- Sports 150

- Posts

- When it comes to sponsorship ROI, soccer fans are the real MVPs

When it comes to sponsorship ROI, soccer fans are the real MVPs

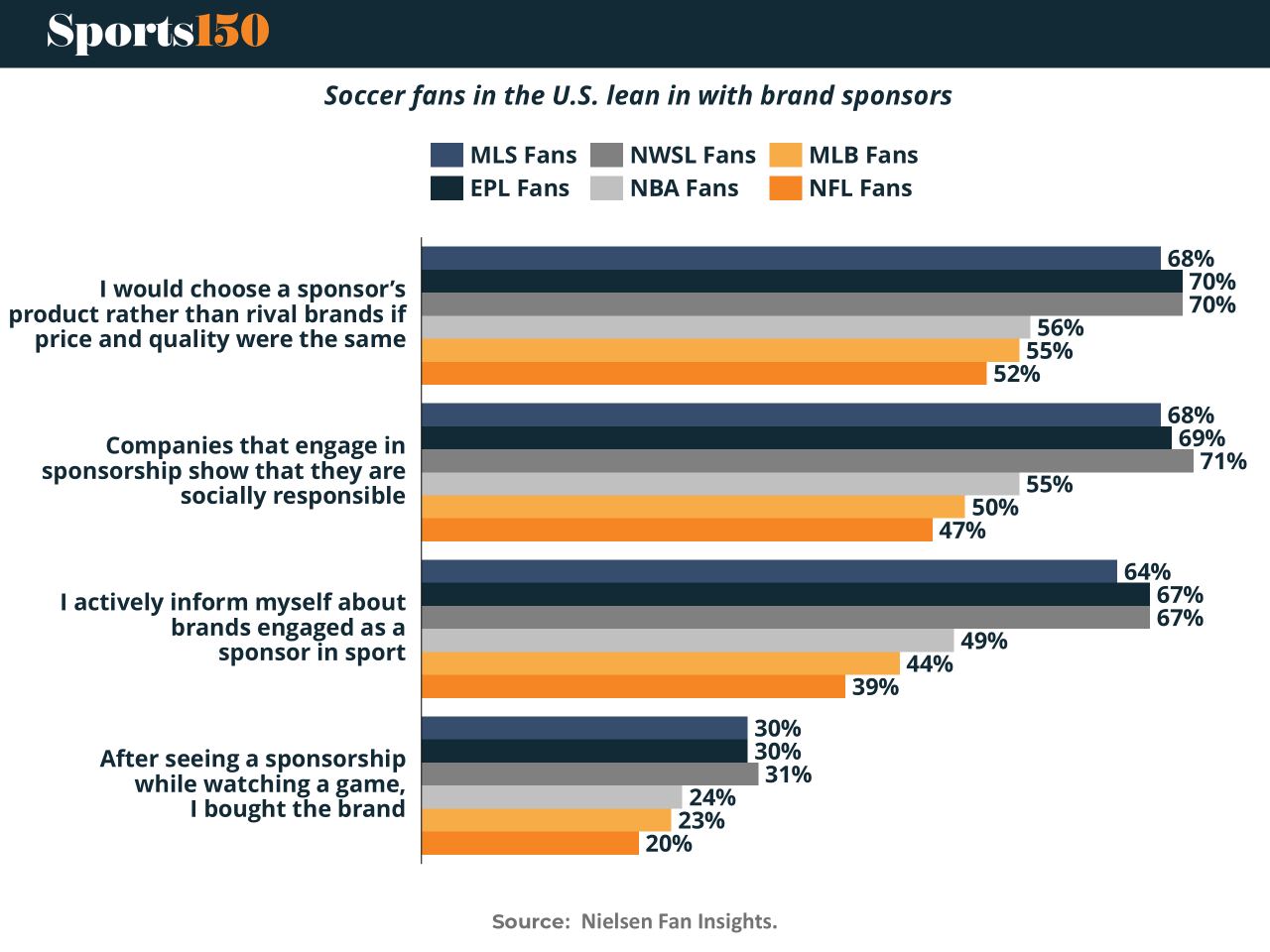

Nearly 70% of MLS, EPL, and NWSL fans say they’d pick a sponsor’s product over a rival brand—far outpacing the 50% loyalty rate among NBA, NFL, and MLB fans.

