- Sports 150

- Posts

- $885M Stadium Deals, $118B Sports Tech, and the New Media Stack

$885M Stadium Deals, $118B Sports Tech, and the New Media Stack

Sports tech targets a $118B valuation and stadium naming rights hit $885M annually, while AI forces a reckoning for broadcasters.

Good morning, ! This week we’re breaking down how sports economics are being rebuilt—from athlete-led empires scaling into nine-figure platforms, to stadium naming rights generating $885M a year as core infrastructure revenue. We look at AI’s looming reckoning for broadcasters, why mobile-first esports is rewriting media rights in Asia, and how sports tech has scaled from a $21.5B market to a projected $118B platform play.

Sponsor spotlight: Affinity’s report breaks down 7 best practices top PE firms use to turn relationship intelligence into better sourcing—finding warm paths early, tightening banker coverage, and building firm-wide visibility. Download Report →

DATA DIVE

From Add-On to Infrastructure

Sports technology is no longer a nice-to-have—it’s becoming core infrastructure. The market is projected to grow from $21.5B in 2025 to $118B by 2034, a scale shift driven by deeper integration across performance, fan engagement, and media production. Europe (34%) and North America (29%) still dominate revenue, but Asia-Pacific (25%) is the growth wildcard, fueled by mobile-first fandom and infrastructure buildout.

Subsector data tells the real story. Stadium and venue tech lead at 28%, followed by wearables (21%) and broadcasting and media (14%). The common thread: recurring revenue and platform density. Capital is following suit, with $32.2B in M&A in the latest half-year alone. The takeaway: sports tech has crossed from experimentation into institutionalization.

Read the Full Report HERE

MEDIA & SPORTS

AI May Rescue Broadcasters, Or Finish Them

For broadcasters, 2026 won’t be a reset. It’ll be a reckoning.

AI is moving from newsroom experiment to operational backbone. Executives like NewsNation’s Michael Corn see production costs falling and visual gaps closing between local stations and legacy giants. CBS, meanwhile, is doubling down on augmented reality studios and AI-assisted storytelling. The outcome? More immersive local content, leaner teams, and a new fight for audience trust.

But the upside comes with existential risk. Fully AI-hosted news shows are expected to debut this year. Corn doubts they’ll succeed—but notes the tech is already good enough to blur the line between real and synthetic. As fabricated video becomes easier to make than verify, CBS and others are betting big on human anchors, trusted brands, and new formats to retain audience credibility.

At the same time, zero-click search behavior is slashing referral traffic. Nearly 60% of searches now end without a click, according to IAB Tech Lab. That’s straining digital ad revenues just as broadcasters ramp up streaming. CBS’s streaming minutes rose 10% YoY, but platforms like YouTube, TikTok, and ChatGPT increasingly control discovery—and monetization.

Bottom line: AI could transform broadcasters into more efficient, trusted storytellers. Or it could push them into irrelevance. The difference will depend on who owns the audience—and the narrative. (More)

PRESENTED BY AFFINITY

Private equity firms face rising competition as auctions drive valuations higher and differentiation lower. The firms that consistently outperform are not simply deploying more capital. They are managing networks more strategically, uncovering warm paths into targets before processes begin, maintaining disciplined banker coverage, and creating visibility across every relationship.

This best practices guide highlights seven proven strategies used by leading firms to source proprietary deals, streamline execution, and position portfolio companies for stronger exits. Built around real-world examples, it shows how relationship intelligence is reshaping private equity deal making from origination through exit.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

Introducing No Off Button: Conversations with founders/investors

Relentless builders don’t wait for permission, and they don’t hit pause. No Off Button goes inside the minds of operators who keep compounding when others tap out.

This week, Aram sits down with Walker Deibel, WSJ bestselling author of Buy Then Build and founder of Acquisition Lab. Walker makes a PE-relevant case that hits close to home: building from zero is often the worst risk-adjusted bet, while buying profitable, owner-operated businesses offers immediate cash flow, control, and asymmetric upside.

The conversation dives into acquisition entrepreneurship, the Silver Tsunami of baby boomer exits, and why “boring” industries deliver better downside protection than most venture-backed plays.

Why PE should care: this is roll-up logic, applied at the individual-operator level, capital discipline, cash yield, and buying earnings instead of narratives.

