- Sports 150

- Posts

- The Business of the Australian Open

The Business of the Australian Open

How Melbourne Built One of Sport’s Most Valuable Annual Properties

Introduction

The Australian Open (AO) has evolved from a traditional Grand Slam tournament into one of the most commercially sophisticated annual sporting properties in the world. Beyond its sporting prestige, the AO is now a case study in rights monetization, demand creation, brand leverage, and scalable event economics.

This report examines the economic engine of the Australian Open through five core dimensions: media rights valuation, sponsorship monetization, prize money reinvestment, attendance growth, and long-term financial scalability.

Media Rights as the Financial Backbone

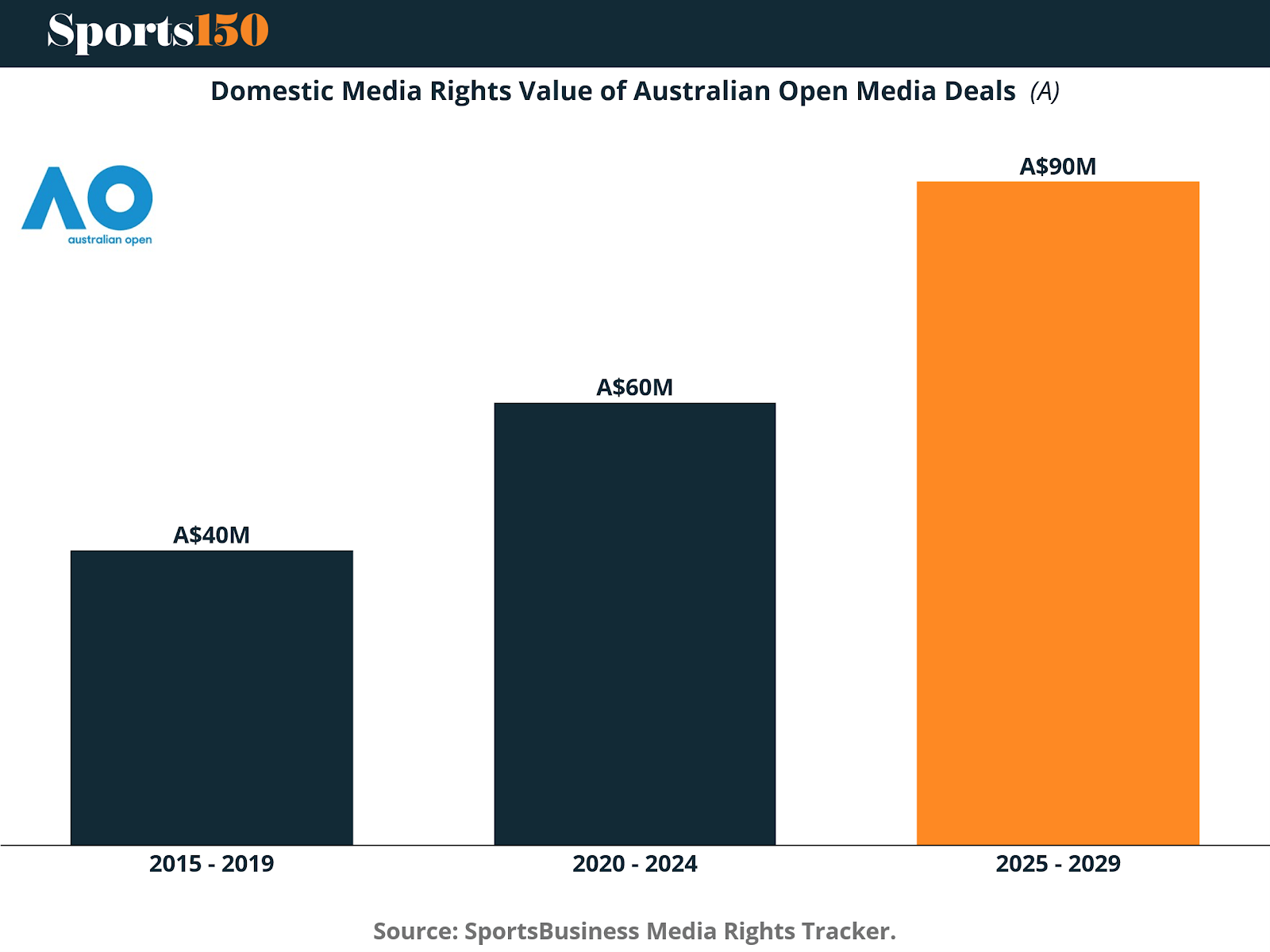

The most structurally important driver of the Australian Open’s commercial growth has been the steady appreciation of its domestic media rights.

Between 2015–2019, the tournament’s domestic rights were valued at approximately A$40M per cycle. This rose to A$60M for 2020–2024 and is projected to reach A$90M for the 2025–2029 cycle — representing more than a doubling in value within a decade.

From a strategic business perspective, this escalation reflects a convergence of market forces. Premium live sports content remains one of the few assets capable of delivering mass real-time audiences in an increasingly fragmented media ecosystem. At the same time, intensifying competition between traditional broadcasters and global streaming platforms has driven aggressive bidding behavior, while the Australian Open’s affluent, global, and brand-safe audience profile has further reinforced its commercial appeal.

Media rights now function not merely as a revenue stream, but as a balance-sheet anchor: underwriting prize money growth, infrastructure investment, and marketing expansion across international markets.

