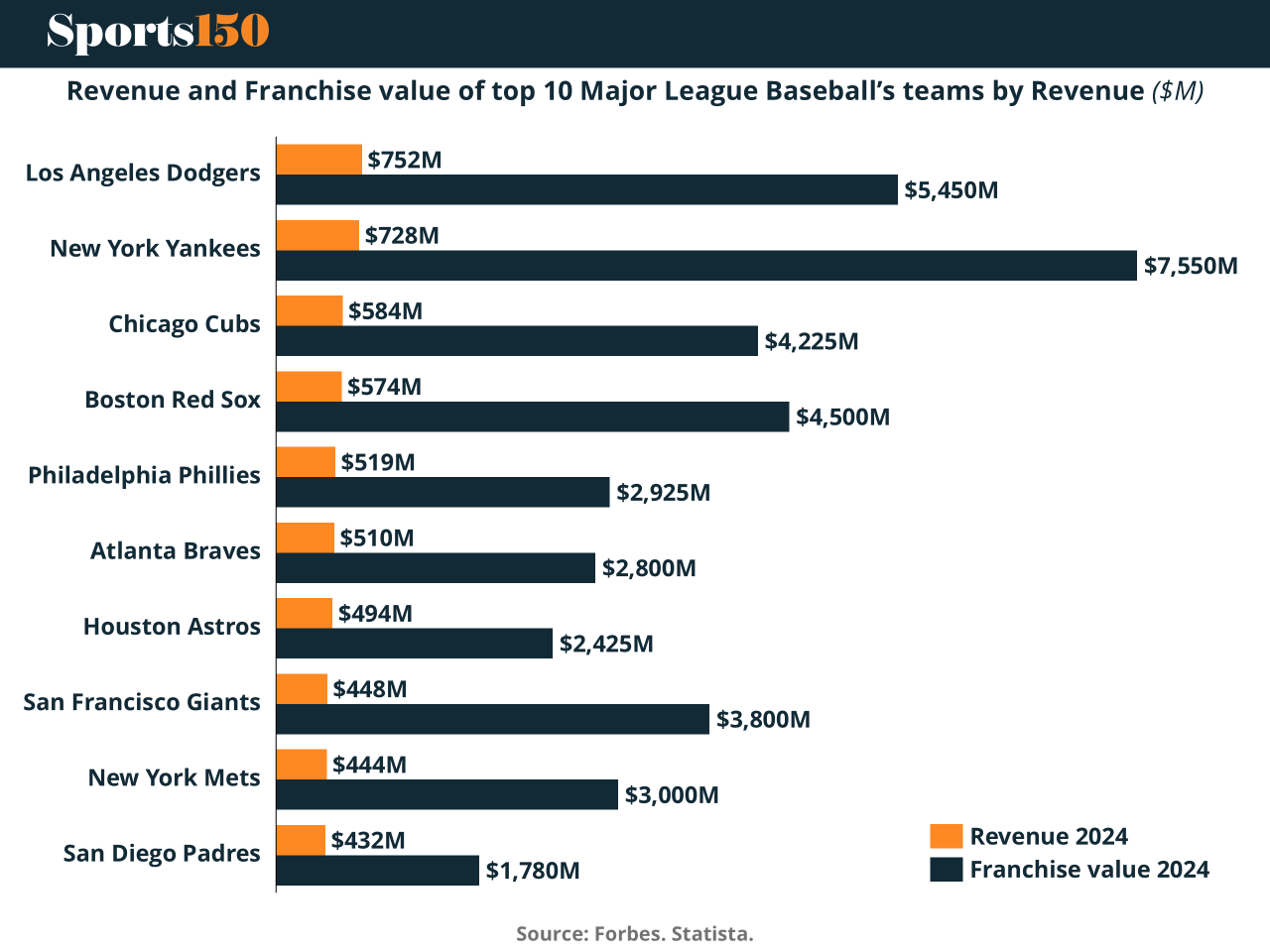

The economic foundations of Major League Baseball are largely rooted in two areas: team-level revenues and long-term franchise valuations. In 2024, the New York Yankees top the league with a franchise valuation of $7.55 billion and annual revenue of $728 million, a close second in income only to the Los Angeles Dodgers, who lead with $752 million in revenue but rank second in valuation at $5.45 billion. Other major market teams like the Chicago Cubs ($4.23 billion), Boston Red Sox ($4.5 billion), and San Francisco Giants ($3.8 billion) remain valuable, high-revenue entities.

