- Sports 150

- Posts

- Sports Technology Market Outlook 2025–2034

Sports Technology Market Outlook 2025–2034

Growth, Platforms, and Capital Formation Across the Global Sports Ecosystem

I. Introduction

The sports technology market has evolved from a supporting function into a strategic pillar of the global sports industry. What began with basic performance tracking and broadcast enhancements now spans a broad ecosystem of data analytics, fan engagement platforms, media production tools, and venue management systems. As competition for audience attention intensifies and traditional revenue models come under pressure, technology has become a primary lever for growth, efficiency, and differentiation across professional and amateur sports alike.

This shift is being reinforced by fundamental changes in how sports are consumed and monetized. The transition toward streaming-led distribution, the rise of always-on digital fandom, and growing expectations for personalized experiences have increased the operational and commercial complexity faced by leagues and teams. In response, sports organizations are investing more aggressively in software-driven solutions that enhance decision-making, deepen fan relationships, and unlock new revenue streams beyond matchday attendance.

At the same time, the sports technology ecosystem has attracted growing interest from private equity firms, venture investors, and strategic buyers seeking scalable, recurring-revenue businesses with global applicability. These capital inflows are accelerating innovation while also professionalizing the market, pushing sports technology providers to deliver enterprise-grade solutions rather than experimental tools. Against this backdrop, sports technology is no longer a discretionary investment but a core component of long-term competitive strategy.

This report analyzes the size, growth outlook, and regional composition of the global sports technology market, providing a data-driven view of where value is currently concentrated and how structural forces are reshaping the industry’s trajectory over the coming decade.

