- Sports 150

- Posts

- What’s Driving Sports Betting and Tech Deals Right Now

What’s Driving Sports Betting and Tech Deals Right Now

Global sports betting soars to $298B, Sony reshapes tennis media, and Magic Johnson's empire expands. Plus: Big Ten's $2.4B PE play and the rise of eSports betting infrastructure.

Good morning, ! This week we’re looking at the Sports Betting market size, sports tech M&A deal activity, Sony's new multi-year partnership with ATP, and Magic Johnson's entrepreneurial side.

Want to advertise in Sports 150? Check out our self-serve ad platform, here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

DATA DIVE

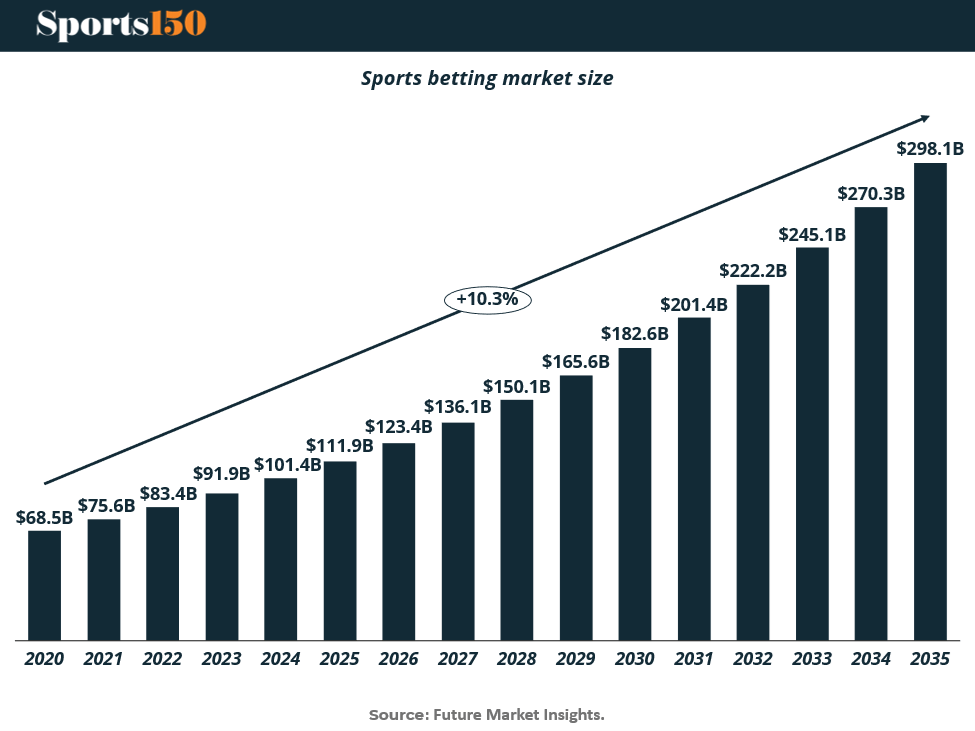

The House Always Wins (Because Football Does)

The global sports betting machine keeps leveling up, and the numbers are starting to look like they were drafted by a CFO on espresso. The market is projected to hit $298.1B by 2035, powered by a 10.3% CAGR and a fan base that increasingly treats betting as a second screen. Football alone commands 63% of global volume, a reminder that the world’s favorite sport is also its favorite vehicle for risk-adjusted hope. Meanwhile, offline channels still hold 58.3% of revenue—proof that bettors still enjoy placing wagers the old-fashioned way: in person, with questionable lighting. The real torque comes from live betting, AI-driven odds, and hyper-personalization, which together pump an incremental +3.5% CAGR into the ecosystem and turn every match into a micro-transaction buffet.