Sponsorship and Media: A Dual-Revenue Flywheel

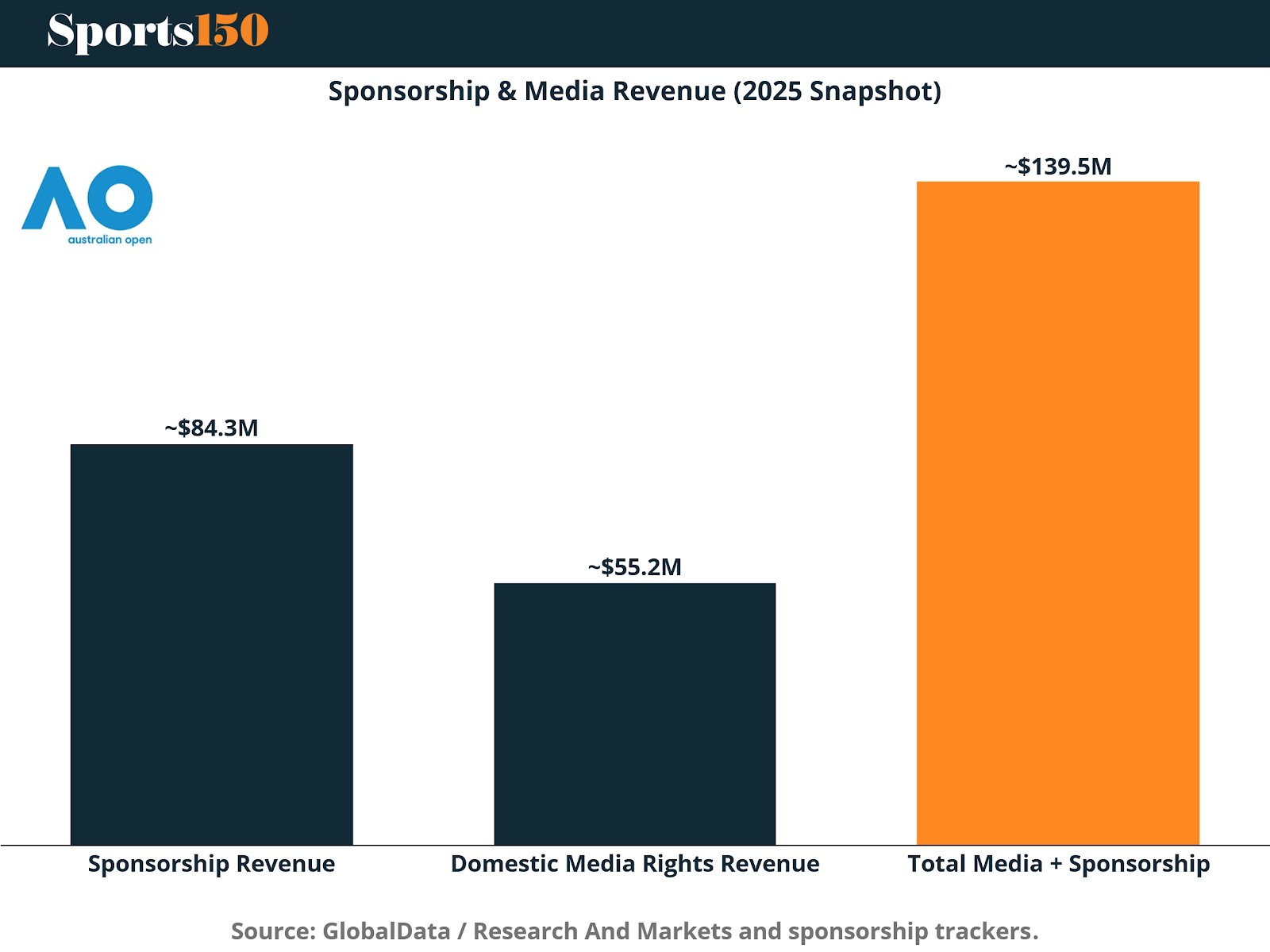

In 2025, the Australian Open generated approximately $84.3M in sponsorship revenue alongside $55.2M in domestic media rights revenue, bringing total media and sponsorship income to nearly $140M.

This dual monetization structure creates a reinforcing commercial flywheel. Higher broadcast reach increases sponsor value, enabling Tennis Australia to secure more lucrative and longer-term partnerships. In turn, those partnerships fund improvements in production quality, fan engagement initiatives, and digital activation, which further enhance the product’s broadcast value.

Strategically, the AO has positioned itself not merely as a tennis tournament, but as a global lifestyle and technology platform. Its sponsorship portfolio now spans financial services, automotive, luxury goods, technology, data, sustainability, and ESG-linked initiatives. Crucially, sponsorship revenue now exceeds domestic rights revenue, indicating the tournament’s success in extracting brand equity beyond simple viewership metrics and into experiential marketing, data partnerships, and year-round brand integration.