II. Market Size & Growth Outlook

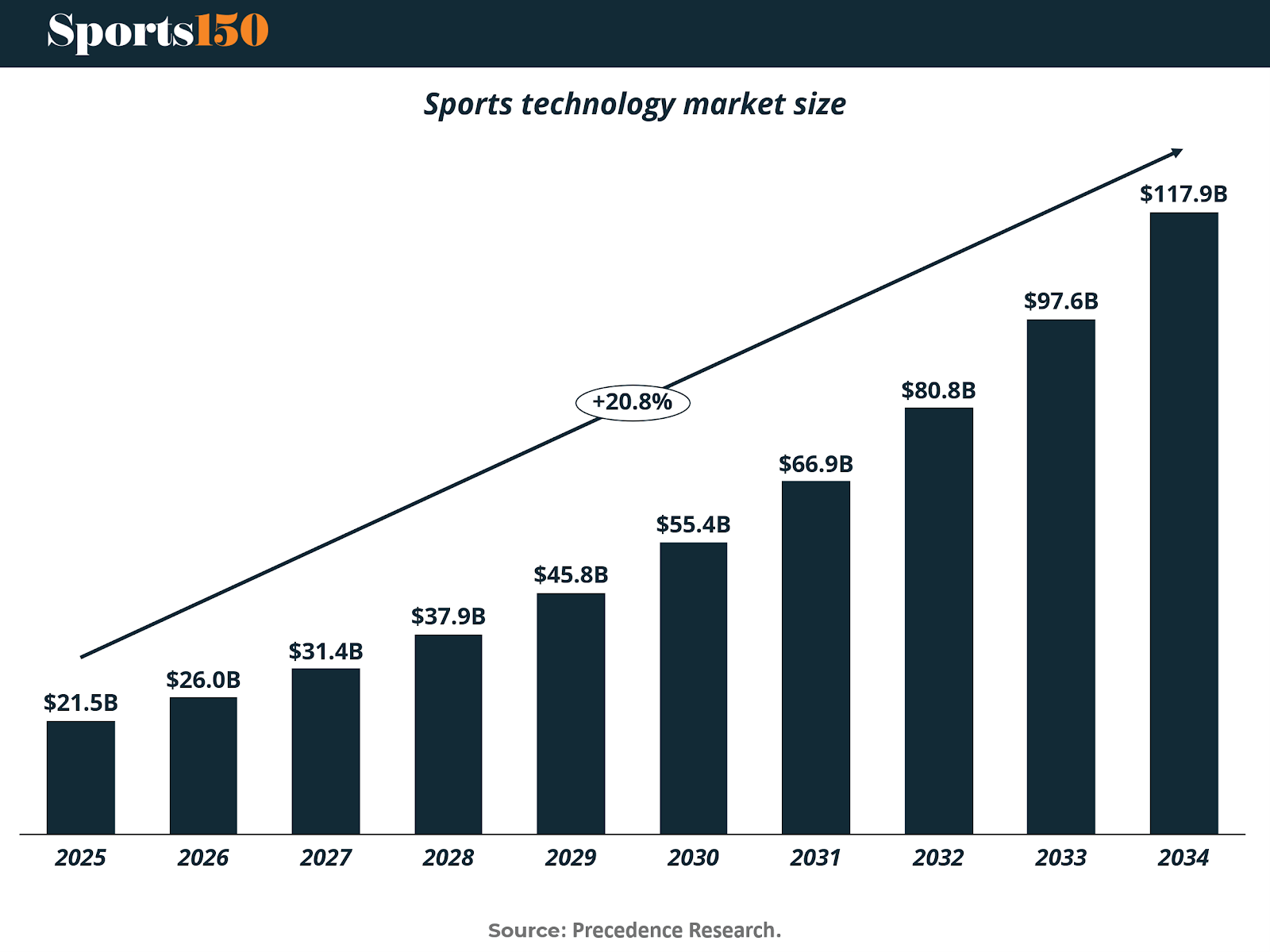

The global sports technology market is entering a period of sustained expansion, reflecting both rising adoption and deeper integration across the sports ecosystem. Market size is projected to increase from USD 21.5 billion in 2025 to approximately USD 118 billion by 2034, representing a steep and consistent growth curve throughout the forecast period. This trajectory underscores the transition of sports technology from an emerging category to a scaled, institutionalized market.

Growth is being driven by multiple demand vectors. On the performance side, teams and athletes are increasingly reliant on advanced analytics, AI-powered insights, and injury prevention technologies to gain marginal competitive advantages. In parallel, leagues and rights holders are expanding investments in fan-facing technologies, including mobile applications, digital ticketing, and personalized content delivery, as they seek to maximize engagement across fragmented digital channels.

Media and content innovation also plays a central role in market expansion. Advances in broadcast technology, cloud-based production, and real-time data integration are enabling sports organizations to produce more content at lower marginal cost, while supporting new monetization models tied to streaming, sponsorship activation, and data licensing. Collectively, these factors are pushing technology spending higher as a percentage of overall sports operating budgets.

Crucially, the pace of growth suggests that sports technology is becoming a non-negotiable investment rather than a cyclical expense. As digital capabilities increasingly influence media rights valuation, fan lifetime value, and commercial scalability, the market’s long-term outlook remains strongly positive, even amid broader macroeconomic uncertainty.