Even mid-tier teams such as the Philadelphia Phillies and Atlanta Braves, both generating just over $500 million annually, still hold multi-billion dollar valuations. The San Diego Padres, with the lowest revenue among the top ten teams at $432 million, still hold a $1.78 billion valuation.

What explains the massive discrepancy between current income and the much higher franchise valuations? For many investors and analysts, this divergence underscores the long-term growth expectations baked into franchise ownership. Real estate value, brand equity, historical legacy, and media potential all inflate these numbers.

For a deeper dive into how these figures are derived and what they mean for investors and leagues alike, refer to this Franchise value of sports teams guide.

The Decline of the RSN Model

But while valuations soar, the foundation beneath them—particularly media revenue—is cracking in places.

The once-stable regional sports network (RSN) model is deteriorating. With close to 80% of all MLB viewership still occurring through RSNs, the collapse or decline of these networks creates significant shortfalls in team budgets. Around a quarter of each team’s revenue originates from media rights, and when RSN deals fall through, the results are financially damaging. Unlike the NFL or NBA, which generate far more from national TV packages, MLB has been disproportionately reliant on RSNs.

Teams like the Cincinnati Reds and Milwaukee Brewers have recently opted to return to regional networks such as FanDuel Sports-branded RSNs instead of partnering with MLB Media. As one RSN executive put it, “no team wants to publicly acknowledge it, but ditching an RSN for other types [of] deals to ‘increase reach’ doesn’t come closer to solving the loss of media revenue.”

In short, reach does not equal revenue—at least not yet.