MEDIA & SPORTS

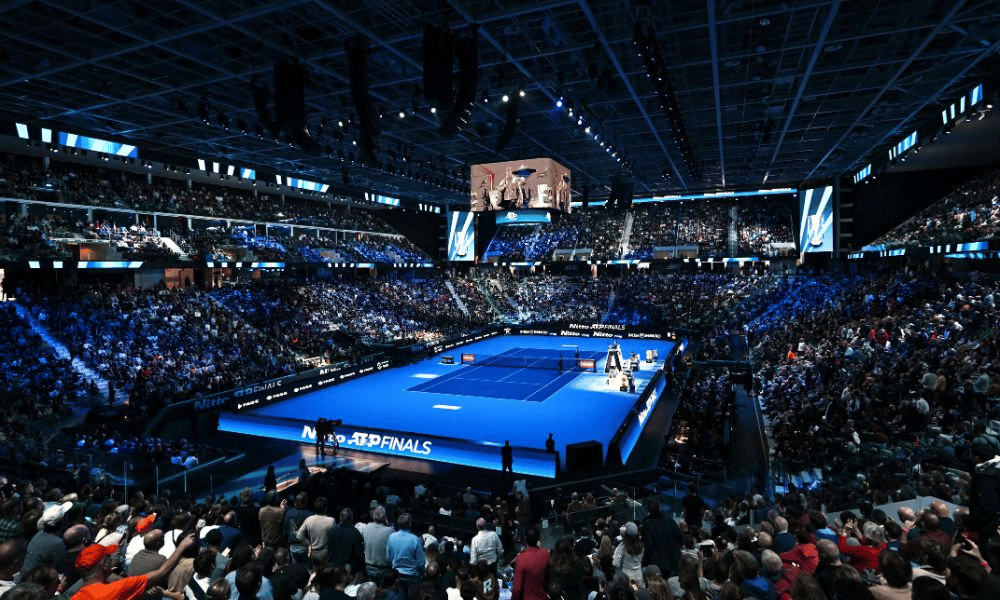

Sony Serves an Ace in Turin

Sony just hit a down-the-line winner with its new multi-year partnership with ATP Media, debuting at the 2025 ATP Finals. The broadcast will feature Hawk-Eye’s HawkAR (for AR-enhanced stats) and HawkVISION (for athlete-perspective shots), turning tennis into a data-rich, cinematic experience.

The duo also teased a next-gen Tennis TV app (coming 2026) and a 5G camera system for live emotion-capturing content. Backdrop: the ATP Finals themselves are booming — now the richest non-Grand Slam event with a $15.5M prize pot and sellout crowds in Turin.

The takeaway: Sony’s tech muscle + ATP’s platform = a media experience Federer-level smooth — with AI, AR, and storytelling at the heart of tennis’ digital future. (More)

TOGETHER WITH OUTSKILL

2025 was the toughest year for the job market;

2025 was the year that saw the most rapid evolution in AI

2025 has less than 60 days left….

If you’re reading this, you’re not too late. Forget 60 days, Outskill can help you learn AI – the most in-demand skill of the decade in just 2 days.

Join Outskill's LIVE 2 day AI Mastermind - 16 hours of intense training on AI tools, automations & building agents to help you work smarter, earn more, and reclaim your time.

It’s happening this Saturday & Sunday; is usually $395, but as a part of their BLACK FRIDAY SALE 🔮, you can get in for completely FREE!

Rated 9.8/10 by trustpilot– an opportunity that makes you an AI Generalist who can build, solve & work on anything with AI, Instead of being replaced.

In the Mastermind, you will learn how to:

✅ Build AI agents that save up to 20+ hours weekly and turn time into money

✅ Master 10+ AI tools that professionals charge $150/hour to implement

✅ Automate 80% of your workload and scale your income without working more hours

✅ Learn basics of LLMS and master prompt engineering in 16 hours

✅ Create high-quality images and videos for content, marketing, and branding.

Learn the exact AI playbook Fortune 500 companies use to automate workflows and 10x revenue 💰

🧠Live sessions- Saturday and Sunday

🕜10 AM EST to 7PM EST

🎁 You will also unlock $5000+ in AI bonuses: prompt bibles 📚, roadmap to monetize AI 💰 and your personalised AI toolkit builder ⚙️ — all free when you attend!

INVESTOR CORNER

Big Ten’s Billion-Dollar Realignment

The Big Ten is courting a $2.4B private equity infusion—and rewriting the college sports investment playbook in the process. The deal, led by UC Investments, would spin off media and sponsorship rights into a new commercial entity, Big Ten Enterprises, in exchange for upfront capital and long-term equity.