Prize Money as Strategic Capital Allocation

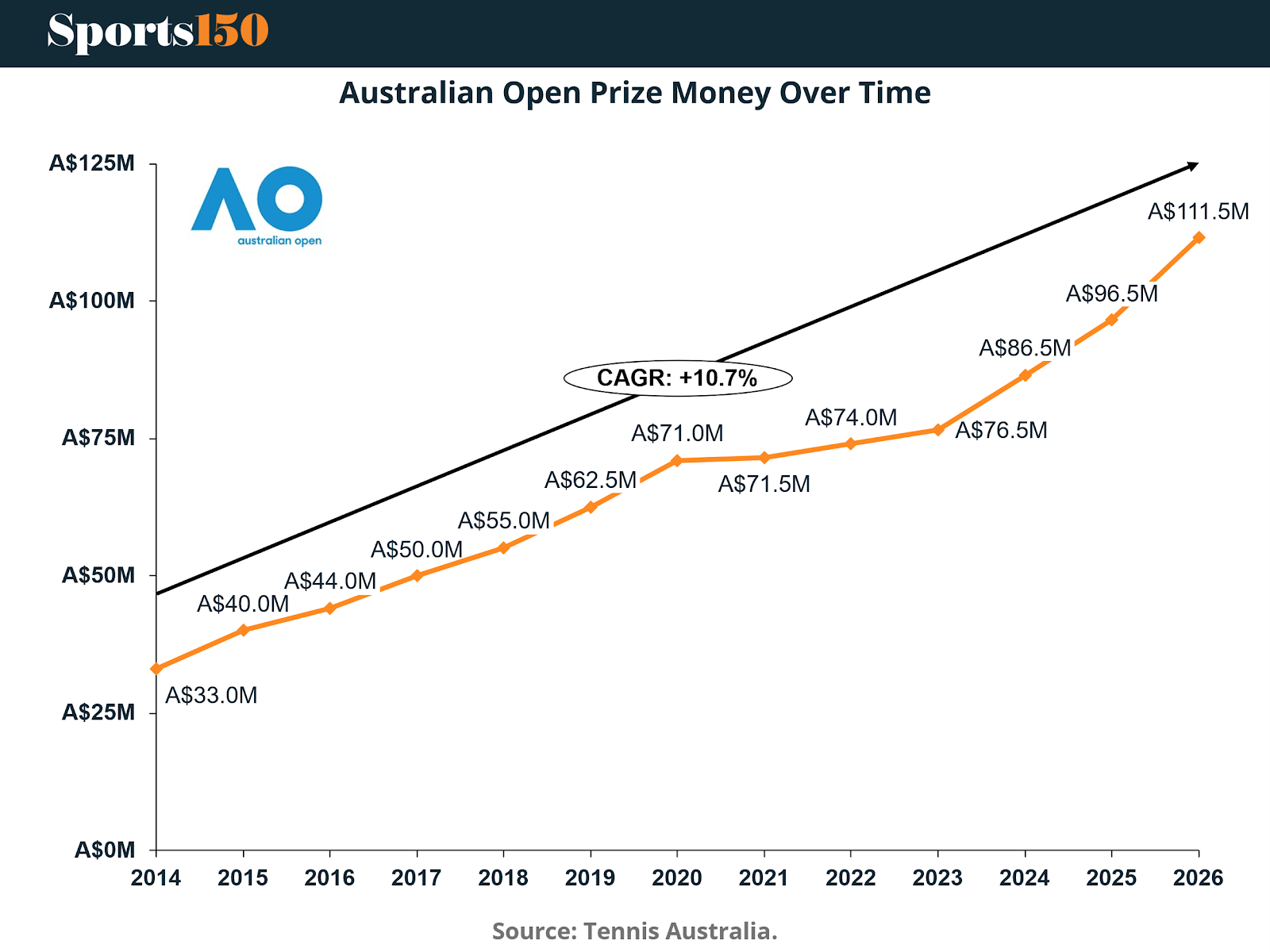

Prize money at the Australian Open has increased from A$33M in 2014 to A$111.5M in 2026, representing a compound annual growth rate (CAGR) of approximately 10.7%.

This is not merely cost inflation; it reflects a deliberate capital allocation strategy into the tournament’s core product: elite competition quality. Higher prize money strengthens player participation, elevates match quality, enhances global media appeal, and reinforces long-term brand credibility. In business terms, this constitutes reinvestment into product differentiation, ensuring the AO remains competitive against Wimbledon, Roland Garros, and the US Open not just in prestige, but in athlete economics.

The acceleration in prize growth after 2023 further signals Tennis Australia’s recognition that elite athletes are not a commodity input, but a value multiplier whose incentives directly shape the tournament’s global positioning.

