- Sports 150

- Posts

- $161B in Games M&A, 365-Day Tournaments, and the Future of Sports IP

$161B in Games M&A, 365-Day Tournaments, and the Future of Sports IP

The Australian Open drives a $600M economy and U.S. leagues hit 14x revenue multiples, while women’s sports viewership climbs 5%.

Good morning, ! This week we’re breaking down the Australian Open’s playbook for asset optimization, the rise of athlete-led scalable sports businesses, the real signal behind $161B in games M&A, why capital keeps choosing U.S. leagues, and how women’s sports became must-buy media.

Want to advertise in Sports 150? Check out our ad platform, here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

DATA DIVE

AO Goes for Australian Open or for Assets Optimization?

The Australian Open has quietly become one of the most commercially potent sports properties on the planet. How? By treating its Grand Slam status like a venture-backed startup.

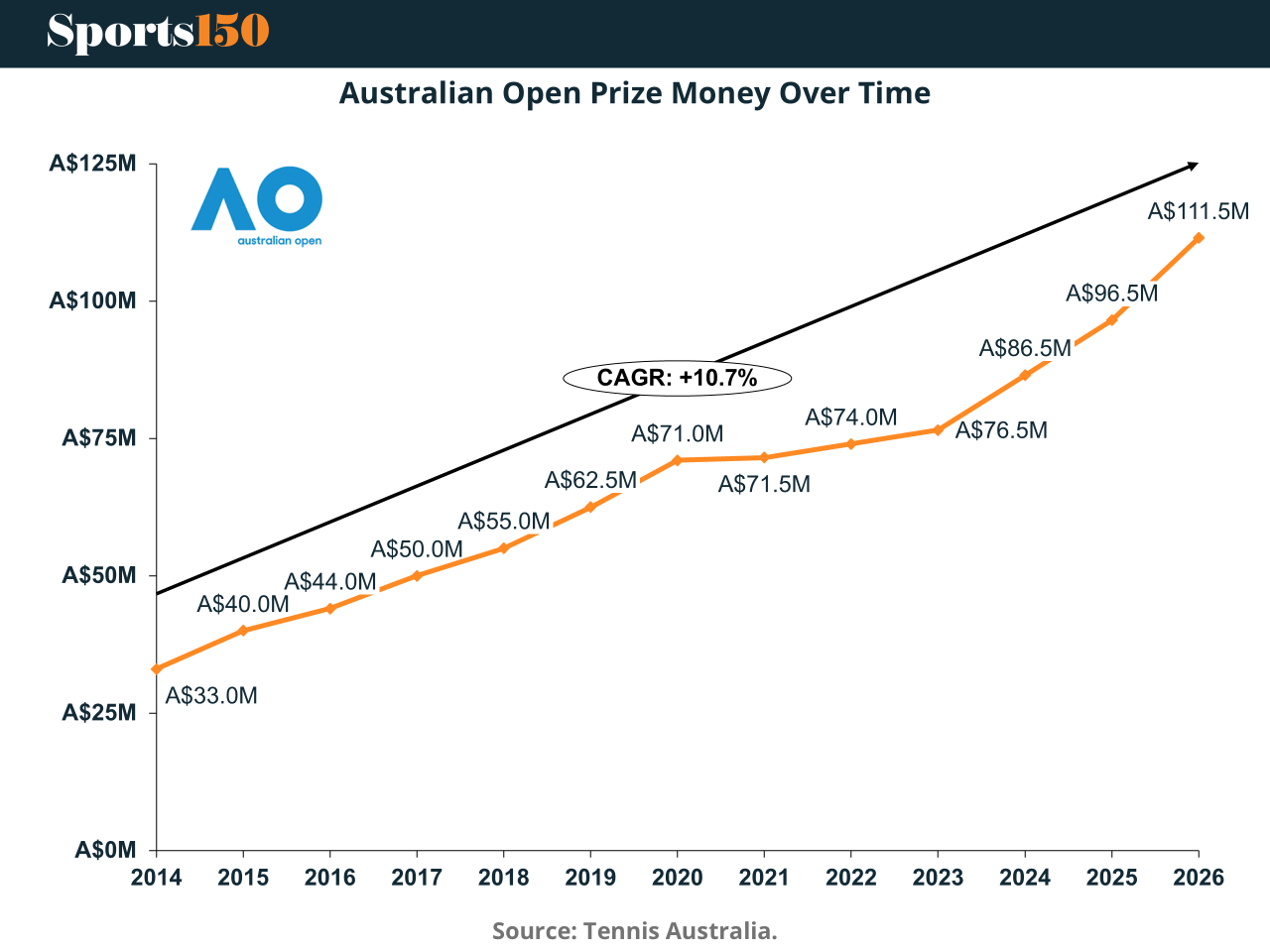

From 2015 to 2029, domestic media rights will more than double from A$40M to A$90M, thanks to the rare combo of scarcity, live-event stickiness, and FOMO among broadcasters. Meanwhile, sponsorship revenue (A$84M) now outpaces media rights, with Tennis Australia leveraging the AO as a lifestyle platform—not just a tennis event.