Payouts aren’t even. Ohio State, Michigan, and Penn State lead the top tier with $190M+ in upfront cash each, while Oregon and USC would net ~$145M, and others would land in the $100–$110M range. For Ohio State, that windfall helps sustain one of the nation’s most expensive athletic departments while locking in favorable revenue tiers through 2046.

The structure is familiar: it's private equity’s club deal model dressed in school colors. Value is pooled, risk is shared, and cash is front-loaded—mirroring recent trends in European football and Latin American soccer. Notably, Michigan and USC have resisted, potentially due to governance concerns (or lingering drama like “SignalGate”).

Why it matters: If successful, this could set a template for other conferences and turn college sports into a structured asset class. Equal revenue splits are out. Tiered monetization tied to media value is in. (More)

ENTREPRENEURS

Magic Johnson, the Blueprint Builder

Magic Johnson didn’t just retire from the NBA, he re-engineered the athlete playbook. Through Magic Johnson Enterprises, now valued at over $1 billion, he shifted athletes from being endorsers to full-fledged allocators. His thesis? Underserved markets were an overlooked goldmine. Starbucks stores, theaters, and community-centric assets became early proof points long before ESG turned corporate chic.

Today, he’s part-owner of the Dodgers, LAFC, Commanders, and Sparks, giving him influence across U.S. sports governance. And with EquiTrust Life Insurance, he controls one of the largest Black-owned financial services platforms in the country.

Magic’s empire is less celebrity empire-building and more institutional-grade diversification, making him the original athlete-CEO blueprint. (More)

PRESENTED BY GAIN PRO

Who are the biggest private equity investors in the US? See the top 250 shaping the market.

Discover the most influential private equity investors in the United States, ranked by the total enterprise value of their US portfolio companies.

In this report, you’ll find in-depth insights into investment trends, sector shifts, and regional dynamics that define US private equity today. Highlights include:

Where the most active investors rank — with Blackstone, KKR & Apollo leading at $446bn combined

Which sectors dominate — with TMT well ahead, followed by Services and Science & Health

How concentrated the market is — the top 25 firms manage nearly half of total US 250 EV

How US investment is shifting across regions

A differentiated view of market power, scale, and deal momentum

Whether you’re benchmarking peers, exploring potential partners, or tracking the most active players, this report is your essential guide to US private equity today.

Download the full US 250 report and uncover the trends shaping tomorrow’s dealmaking.