This level of brand affinity highlights soccer’s unique position in the sponsorship landscape: fans are not just passive spectators, they are active participants who integrate brand choices into their identity as supporters.

Beyond purchases, soccer fans also see sponsorships as a form of social responsibility. Two-thirds believe that brands backing their league are making a positive contribution to local communities, reinforcing the idea that sponsorship is not only transactional but also cultural. For brands, this means every activation has the potential to resonate far beyond the stadium, building goodwill that strengthens long-term equity.

The engagement isn’t passive either. Two-thirds of soccer fans actively research the companies that sponsor their teams, compared to just 39% of NFL fans. This demonstrates that soccer fandom creates an environment where brand partnerships are noticed, discussed, and evaluated—making sponsorship dollars work harder.

And the timing couldn’t be better. With the 2026 FIFA World Cup headed to North America, soccer is on the brink of its biggest audience surge yet in the region. Brands that invest now are not just aligning with a sport—they are embedding themselves in a movement, buying into a growing fan base that doesn’t just acknowledge sponsorships, but actively rewards them with loyalty, advocacy, and spending power.

Women’s sports: from purpose-driven to business-driven

Women are increasingly making up a larger share of fans for both women’s and men’s sports. In 2024, women represented 47% of fans of women’s sports and 42% of fans of men’s sports, up from 45% and 40%, respectively, in 2022. This shift underscores a crucial reality: different audiences call for different approaches—and unique brand opportunities.

Supporting women’s sports is no longer just the right thing to do, it’s a business imperative. With a strong female fandom, women’s sports are opening the door to new players within the sponsorship space. Categories are diversifying as purchase intent evolves. For example, luxury brand Coach recently became the official handbag partner of the WNBA, a category where women’s team sports fans are significantly more likely to buy compared to the general population. Similar to football fans globally, women’s sports fans are eager to engage with the brands that sponsor the teams, games, and leagues they care about.