Prize Distribution and Competitive Equity

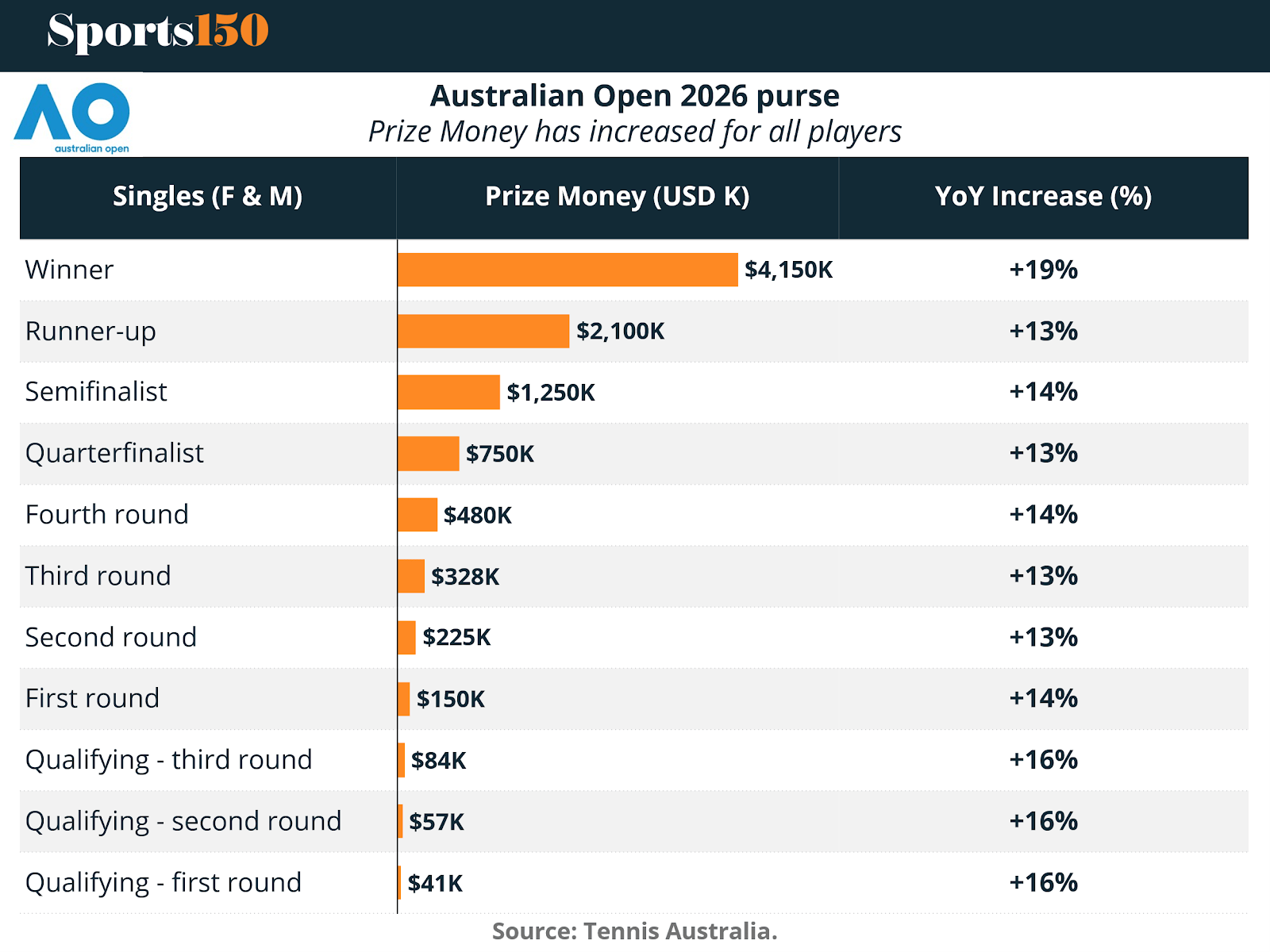

The 2026 prize money distribution demonstrates a clear strategic shift toward economic inclusivity across the player pyramid.

While winners will receive $4.15M (+19% YoY), Tennis Australia has also materially increased compensation across early rounds and qualifying stages. First-round players will receive $150K (+14%), while qualifying rounds have seen increases of up to +16%.

This structure reflects a progressive labor market model within professional tennis. By broadening economic participation, the AO enhances the sustainability of the talent pipeline, mitigates reputational and labor-relations risk, and strengthens the competitive depth of the tournament. From a business standpoint, prize money has evolved from a reward mechanism into a form of human capital strategy.