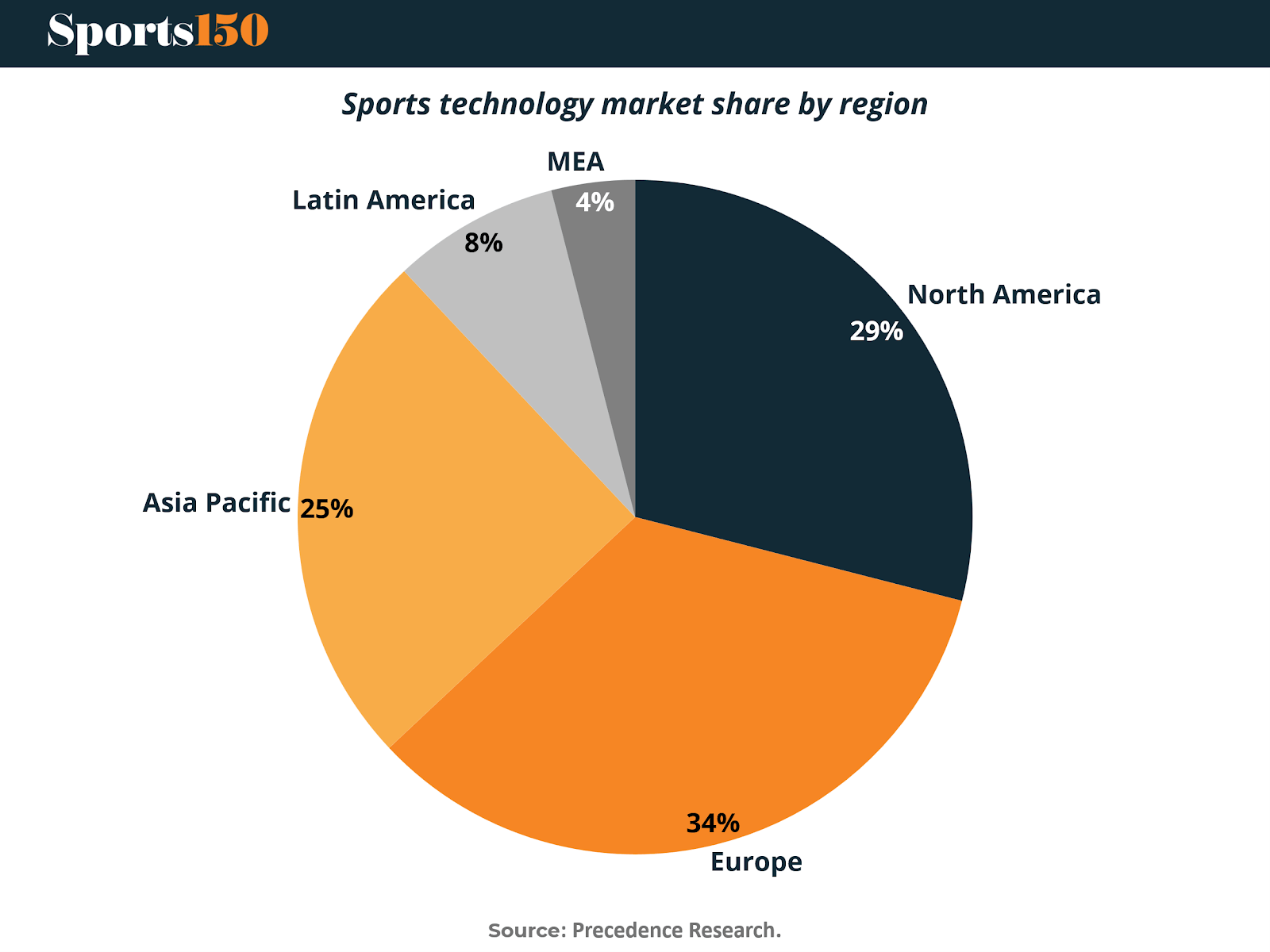

Despite its global relevance, the sports technology market remains regionally concentrated, with developed markets accounting for the majority of current revenue. Europe leads with 34% market share, reflecting the region’s dense network of professional leagues, international competitions, and technology-forward sports organizations. North America follows closely at 29%, supported by high per-team spending, strong commercialization, and early adoption of data-driven solutions across major leagues.

Asia Pacific, representing 25% of market share, stands out as the most dynamic region from a growth perspective. Expanding sports audiences, rapid smartphone penetration, and increasing government and private-sector investment in sports infrastructure are accelerating demand for scalable, cloud-native sports technologies. While average spend per organization remains lower than in North America or Europe, volume-driven growth and digital-first consumption patterns position the region as a critical engine of future expansion.

In contrast, Latin America (8%) and Middle East & Africa (4%) currently account for a smaller share of the market, reflecting structural constraints such as limited infrastructure and lower commercialization levels. However, these regions are increasingly attractive for technology providers offering modular, cost-efficient solutions, particularly in fan engagement, mobile platforms, and broadcast distribution.