Fans of women’s team sports show higher purchase intent

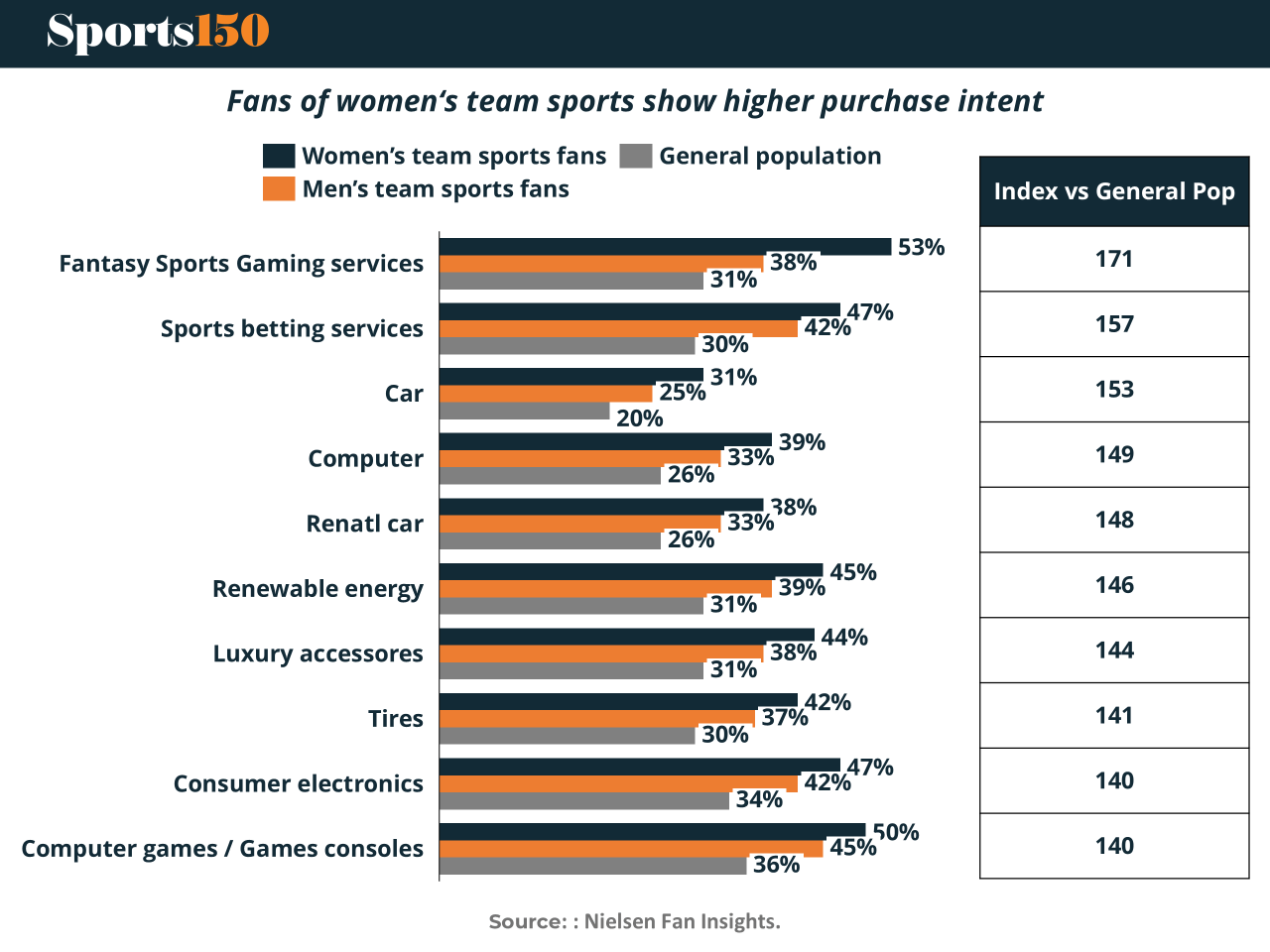

New data highlights just how valuable these fans are to brands. According to Nielsen Fan Insights (2024), fans of women’s team sports consistently outpace both men’s sports fans and the general population in purchase intent across a wide range of categories. For example, 53% of women’s team sports fans plan to use fantasy sports gaming services (vs. 38% of men’s sports fans and 31% of the general population). They are also more likely to spend on sports betting (47% vs. 42% vs. 30%), consumer electronics (47% vs. 42% vs. 30%), and computer games (50% vs. 45% vs. 36%).

This trend extends to lifestyle categories as well, where women’s sports fans show greater intent to buy cars, rental cars, luxury accessories, and even renewable energy solutions compared to the average consumer. The index scores reinforce the point: women’s team sports fans over-index the general population by as much as 171 points in fantasy sports, 157 in sports betting services, and 153 in car purchases.

What this means for brands

The message is clear: fans of women’s team sports represent one of the most commercially valuable audiences in the sports ecosystem. They are more engaged, more loyal, and more willing to reward the brands that invest in their favorite leagues and teams. For sponsors, this creates an opportunity not only to reach a growing and increasingly female audience, but also to drive measurable ROI across a wide spectrum of consumer categories—from gaming and electronics to luxury goods and renewable energy.

As women’s sports continue to rise in visibility and cultural relevance, brands that align early will not just benefit from heightened exposure but also from deeper, more lasting relationships with fans who are ready to act.