Attendance Growth: Demand as Proof of Brand Power

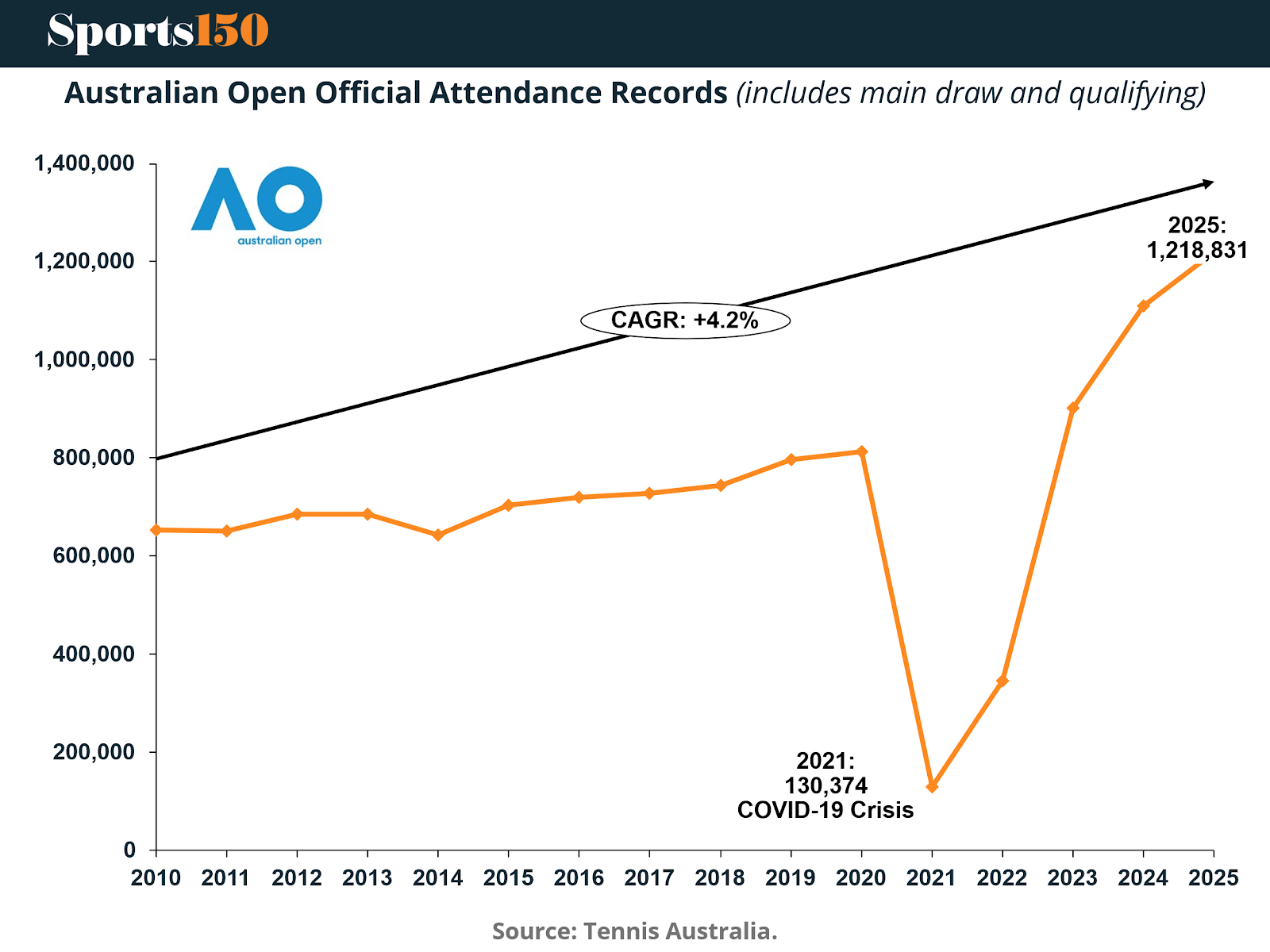

Between 2010 and 2025, attendance at the Australian Open expanded from roughly 650,000 to more than 1.2 million spectators, despite a dramatic pandemic-driven collapse in 2021.

