- Sports 150

- Posts

- Amazon, NBC, Disney: The New NBA Power Trio

Amazon, NBC, Disney: The New NBA Power Trio

It’s Thursday and we’re analyzing the capital imbalances reshaping college athletics, Federer’s equity-driven blueprint in performance retail, the undervalued upside in global esports, strategic consolidation in the sports retail sector, and the growth of data-driven infrastructure in professional sports.

Good morning, ! It’s Thursday and we’re analyzing the capital imbalances reshaping college athletics, Federer’s equity-driven blueprint in performance retail, the undervalued upside in global esports, strategic consolidation in the sports retail sector, and the growth of data-driven infrastructure in professional sports.

First time reading? Join thousands of investors and executives keeping pace with the business of sports by Subscribing Here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

MEDIA & SPORTS

The NBA’s $6.9B Media Migration: Ad Dollars Up for Grabs

The NBA’s seismic media rights shift is set to redefine the sports advertising landscape. Beginning in 2025, games will depart Warner Bros. Discovery's TNT for a triumvirate of Disney, NBCUniversal, and Amazon—triggering the largest TV ad-dollar redistribution since Fox snatched the NFL from CBS in 1993.

The numbers are eye-watering. NBC is paying $2.5B/year, Disney $2.6B, and Amazon $1.8B for their slices of the NBA. In return, they're projected to rake in $3B+ annually in NBA ad revenue: Disney ($1.25B), NBC ($1B+), and Amazon ($750M). For Warner, the loss is a projected $1.1B in 2026 ad revenue, 23% of its total.

This media reallocation isn't just about rights—it's about retail. NBC is linking NBA games to the Super Bowl, Olympics, and World Cup. Amazon is bundling basketball into its Black Friday NFL playbook. Disney, the incumbent, is betting on consistency and its Finals exclusivity.

With 75 NBA games heading to broadcast (up from 15), and streamers chasing younger demos, this is more than a rights deal—it’s a generational reset. For advertisers and media investors, the question isn’t who’s paying—it’s who can extract the most value. (More)

PRESENTED BY PACASO

The key to a $1.3T opportunity

A new real estate trend called co-ownership is revolutionizing a $1.3T market. Leading it? Pacaso. Led by former Zillow execs, they already have $110M+ in gross profits with 41% growth last year. They even reserved the Nasdaq ticker PCSO. But the real opportunity’s now. Until 5/29, you can invest for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

INVESTOR CORNER

Dick’s Grabs Foot Locker in $2.5B Bid for Sneaker Supremacy

In a bold retail play, Dick’s Sporting Goods is acquiring Foot Locker for $2.5B, marking its first international expansion and a major reshuffling of the sneaker and sportswear landscape. The deal gives Dick’s access to 2,400 stores across 20 countries, including the Champs Sports and atmos banners, while Foot Locker gains stability after years of mall exposure and earnings pressure.

Foot Locker shareholders will receive either $24 in cash or 0.1168 shares of Dick’s stock, a 66% premium to Foot Locker’s 60-day average. The market reaction was split: Foot Locker soared +80%, while Dick’s tumbled -14%, as analysts questioned integration challenges and the logic of merging two Nike-reliant chains.

Still, Dick’s is betting big on operational synergy, omnichannel upgrades, and capturing more share of Nike’s wholesale pipeline. The combined entity would command serious shelf power in sneaker culture, a space increasingly defined by drops, hype, and brand alignment.

Bottom line: Investors should watch execution closely. If Dick’s can modernize Foot Locker without losing its edge, or Nike’s favor, it may have just bought itself a global growth engine. (More)

ENTREPRENEURS

Roger Federer’s $10B Endorsement Play

Roger Federer isn’t just winning in retirement—he’s scaling a brand past $2B in revenue.

His stake in On Running, now worth $300M+, is more than celebrity equity. Federer co-designed shoes, shaped DTC strategy (now 37.5% of sales), and helped On target $10B+ in future revenue. The Swiss brand posted 20.9% YoY growth in Q1 2025 and is expanding globally with 35+ stores and new product lines in tennis, trail, and apparel.

The model: Athlete-led, equity-first, brand-building from day one. (More)

COLLEGE ATHLETICS

The $1.67B Question: Can Mid-Majors Compete in NIL Era?

College sports is no longer a contest between amateur athletes, it’s a high-stakes talent market. In 2024 alone, $1.67 billion was spent compensating student-athletes through NIL, with $1.1 billion flowing into college football and $390 million into men’s basketball, per Opendorse. That leaves crumbs for non-revenue sports—and leaves schools like Oakland University at a financial cliff’s edge.