MLB’s Media Revenue Breakdown: 2024 Snapshot

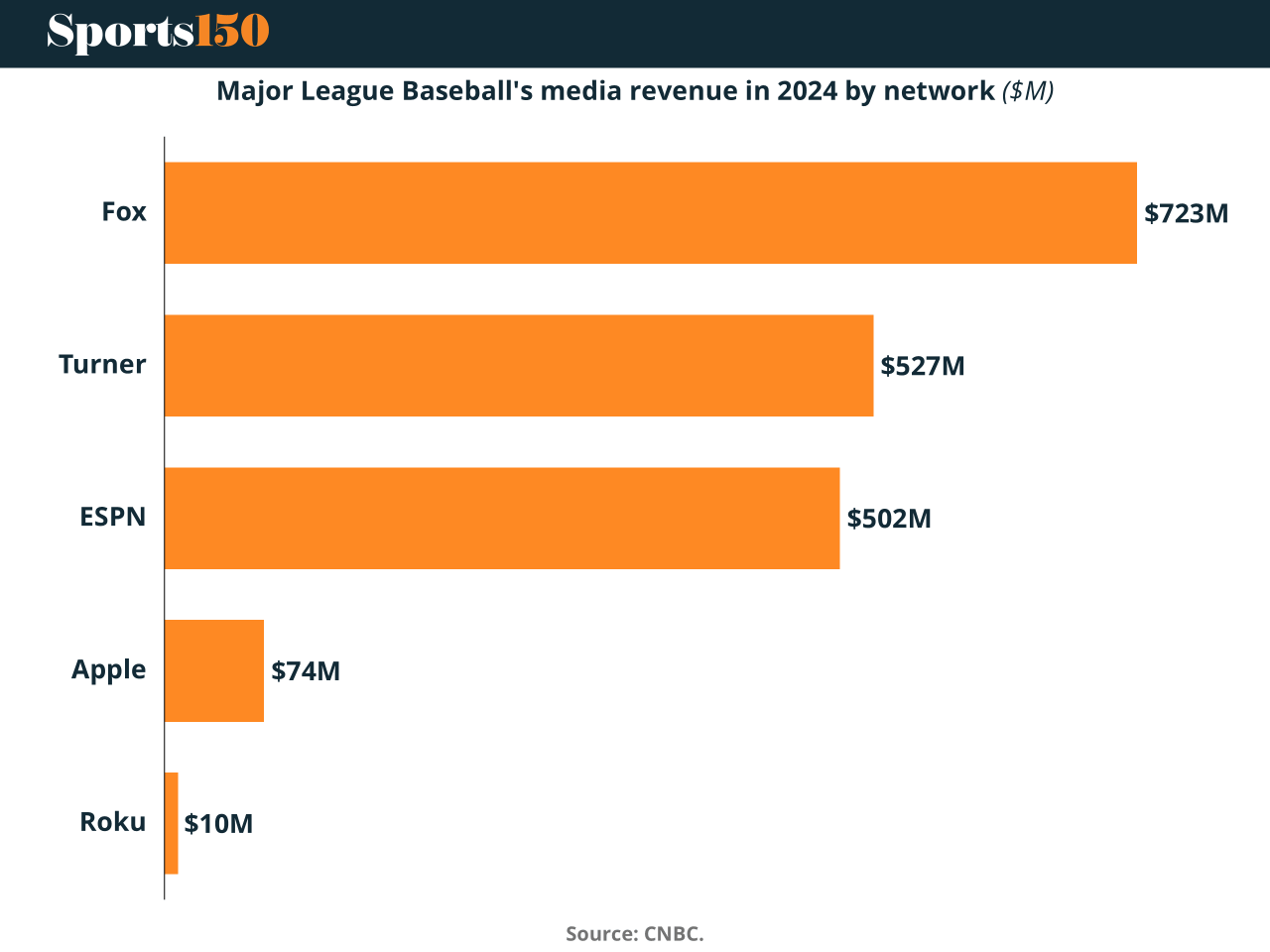

According to CNBC data, MLB’s media revenue in 2024 from national network partners is heavily concentrated among a few giants:

Fox: $723 million

Turner Sports (TNT): $527 million

ESPN: $502 million

Apple: $74 million

Roku: $10 million

While ESPN is still a player, it notably walked away from its exclusive "Sunday Night Baseball" package, citing diminishing returns. Fox remains the biggest spender, while streaming partners like Apple and Roku contribute relatively small amounts by comparison. This exposes a central problem: while streaming is the future, it hasn’t yet matched the scale of traditional cable in terms of direct payouts.

Commissioner Manfred’s Gamble on 2028

Rob Manfred, MLB’s Commissioner, is betting big on 2028. That’s when all the league’s major national media deals expire, giving MLB a rare chance to rewrite the playbook. Manfred's plan? To repackage and resell the league's broadcasting rights in a way that reflects modern consumption habits, with a likely focus on streaming-first strategies.

Instead of waiting for declining networks to step up, MLB may offer a nationalized package of local games—a drastic break from the current RSN-driven, team-by-team broadcast structure. This would likely appeal to platforms like Apple, Amazon, Peacock, or YouTube, all of which could bid heavily to own exclusive, flexible broadcasting rights for regional games.

Removing blackout rules—long a bane for MLB fans—and bundling games into a single, easily accessible streaming service could both improve fan engagement and unlock new revenue streams.

This model mimics Apple’s deal with Major League Soccer, which granted them full control of streaming inventory. MLB likely wouldn’t give away that much power, but it does signal how big tech can reshape the ecosystem.

Risks and Demographic Reality

Yet, Manfred’s vision is not without risks. The median age of an MLB viewer is 60 years old, significantly older than that of the NBA (50) or NFL (54). Many in this demographic still rely on traditional cable and may struggle with the transition to digital platforms. At the other end of the spectrum, younger fans—more comfortable with streaming—may be unwilling to pay for baseball content due to lower interest levels compared to basketball or football.