The long-term CAGR of approximately 4.2% underscores the tournament’s success in expanding venue capacity, enhancing the fan experience, and converting global interest into physical footfall. Particularly instructive is the post-COVID rebound: attendance not only recovered but exceeded pre-pandemic levels, signaling structural rather than cyclical demand.

For sponsors and broadcasters alike, live attendance is not merely a source of ticket revenue. It is a signal of brand magnetism, content authenticity, and pricing power across commercial rights.

Economic Impact and Host City Value

Beyond direct tournament revenues, the Australian Open generates substantial macroeconomic value for Melbourne and the state of Victoria.

Recent estimates place the annual economic benefit at approximately A$565M in 2025, with projections exceeding A$600M in future editions. This positions the AO as a tourism catalyst, a hospitality demand engine, and a justification for sustained public-private investment in infrastructure and urban development.

From a public finance perspective, this strengthens Tennis Australia’s bargaining position with government stakeholders, enabling continued capital support while reinforcing the tournament’s status as a strategic urban asset rather than merely a sporting event.

Strategic Synthesis: Why the AO Is an Elite Sports Business Asset

The Australian Open’s economic model reflects rare alignment across multiple dimensions. Its media rights valuation continues to grow at a rate exceeding inflation and GDP benchmarks, sponsorship revenue now outpaces domestic broadcast income, prize money reinvestment strengthens product quality, attendance growth confirms structural demand, and public economic impact justifies long-term institutional support.

This alignment enables financial resilience, competitive insulation, strong bargaining power with partners, and sustained brand appreciation. Unlike league-based properties dependent on weekly fixtures, the AO monetizes scarcity, prestige, and seasonality, making it uniquely valuable within the global sports property ecosystem.

Outlook: The Next Phase of Growth

Looking ahead, the Australian Open’s next growth phase is likely to be driven by digital rights packaging, direct-to-consumer international content strategies, data-driven sponsorship activation, premium hospitality expansion, and ESG-linked brand partnerships.

As sports economics increasingly reward platform-scale events capable of delivering both global reach and premium audience quality, the Australian Open stands as a textbook example of how a legacy tournament can evolve into a modern, diversified, global sports enterprise.

Sources & References

Australian Open. (2025). AO delivers record $565.8 million in economic benefits to Victoria. https://ausopen.com/articles/news/ao-delivers-record-5658-million-economic-benefits-victoria

Businesswire. (2025). Australian Open 2025 Post Event Analysis: Record Viewership and Prize Money. https://www.businesswire.com/news/home/20250425528754/en/Australian-Open-2025-Post-Event-Analysis-Record-Viewership-and-Prize-Money---ResearchAndMarkets.com

GlobalData. (2025). Australian Open 2025 generates estimated annual sponsorship revenue of $84.32 million, reveals GlobalData. https://www.globaldata.com/media/sport/australian-open-2025-generates-estimated-annual-sponsorship-revenue-84-32-million-reveals-globaldata/

News Nab. (2026). Australian Open set to serve $600m economic ace for Melbourne. https://news.nab.com.au/tag/consumer-spending/australian-open-set-to-serve--600m-economic-ace-for-melbourne

Notice. (2024). A look inside the business of the Australian Open. https://www.noticesports.com.au/p/a-look-inside-the-business-of-the

Perfectennis. (2026). Australian Open Prize Money 2026. https://www.perfect-tennis.com/prize-money/australian-open/

Sportcal. (2026). Preview: Australian Open ready to serve up commercial success. https://www.sportcal.com/features/preview-australian-open-ready-to-serve-up-commercial-success/

Tennis Australia. (2025). Australian Open Prize Money. https://www.tennis.com.au/wp-content/uploads/2025/01/AO25-Prize-Money.pdf

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.