INVESTOR CORNER

Game Plan: Billionaires Go Long on Sports

Forget yachts. Today’s Ultra-High-Net-Worth Families are snapping up NBA teams and training facilities like they’re blue-chip stocks. Roughly 50% of family offices are in or exploring sports investments, shifting from vanity buys to inflation-protected assets with strategic control. Men’s major leagues dominate, buoyed by media rights, scarcity value, and global fans.

But the real play? Diversification: streaming, venues, ticketing, gaming—sports are becoming multi-revenue platforms. Women's leagues still lag on capital, seen as long-term bets, but a few bold names are moving early. Call it private equity with box seats. (More)

ENTREPRENEURS

From MVP to Multi-Vertical Operator

Stephen Curry has quietly built one of the most sophisticated athlete-led business platforms in sports. At the center is Thirty Ink, his holding company spanning media, consumer brands, and lifestyle ventures, which generated roughly $173.5M in revenue and $144M in EBITDA in 2024—numbers that would look respectable even without a Hall-of-Fame jumper attached.

His earlier vehicle, SC30 Inc., incubated Curry Brand, which helped elevate Under Armour’s basketball franchise for over a decade before the partnership ended in late 2025, with the brand moving independent. Off the court, Unanimous Media anchors Curry’s push into film and TV, while Penny Jar Capital backs bets across fitness tech, fintech, and esports. The playbook is clear: own the platform, not just the endorsement. (More)

TECH & INFRASTRUCTURE

Stadium Naming Rights Are Now Core Infrastructure Revenue

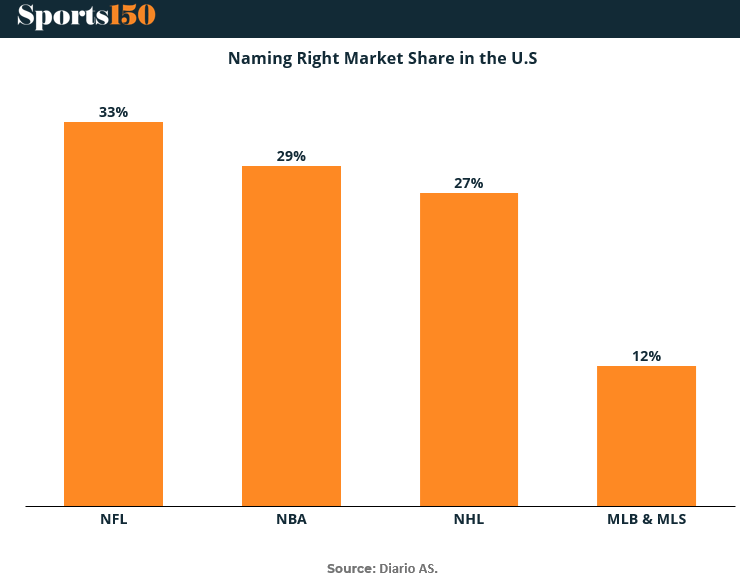

Stadium naming rights in the U.S. have quietly matured into infrastructure-grade cash flows. Across the NFL, NBA, NHL, MLB, and MLS, naming rights now generate $884.7M annually, with the average deal worth $7.4M per year. More telling, 51% of total revenue is concentrated in just 30 contracts, underscoring how top-tier venues have pulled away from the long tail.

The NFL leads with $289.5M annually, or 32.7% of the total market, followed closely by the NBA at $257.4M. These are not sponsorship add-ons. They function as long-dated, low-volatility revenue streams that lenders, municipalities, and private equity underwrite directly into stadium financing models.

For owners and developers, naming rights now behave more like lease income than marketing. Predictable cash flows improve debt service coverage and support larger, more tech-forward builds. For sponsors, the strategy is shifting from awareness to global asset networks. Allianz’s seven-stadium portfolio reflects a play for durable, place-based brand infrastructure rather than one-off exposure.