Overall, the regional breakdown highlights a clear divergence between revenue leadership and growth momentum. Mature markets continue to drive near-term scale, while emerging regions are set to play a disproportionately large role in shaping the next phase of sports technology adoption and innovation.

In 2025, the sports technology market remains diversified across multiple subsectors, with spending concentrated in areas that directly support fan monetization, venue operations, and performance optimization. The distribution of market share highlights a balance between mature, revenue-generating categories and smaller but strategically important niches.

Stadium and venue technology represent the largest subsector, accounting for 28% of total market share, underscoring the importance of infrastructure-driven investments. Spending in this segment is driven by smart venue systems, digital ticketing, access control, cashless payments, and in-venue connectivity solutions. As teams and venue operators prioritize improving the live experience while optimizing operating efficiency, technology embedded at the venue level remains a critical area of allocation.

Wearable technology follows closely at 21%, reflecting widespread adoption across professional, collegiate, and increasingly amateur sports. Wearables have become foundational tools for performance monitoring, workload management, and injury prevention, with data integration capabilities elevating their strategic value beyond hardware alone.

Sport analytics captures 13% of market share, highlighting the growing reliance on data-driven decision-making. This segment spans performance analytics, scouting, tactical analysis, and business intelligence, serving both on-field and front-office use cases. While smaller than infrastructure-focused categories, analytics continues to punch above its weight in terms of strategic importance and influence on competitive outcomes.

Fan engagement and experience technologies represent 10% of the market. This includes mobile applications, CRM platforms, loyalty programs, and personalized content delivery tools designed to deepen fan relationships across digital touchpoints. Although not the largest category by revenue, this segment plays a central role in long-term fan lifetime value and commercialization strategies.

Smaller but notable segments include sport equipment and smart gear (8%), health and injury prevention (4%), and esports and gaming(2%). While collectively representing a modest share of current market revenue, these categories often sit at the intersection of innovation and future growth, particularly as advances in sensors, AI, and content production lower barriers to adoption.

Overall, the 2025 subsector breakdown reflects a market still anchored in engagement and infrastructure, while steadily expanding into data-centric and performance-focused solutions. This composition underscores the dual mandate facing sports organizations today: enhancing the fan-facing product while simultaneously extracting marginal gains through technology-enabled performance and operational excellence.