Prize money? Up 3x in a decade. Fan attendance? Doubled since 2010. And Melbourne’s economic benefit? A$600M+ annually.

The AO’s secret sauce: Turn a two-week tournament into a 365-day brand ecosystem.

MEDIA & SPORTS

From Momentum to Media Muscle

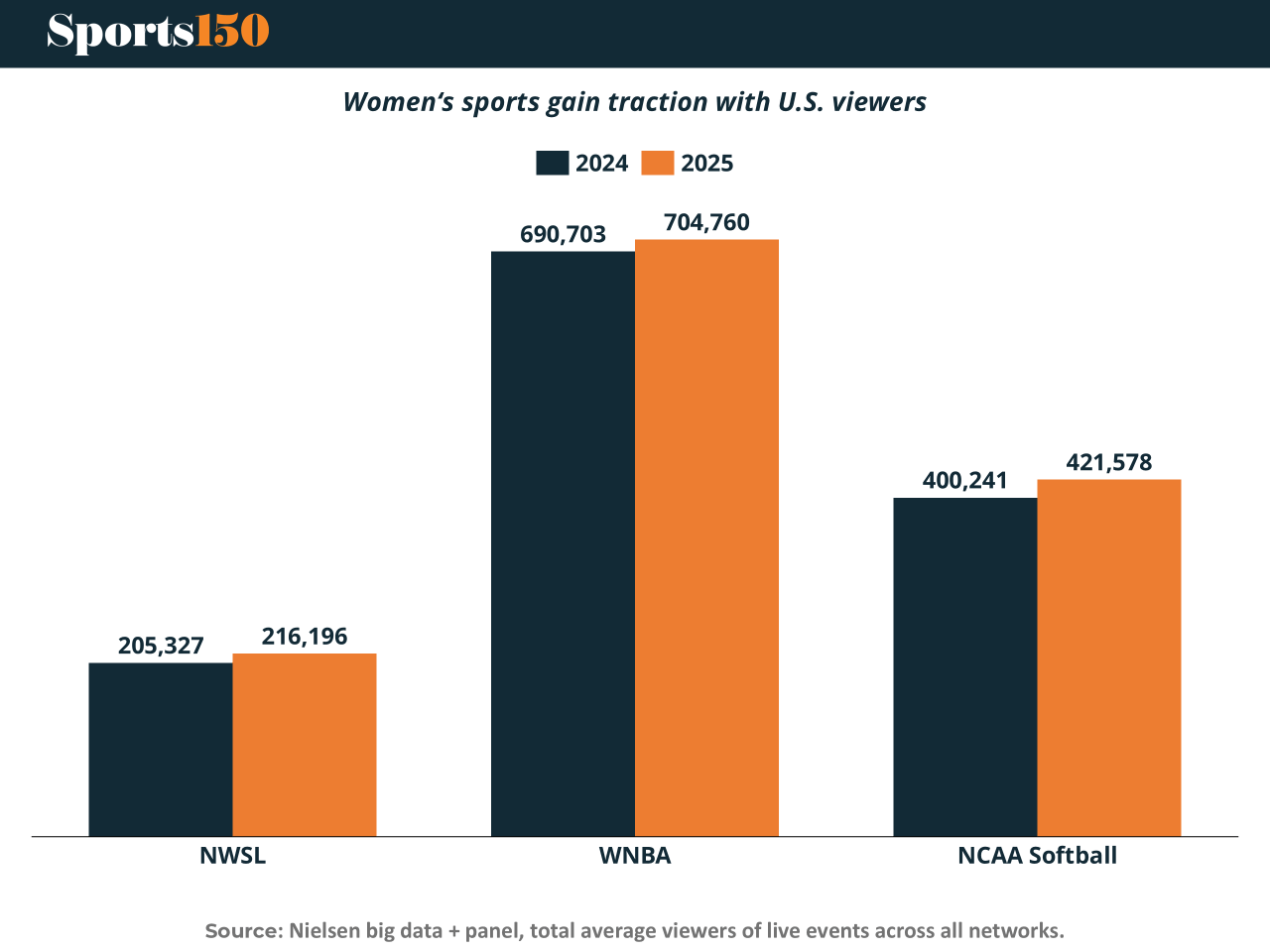

Women’s sports have crossed an important threshold: they’re no longer an emerging bet—they’re a scaled media asset. Fresh Nielsen data shows consistent year-over-year viewership growth across major leagues, reinforcing their relevance for broadcasters, advertisers, and sponsors.

The NWSL posted a 5% increase in average viewership, driven by expanded media distribution and rising international talent. The WNBA, already the category’s largest property, grew a more modest 2%, but at scale—adding hundreds of thousands of incremental viewers. NCAA Women’s Softball matched the NWSL’s 5% growth, benefiting from appointment viewing and a steadily refined broadcast product.

Audience composition matters, too. Women now account for 47% of women’s sports fans, with global football trending toward a female-majority audience.