Why this matters now. As stadium costs inflate and public funding tightens, naming rights are no longer optional upside. They are foundational capital tools shaping how venues get built, financed, and valued. (More)

eSPORTS

Eyes on Screens, Fingers on Phones

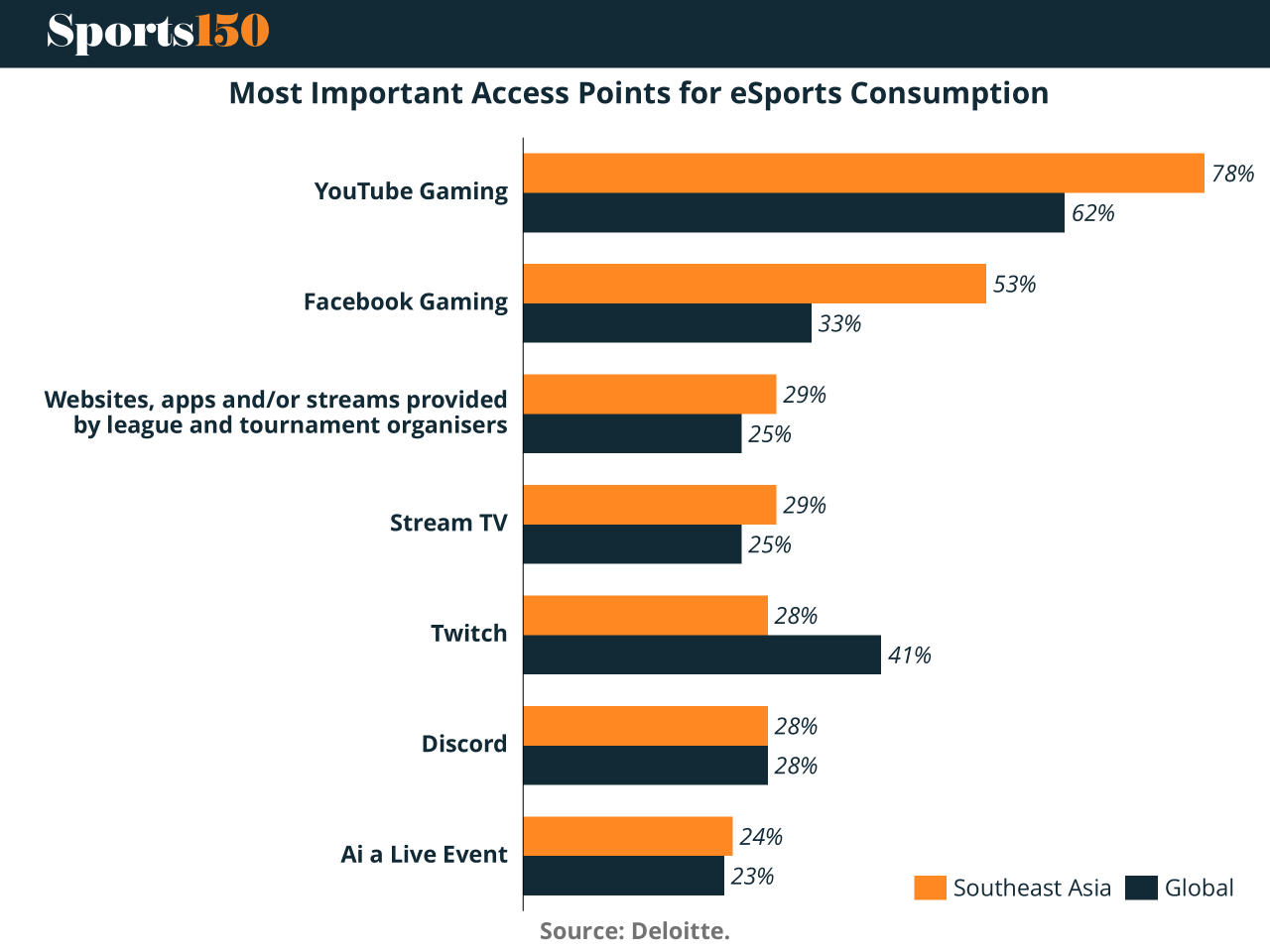

Want to know where eSports is headed? Look where fans are watching. In Southeast Asia, the kingmakers are YouTube Gaming (78%) and Facebook Gaming (53%) — not Twitch. The region’s mobile-first habits flip the Western narrative, with PC-heavy platforms lagging behind. Even league-run apps and sites can’t crack 30%. Global players still lean on Twitch (41%), but in SEA, it’s a different game.

For media rights holders and marketers, this isn’t a minor trend — it’s a distribution disruption in progress. Build for phones. Stream for socials. Or get left on the loading screen. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time."

Thomas Edison