Last year, Oakland head coach Greg Kampe watched three of his top players transfer—, lured away by programs offering up to $500,000 each. “I spend my summers raising money to buy players,” Kampe told CBS. “That’s just the reality now.”

For smaller programs, the NIL arms race means fundraising, not coaching, is now a core skill. And the gap between Power 5 and everyone else is turning into a canyon. That’s not just a talent distribution issue—it’s an existential threat to competitive balance.

If the same dozen schools dominate postseason play year after year, as Kampe fears, the NCAA could lose the unpredictability that makes March Madness a commercial juggernaut.

Bottom line: In the new pay-to-play era, financial horsepower trumps tradition. Investors and administrators alike should watch how this imbalance reshapes the business model of college sports. (More)

TECH & INFRASTRUCTURE

The smart stadium arms race

Athlete availability is now a data point. With Zone7’s predictive AI cutting soft tissue injury days by up to 57%, the bar for performance infrastructure has moved from gym floors to NASA-style command centers. This isn't science fiction—it’s a $34B industry en route to $68.7B by 2030, thanks to real-time biometrics, smart stadiums, and 5G-fueled training hubs. As Whoop and Catapult collect the vitals, the edge is no longer just physical—it's programmable. Teams still ignoring this? One pulled hamstring away from irrelevance. (More)

CONSUMER & SPORTS

The NBA Finals Have a Viewer Problem

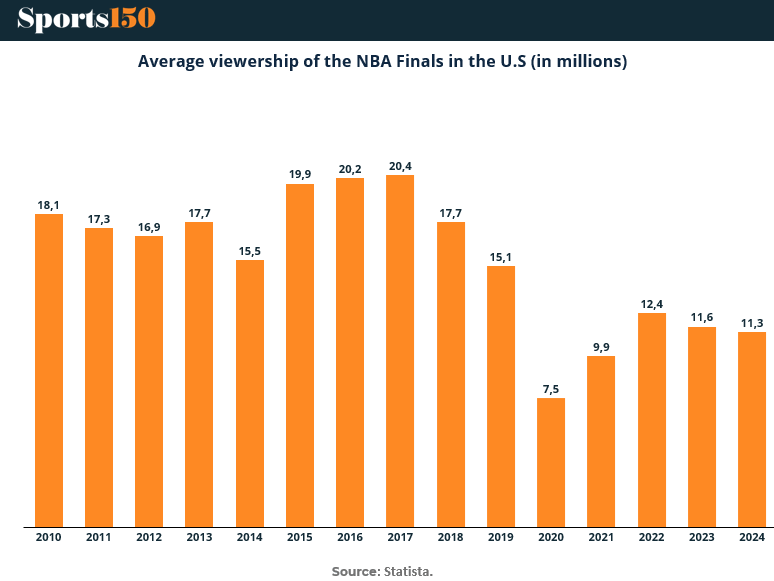

The NBA’s biggest stage isn’t drawing like it used to. Average U.S. viewership for the NBA Finals has dropped 44% since 2017, from 20.4M to just 11.3M in 2024, per Statista. Even with recent recovery from the pandemic-era low of 7.5M in 2020, the Finals haven’t cracked 13M since.

This isn’t just a Nielsen footnote, it’s a strategic concern for advertisers, rights buyers, and the league itself. Despite the NBA’s global appeal and massive domestic media deal ($6.9B/year across Disney, NBC, and Amazon), its flagship event is struggling to command attention at home.

What’s driving the slide? Fragmented viewing habits, diluted star power, and shifting fan loyalties all play a role. And with more games moving to streaming, the league may gain reach, but lose the cultural moment.

Bottom line: If the Finals can’t anchor the NBA’s value narrative, advertisers may begin to price risk into premium slots. For investors, engagement, not just rights inflation, will be the metric to watch.