This leads to a conundrum: how does MLB create a streaming product that appeals across demographics without cannibalizing its existing audience?

Adding to the uncertainty is the global media environment. In Europe, marquee sports leagues such as the English Premier League and Italy’s Serie A have experienced declines in media revenue in recent TV rights renewals. If gravity truly applies to all major leagues, as Disney veteran Kevin Mayer suggests, then MLB might not see exponential rights growth again—at least not without significant restructuring.

The Advertising Silver Lining

While media distribution is turbulent, advertising on RSNs remains surprisingly strong. According to Craig Sloan, CEO of Playfly Sports, local baseball broadcasters will bring in more advertising dollars in 2024 than ESPN, Fox, Turner, MLB Network, and Apple combined.

That’s a major silver lining—and a testament to baseball’s regional loyalty and advertiser trust. Despite subscriber losses, local broadcasts still command loyal eyeballs and consistent ad revenue. This underscores the importance of keeping some form of regional distribution, even in a future dominated by streaming.

Direct-to-Consumer (DTC): Progress, but Not a Panacea

One promising development is the growth of direct-to-consumer (DTC) streaming options. As of 2024, 27 out of 30 MLB teams have resolved DTC broadcasting options, allowing them to reach fans more directly and potentially replace some RSN revenue.

However, this too has limitations. DTC offerings are expensive—typically ranging from $20 to $30 per month per team—and may not scale effectively without bundling or price reform. Fans who follow multiple teams or just want casual access may balk at the idea of paying hundreds annually just to watch baseball.

A successful DTC strategy would require tiered access, flexible subscriptions, or integration with other entertainment platforms to encourage uptake.

2028 and Beyond: What’s at Stake?

Ultimately, the fate of MLB’s media rights rests on the strategic decisions made between now and 2028. That year could mark the dawn of a new media era for baseball—or a painful reckoning. Will MLB succeed in converting legacy partnerships into forward-looking, digital-first platforms? Or will the league see diminishing returns in a saturated, increasingly cost-conscious streaming market?

Team owners will also play a crucial role. Convincing them to abandon the high-revenue RSN model for a long-term bet on streaming requires ironclad evidence and a leap of faith. But as more owners see national platforms grow stale and younger fans migrate online, consensus may build—especially if the alternative is stagnation.

In the meantime, franchise values will likely remain robust. Even if media revenue dips in the short term, the prestige and scarcity of owning a professional baseball team continues to lure billionaires and private equity. Yet if media rights crumble and RSNs fade without a viable replacement, it may eventually affect how investors perceive the future earnings potential of MLB franchises.

Conclusion: A League in Transition

Major League Baseball is at an inflection point. The league’s franchise valuations remain strong, but the underlying revenue model is in flux. As traditional RSNs falter and streaming players hesitate to pay premium prices, MLB must craft a new model—one that balances accessibility, profitability, and long-term vision.

Commissioner Manfred’s strategy for 2028 is bold and potentially transformative. If successful, it could bring about a renaissance for baseball media. If it fails, however, MLB risks falling behind other major leagues that have already embraced the future.

Whether it's Fox continuing to write big checks or Apple entering the fold with deeper involvement, the next few years will shape the financial backbone of America’s pastime for decades to come.

Sources & References

CNBC. (2025). CNBC Sport: MLB’s playbook to grow media revenue. https://www.cnbc.com/2025/03/27/cnbc-sport-mlbs-playbook-to-grow-media-revenue.html

SBJ. (2025). MLB teams keep eyeing ways to replace media dollars, which sources peg at close to 25% of club revenue. https://www.sportsbusinessjournal.com/Articles/2025/03/24/mlb-teams-keep-eyeing-ways-to-replace-media-dollars-which-sources-peg-at-close-to-25-of-club-revenue/

Sports 150. (2025). Scoring Money: The Economics of Sports. https://www.sport150.com/p/scoring-money-the-economics-of-sports