V. Market Breakdown by Technology Type: Wearables Lead, Platforms Drive the Next Wave

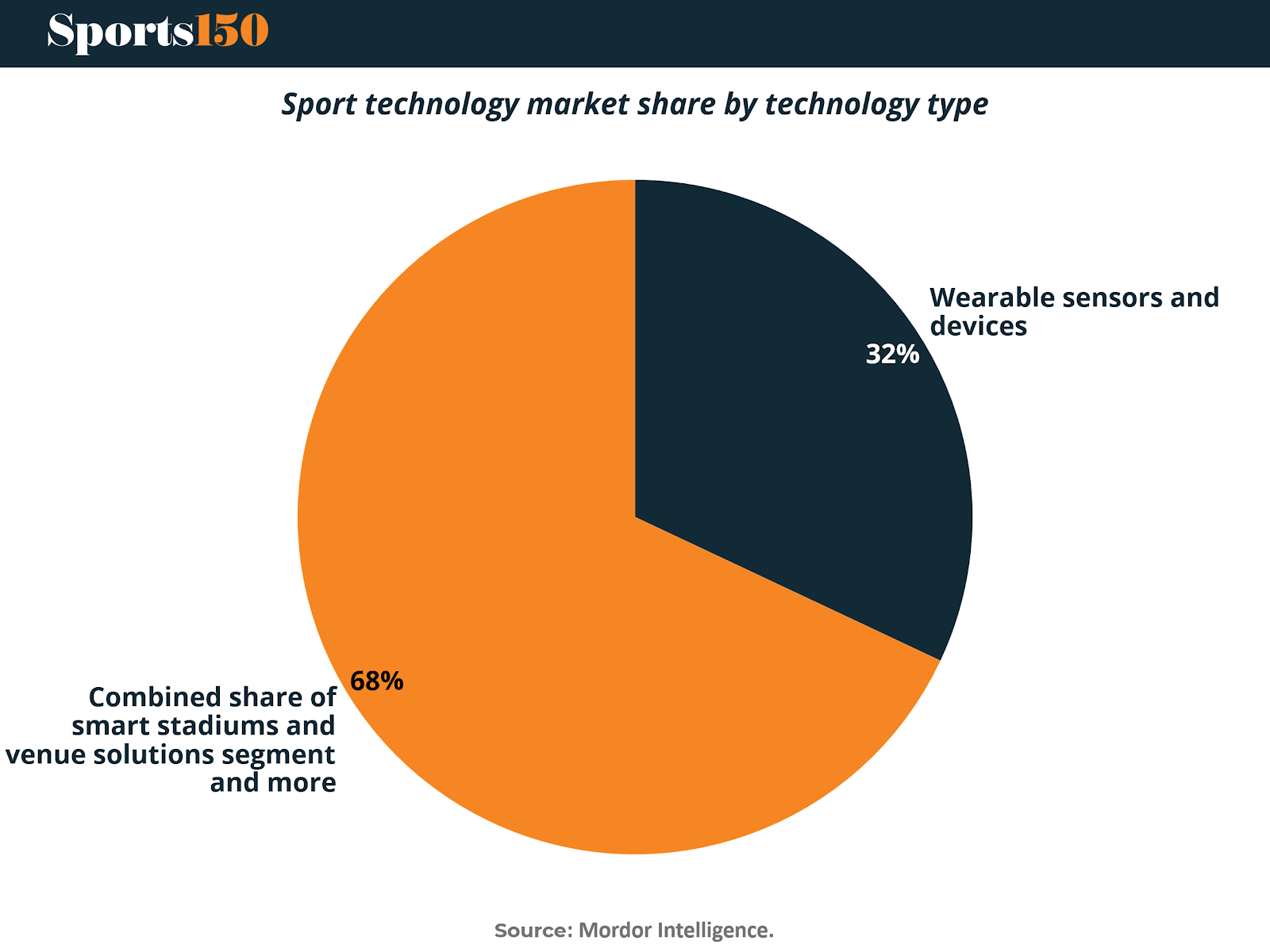

The sports technology market is increasingly defined by the type of technology deployed rather than by end user alone, with clear differentiation emerging between hardware-anchored systems and software-led platforms. In 2024, wearable sensors and devices accounted for approximately one-third of total market revenue, representing the largest single technology category within sports technology. Their scale reflects widespread adoption across professional teams, collegiate programs, and high-performance environments, where continuous monitoring of athlete workload and health has become standard practice.

The strategic importance of wearables extends beyond device sales. Teams are increasingly linking sensor hardware to cloud-based analytics dashboards, converting one-time equipment purchases into recurring software and data subscriptions. This shift has reinforced renewal rates, reduced non-contact injury incidence, and supported higher enterprise valuations by anchoring predictable, annuity-like revenue streams. As a result, wearables now function as entry points into broader performance and analytics ecosystems rather than standalone products.

Beyond wearables, esports platforms are emerging as the fastest-advancing technology category, with projected growth of approximately 26.5% CAGR through 2030. Purpose-built arenas, fiber-to-seat connectivity, and global streaming partnerships are enabling esports organizers to scale international competitions at unprecedented speed and efficiency. Cloud-native technology stacks are further lowering barriers to entry for tournament operators, contributing to rapid expansion in both participation and monetization.

Advances in computer vision and video analytics are also reshaping performance analysis and broadcast workflows. Automated tagging and AI-driven insight generation are materially reducing analysis time while increasing the depth and consistency of performance evaluation. At the same time, fan-engagement platforms are converging previously fragmented capabilities—ticketing, loyalty, content, and merchandising—into unified interfaces, reinforcing the platformization trend observed across the sector.