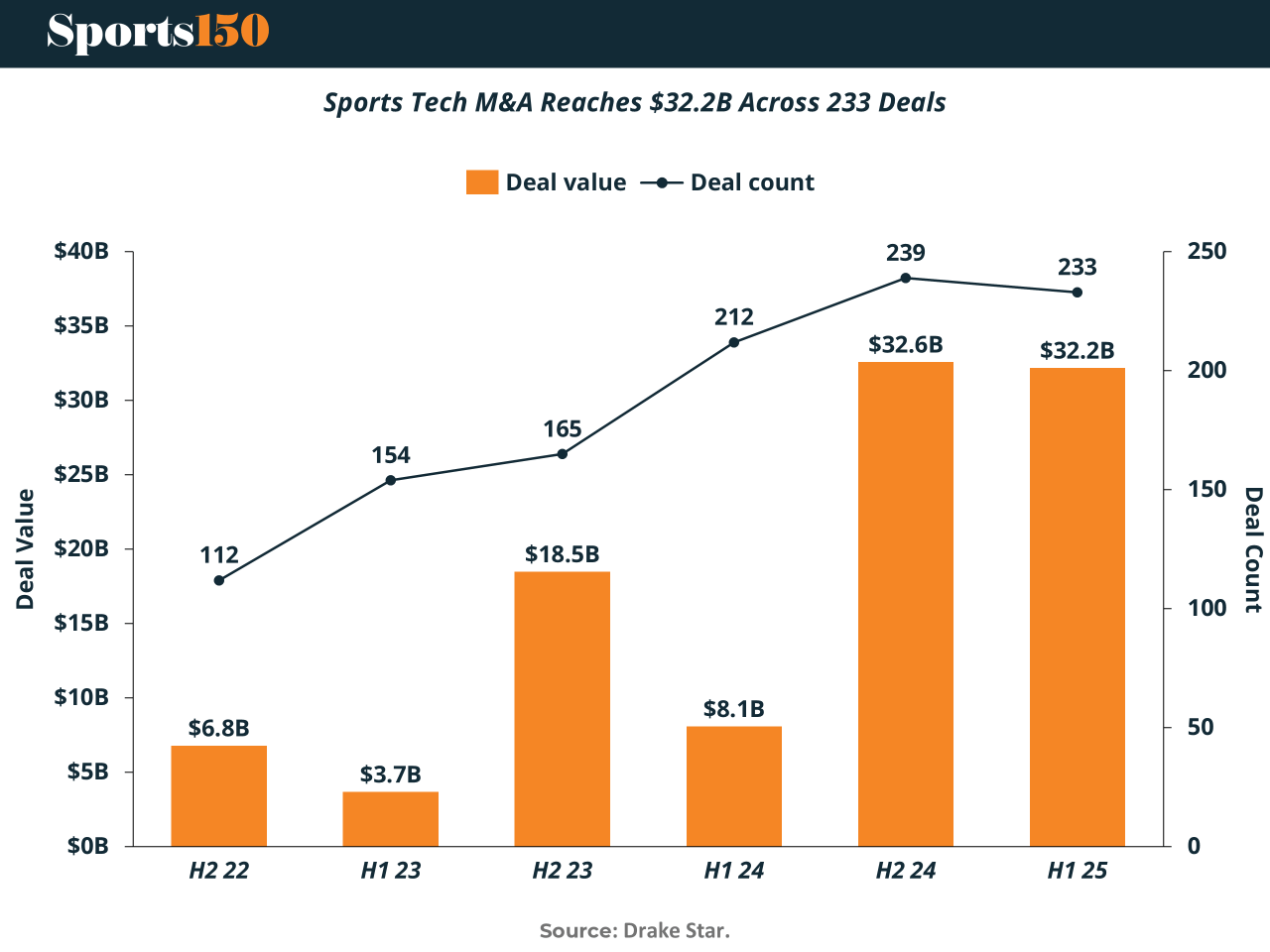

TECH & INFRASTRUCTURE

Consolidation’s New Personal Best

Sports Tech just posted a $32.2B half and 233 deals, keeping infrastructure teams busy building “end-to-end everything.” The fitness stack is rolling up fast: TSG’s $1.5B buy of EōS Fitness mirrors other HVLP moves, signaling a land-grab for recurring revenue. In media, Disney’s majority stake in FuboTV plus a fusion with Hulu + Live TV creates a distribution giant—bad news for standalone streamers. Youth sports software is quietly becoming a platform play, with Genstar–PlayMetrics–Stack Sports forming a category leader and IMG Academy adding SportsRecruits to tighten its athlete-development loop. And in event infrastructure, Valeas’ $110M deal for TicketManager adds muscle to enterprise ticketing. The through-line: buyers want platform density across the fan-to-athlete lifecycle. (More)

eSPORTS

The Back-End Betting on eSports

iGaming software providers are quietly reshaping the eSports landscape—not with flashy sponsorships, but with infrastructure. In 2025, these firms are powering a new generation of competitive platforms through AI, blockchain, and VR, transforming how fans play, watch, and wager.

The real play? Turning eSports betting into a seamless, scalable experience. Providers now offer turnkey platforms with fraud-resistant payments, localized UX, and real-time compliance monitoring—must-haves as global regulators tighten the reins on online gambling.

Blockchain, once a buzzword, now enables provably fair gaming and instant payouts, while AI personalizes experiences and flags bad actors. Meanwhile, gamification is being woven directly into betting interfaces: leaderboards, loyalty systems, and real-money tournaments that blur the line between gaming and gambling.

This matters. As eSports monetization matures, backend software isn’t just a tech stack—it's a competitive differentiator. The future of eSports betting won’t be built by teams or leagues. It’ll be architected by whoever owns the infrastructure. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Do not be embarrassed by your failures, learn from them and start again."

Richard Branson