The takeaway: Women’s sports are shifting from optional inventory to must-buy programming. (More)

INVESTOR CORNER

Closed Leagues, Open Wallets: Why Capital Keeps Choosing U.S. Sports

The valuation gap between U.S. franchises and European football is no longer cyclical. It is structural. Recent minority and control transactions in the National Football League and National Basketball Association imply revenue multiples north of 10x and 14x, with marquee assets clearing $9B to $10B headline values. By contrast, elite European football clubs remain stuck near 4–5x revenue, despite global fandom and cultural relevance.

The core driver is risk architecture. Closed leagues offer predictable media cash flows, central revenue sharing, cost controls, and now formal private equity access. Open leagues absorb relegation risk, wage inflation, weak debt discipline, and fragmented media markets. The result is volatility that equity capital prices aggressively.

This divergence is accelerating. U.S. leagues are compounding upside through long-dated media contracts and financial engineering at the league level. European football is still fighting fires at the club level, with aggregate losses exceeding €1B and debt above €28B.

For investors, the takeaway is not that football is uninvestable. It is that alpha requires structural change or mispriced control situations, not passive exposure. Until governance and cost containment converge with U.S. models, capital will keep paying premiums for predictability.

Why this matters now: capital is voting with valuation. The next decade of sports ownership returns will be determined less by fandom growth and more by league design. (More)

ENTREPRENEURS

Del Potro’s Second Serve Is a Scalable Business

Juan Martín del Potro isn’t just running a tennis academy—he’s building a brand. The Del Potro Tennis Academy in South Florida leverages his star power to enter the high-performance training market with global reach and a premium price point.

The model is more than courts and coaches. Del Potro offers a holistic athlete development platform—blending technical training, injury prevention, mental coaching, and lifestyle guidance. It’s designed to attract both aspiring pros and high-income amateurs, with diversified revenue from junior programs, adult clinics, short-term camps, and branded gear.

Most importantly, it scales. With potential for satellite locations, digital coaching, and international partnerships, this is sports IP monetization done right: turning elite reputation into a replicable business. (More)

TECH & INFRASTRUCTURE

Melbourne’s Grand Slam of Urban Economics

Melbourne Park isn’t just serving aces—it’s serving ROI. With nearly A$1B in public-private investment, the home of the Australian Open is now a 365-day entertainment machine. The shift from tennis-only to a year-round precinct model (think MSG with better weather) has turned Melbourne into a competitive player in the global venue game.

Key to the playbook: asset diversification, strategic risk-sharing with the Victorian government, and the Australian Open acting as a brand amplifier. The result? An economic engine that hosts everything from esports to corporate conferences, all while generating hundreds of millions in activity annually. Not bad for a venue that used to shut down after January. (More)

eSPORTS

Games M&A Hits $161B. Esports Is the Optionality Layer

The record $161B in global games M&A in 2025 is not an esports headline. But it is an esports signal. Strategic buyers like Netflix, Tencent, and Sony are consolidating distribution, IP, and tooling. Esports sits downstream as a leveraged monetization layer on top of that infrastructure.

Capital is flowing where esports economics will be built, not where they are today. Mobile studios absorbed multi billion dollar checks. AI and creator tools attracted sustained late stage funding. UGC platforms and identity layers are being quietly rolled up. These assets define how competitive gaming is produced, surfaced, and monetized, even if teams and leagues are not direct beneficiaries yet.

For esports operators, this matters because control is shifting up the stack. Publishers and platforms with deeper balance sheets will dictate formats, calendars, and media surfaces. Teams without differentiated IP or proprietary audiences risk becoming interchangeable labor.

For investors, the takeaway is clear. Esports exposure in 2026 looks less like team equity and more like picks and shovels. Infrastructure, tooling, and distribution assets with esports adjacency offer asymmetric upside without relying on fragile league economics.

Why this matters now: consolidation cycles set power dynamics for the next decade. Esports stakeholders who do not align with the buyers shaping the stack will not set the terms later. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

PUBLISHER PODCAST

No Off Button: Work/Life Lessons To Reach 700,000 Subscribers And #1 In Your Niche

Champions don’t slow down. They don’t wait for shortcuts. And they definitely don’t have an off switch. No Off Button is where Aram sits down with founders and creators who treat their craft like a long game—obsessive execution, high standards, and zero excuses.

This week’s guest is Rocky Xu, a finance filmmaker who built a 700,000+ subscriber audience and became #1 in his niche by skipping the creator playbook entirely. From day one, Rocky approached YouTube like a media company—producing Netflix-level documentaries from his bedroom and focusing on assets that compound, not viral hits.

The conversation digs into lessons PE minds will recognize instantly: why consistency beats hacks, why distribution is power, why AI is a tool—not a replacement for judgment—and why real value is built by owning evergreen catalogs, not chasing weekly spikes.

Why it matters: this is capital allocation and brand-building logic applied to media. Long-term thinking, defensible taste, and doing the work when no one’s watching.

"Always bear in mind that your own resolution to succeed is more important than any other."

Abraham Lincoln