Middleware and integration layers are playing a growing role in this evolution. Vendors are increasingly combining wearable telemetry with AI-captured match footage to deliver integrated performance reports that raise the baseline for coaching and sports science. Esports, in particular, is serving as a proving ground for interactive overlays and data-rich viewing experiences that are now migrating into traditional broadcast environments. The publication of open API roadmaps has further reduced integration friction, accelerating customer preference for platforms over point solutions.

Overall, the technology-type breakdown reinforces a consistent theme across the sports technology market: value is increasingly captured by suppliers that pair hardware adoption with software, analytics, and data subscriptions. As recurring revenue models replace one-off sales, and as platforms consolidate functionality across use cases, technology type has become a critical determinant of scalability, defensibility, and long-term value creation.

VI. Investor Landscape and Competitive Maturity: U.S. Leadership and Europe’s Catch-Up Phase

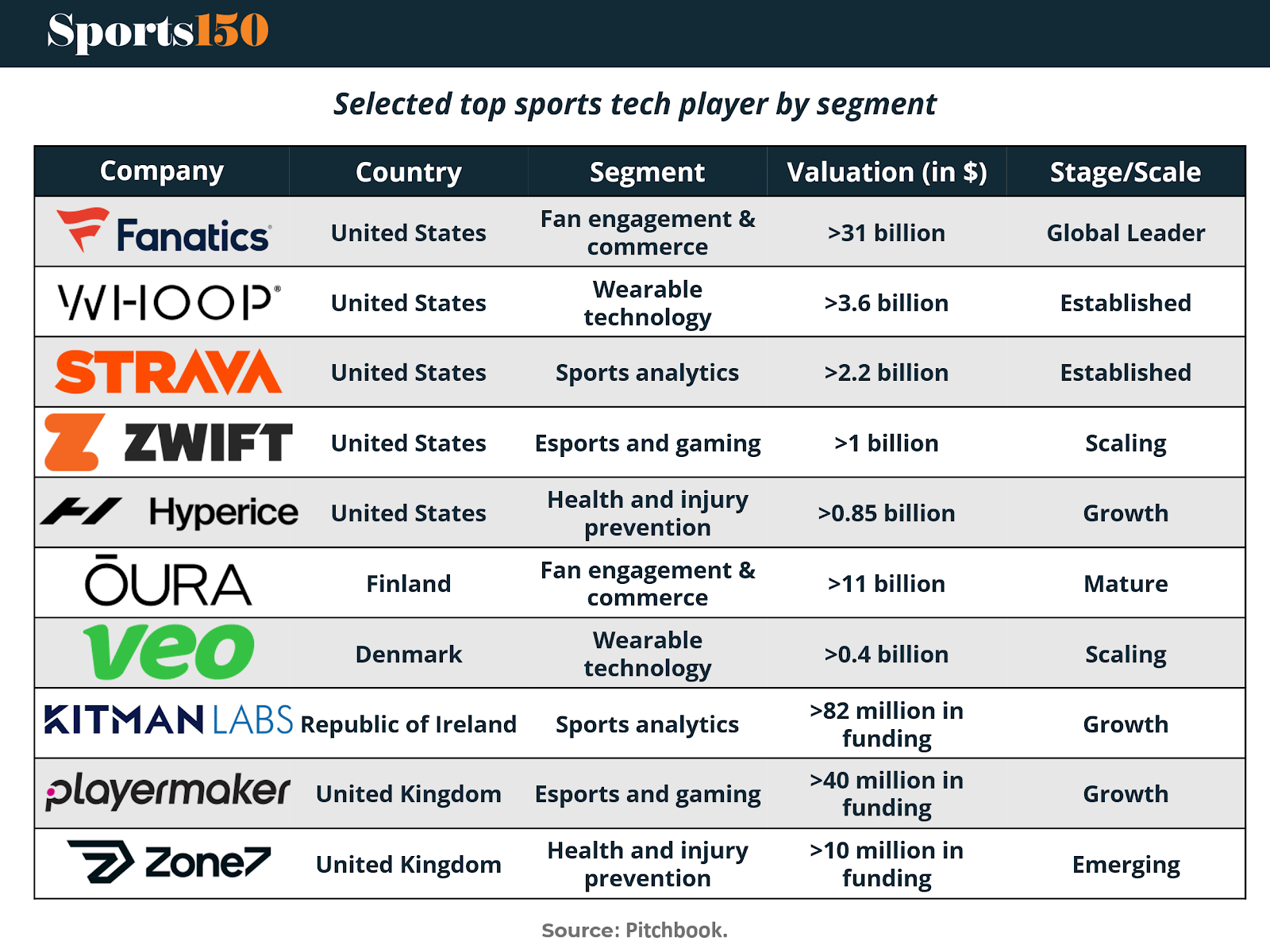

The sports technology investment landscape is increasingly defined by a transatlantic dynamic, with the United States representing a mature, scaled market and Europe emerging as the next major growth frontier. The U.S. sports technology ecosystem has reached a high level of institutional maturity, characterized by proven business models, global category leaders, and sustained capital inflows across multiple subsectors. This maturity has translated into large-scale platforms with defensible market positions, recurring revenue streams, and clear exit optionality for investors.

In the U.S., value creation has been most pronounced in fan engagement and commerce, wearable technology, and sports analytics. Market leaders such as Fanatics, WHOOP, and Strava demonstrate how technology-enabled platforms can scale across leagues, sports, and geographies while embedding deeply into consumer and athlete behavior. These businesses benefit from strong network effects, data advantages, and established partnerships with leagues and media rights holders, reinforcing investor confidence and supporting multi-billion-dollar valuations. The presence of scaled esports and gaming platforms further underscores the U.S. market’s ability to commercialize digital-first sports experiences at global scale.

By contrast, Europe’s sports technology sector is following a similar structural trajectory, but remains at an earlier stage of development. While fewer European companies have reached the valuation scale of their U.S. counterparts, the region is exhibiting accelerating momentum driven by increased innovation density, expanding public and private funding, and rising investor appetite. European leaders such as Oura in wearable technology and Veo in sports analytics highlight the region’s strength in product-led innovation, particularly in hardware-software integration and data-centric performance solutions.