eSPORTS

The Billion-dollar Perception Gap in eSports

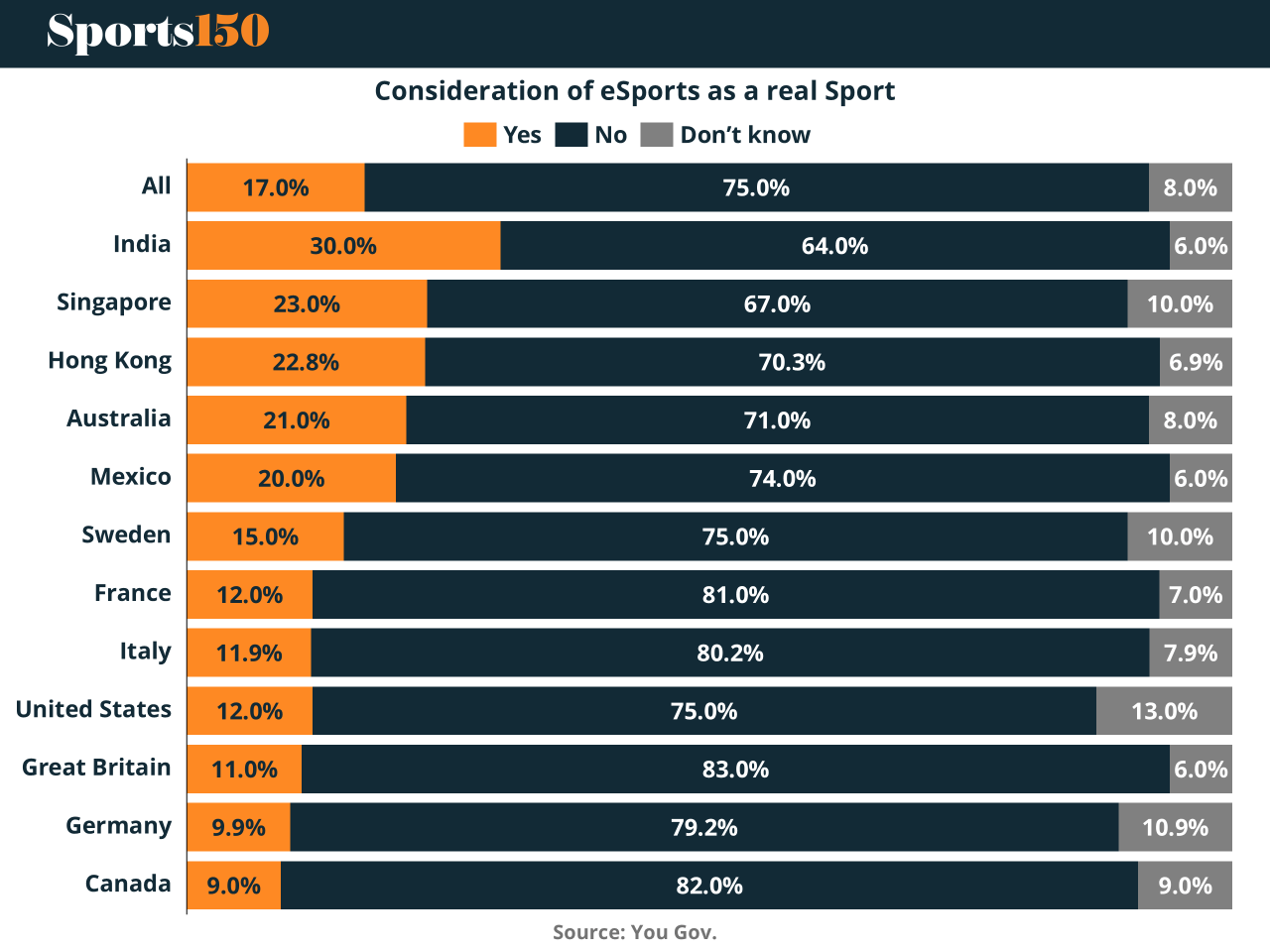

Esports has 532M viewers, $1.38B in revenue, and $837M in sponsorships. Yet, 75% of consumers still don’t think it’s a “real sport”. That’s a gift-wrapped arbitrage. The projected $6.26B market by 2031 is underpinned by youth engagement, device-agnostic access, and real monetization—not cultural validation. In other words, the legitimacy lag is the alpha. Adoption is already surging in Asia and MENA while Europe lags, echoing fintech and streaming curves. Investors betting on sentiment to catch up with infrastructure could ride a 4x return wave. Reminder: Soccer in the U.S. once had the same credibility problem. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

PGA Championship: CBS draws 4.763M for the final round, down 4% from 4.958M last year (Xander). Up 5% from 4.517M two years ago (Koepka). Final hour drew 6.8M.

Prior three years:

2022: 5.273M (Thomas)

2021: 6.583M (Mickelson)

2020: 5.150M (Morikawa)YTD for CBS: 3.6M, up 13%

— Josh Carpenter (@JoshACarpenter)

1:40 PM • May 20, 2025

"I find that the harder I work, the more luck I seem to have"

Thomas Jefferson