Notably, Europe shows a higher concentration of growth and scaling-stage companies, especially in health and injury prevention and wearable technology. Firms such as Kitman Labs, PlayerMaker, and Zone7 reflect a pipeline of specialized solutions addressing elite performance, athlete health, and injury risk management—areas of growing strategic importance for clubs and federations under cost and performance pressure. While these companies are generally earlier in their commercialization journey, they benefit from strong technical foundations and increasing adoption across professional sports organizations.

From an investor perspective, the contrast between the two regions highlights a shift in opportunity. The U.S. market offers scale, liquidity, and proven winners, while Europe increasingly represents an attractive environment for earlier entry, longer-duration growth, and platform build-up. As European sports organizations continue to professionalize and digitize, and as capital availability improves, the region is well positioned to narrow the maturity gap and produce the next generation of global sports technology leaders.

Overall, the current landscape suggests that sports technology is entering a phase where geographic differentiation matters less for end-market relevance, but significantly for investment timing. The U.S. illustrates what is possible when innovation, capital, and commercialization align, while Europe is now building the conditions to replicate—and potentially extend—that success over the coming decade.

VII. M&A Acceleration and Platform Consolidation in Sports Technology

Mergers and acquisitions activity in sports technology has reached a new inflection point, underscoring the sector’s transition from fragmented innovation to platform-led consolidation. In the most recent half-year period, sports technology M&A totaled $32.2 billion across 233 deals, representing one of the strongest periods on record by both value and volume. While deal count has moderated slightly from peak levels, transaction value remains elevated, signaling a shift toward larger, more strategic acquisitions rather than opportunistic bolt-ons.

This acceleration reflects a clear change in buyer behavior. Acquirers are increasingly focused on building end-to-end platforms that span the full sports ecosystem, from fan engagement and media consumption to athlete development, performance analytics, and operational infrastructure. Rather than acquiring point solutions, strategic buyers and financial sponsors are prioritizing asset density, data integration, and recurring revenue across the fan-to-athlete lifecycle.

The fitness and wellness segment has emerged as a particularly active consolidation arena. High-value transactions, such as TSG’s approximately $1.5 billion acquisition of EōS Fitness, mirror broader high-volume, low-price (HVLP) roll-up strategies aimed at scaling subscription-based revenue models. These moves highlight investor appetite for businesses that combine physical infrastructure with technology-enabled engagement and monetization.

In sports media and distribution, consolidation is reshaping the competitive landscape. Disney’s majority stake in FuboTV, alongside the consolidation of Hulu + Live TV, illustrates the growing advantages of scale in streaming and broadcast distribution. As rights costs rise and customer acquisition becomes more expensive, standalone platforms are increasingly disadvantaged relative to vertically integrated media ecosystems with diversified revenue streams.

Youth sports and athlete development software is also undergoing quiet but meaningful consolidation. Transactions involving Genstar, PlayMetrics, and Stack Sports are forming a category leader in youth sports management, while IMG Academy’s acquisition of SportsRecruits strengthens its position across the athlete development and recruitment funnel. These moves underscore the strategic value of controlling early-stage athlete data, engagement, and institutional relationships.

Finally, event and ticketing infrastructure continues to attract capital as enterprise buyers seek operational leverage. Valeas’ $110 million acquisition of TicketManager reflects sustained demand for scalable, B2B ticketing platforms capable of serving corporate clients and large-scale venues with complex distribution needs.

Taken together, the current M&A environment highlights a clear through-line: buyers are optimizing for platform breadth, integration, and recurring revenue rather than standalone innovation. As consolidation continues, competitive advantage in sports technology is increasingly defined by ecosystem control, data ownership, and the ability to serve multiple stakeholders across the sports value chain. This dynamic suggests that M&A will remain a primary mechanism for value creation as the sector matures and capital continues to favor scaled, defensible platforms.

VIII. Conclusion: From Fragmentation to Platform-Centric Growth

The global sports technology market is entering a decisive phase of maturation. What was once a fragmented landscape of point solutions has evolved into an increasingly integrated ecosystem defined by platforms, data, and recurring revenue models. As technology becomes inseparable from how sports are played, consumed, and monetized, its role has shifted from optional enhancement to strategic infrastructure.

Market growth remains robust, supported by sustained investment in performance optimization, fan engagement, media distribution, and venue operations. Regional dynamics highlight a clear bifurcation between mature markets that offer scale and liquidity, and emerging markets that provide long-term growth optionality. At the same time, subsector and technology-level analysis points to a consistent pattern: solutions that combine hardware adoption with software, analytics, and data subscriptions are capturing disproportionate value and commanding premium valuations.

Investor behavior reinforces this trend. The U.S. market demonstrates how capital, commercialization, and platform density can align to produce category leaders, while Europe is increasingly positioned as the next platform-building opportunity. Across both regions, M&A activity has accelerated as strategic buyers and financial sponsors seek to assemble end-to-end capabilities across the fan-to-athlete lifecycle. Consolidation is no longer defensive; it is a primary mechanism for scaling, differentiation, and value creation.

Looking ahead, competitive advantage in sports technology will be determined less by novelty and more by integration, data ownership, and ecosystem control. Companies that can embed themselves across multiple workflows—spanning performance, engagement, and operations—will be best positioned to benefit from the sector’s continued institutionalization. For investors and operators alike, sports technology now represents not just a growth market, but a durable, platform-driven industry with long-term strategic relevance.

Sources & References

Global Sports Market Update: Media, Technology, and Rights Landscape (Fall 2025)

Global Sports Technology Market Size and Growth Forecasts

Sports Technology Market Share, Segmentation, and Competitive Analysis

Sports Technology M&A, Valuations, and Capital Markets Activity (H1 2025)

Sports Technology Industry Overview and Investment Trends (Q3 2025)

https://www.lincolninternational.com/wp-content/uploads/Q3-25_Sports-Tech-Industry-Report.pdf?x93432

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.