- Sports 150

- Posts

- The Wellness Economy and the Fitness Tech Industry

The Wellness Economy and the Fitness Tech Industry

The wellness economy has moved from a discretionary “lifestyle” category to a structurally resilient macro market that is now comparable in scale to the world’s largest industries.

Introduction

In 2024, the global wellness economy reached $6.8 trillion, expanding 7.9% year over year and more than doubling since 2013. This expansion is not simply cyclical recovery from the pandemic years; it reflects a sustained reallocation of household, employer, and public-sector spending toward prevention, performance, and quality of life.

Wellness also continues to outpace broad economic growth over the long term, compounding at 6.5% annually from 2013–2024 versus 3.2% annual global GDP growth, and representing 6.12% of global GDP as of 2024. The forward outlook remains strong, with expectations for ~7.6% annual growth from 2024–2029, bringing the market to nearly $9.8 trillion by 2029.

Within this macro context, fitness—and increasingly fitness tech—has become one of the most investable and innovation-intensive verticals. “Fitness” is no longer defined only by gym memberships; it now encompasses a hybrid model of physical spaces, digital coaching, on-demand content, connected devices, wearables, workplace programs, and data-driven personalization. The result is a converging ecosystem where physical activity and healthy eating remain massive spend categories, while enabling layers of software, AI, connected hardware, and subscription services are becoming the operating system for how consumers train, recover, sleep, and manage health behaviors.

This report analyzes the wellness economy and the fitness tech vertical through a data-driven lens. It covers market size and growth, sector composition, the evolution of fitness clubs and digital training models, the rapid scaling of smart fitness and online/virtual fitness, and M&A dynamics that signal where strategic value is concentrating.

The Wellness Economy

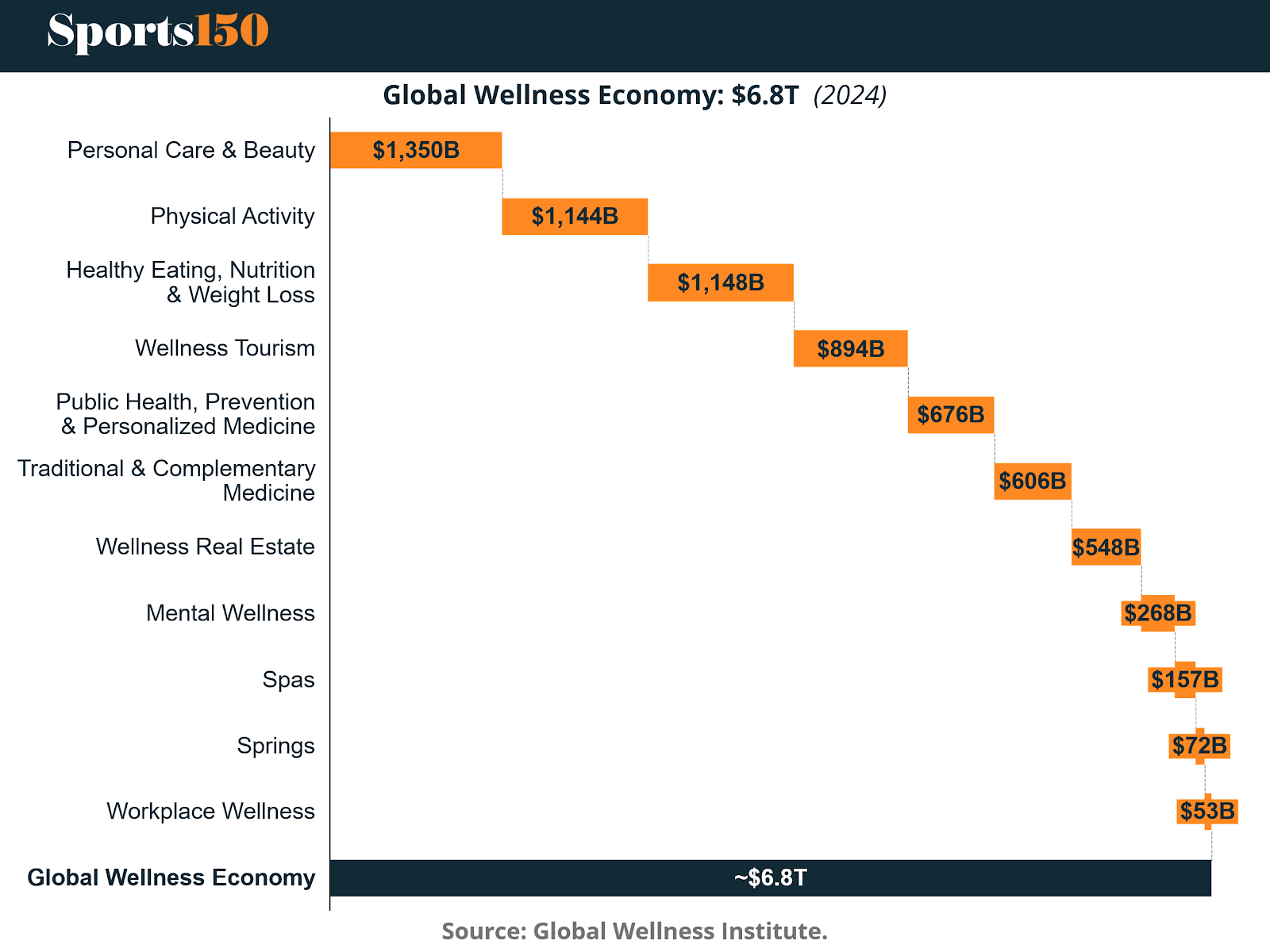

The global wellness economy’s scale is best understood as a diversified portfolio of eleven sectors that collectively capture consumer and institutional spending across prevention, self-care, and well-being.

In 2024, the market’s $6.8 trillion total was anchored by three mega-sectors—Personal Care & Beauty ($1.35T), Healthy Eating, Nutrition & Weight Loss ($1.148T), and Physical Activity ($1.144T)—each independently comparable to the GDP of a major economy. These are not niche categories; they represent baseline consumer priorities that are increasingly “non-negotiable” even under inflation pressure. Beneath the top tier, Wellness Tourism ($894B) and Public Health, Prevention & Personalized Medicine ($676B) form a second tier where spending is supported by both consumers and institutions. A third tier—Traditional & Complementary Medicine ($606B) and Wellness Real Estate ($548B)—highlights wellness’ expansion into long-duration assets and culturally embedded care models. Finally, specialty services including Mental Wellness ($268B), Spas ($157B), Springs ($72B), and Workplace Wellness ($53B) round out a long tail that, despite smaller absolute size, often delivers premium margins and strong brand defensibility.

This sector composition matters because it clarifies where fitness fits. Physical activity is already a $1.144T market in 2024, making it one of the “core engines” of wellness, not an adjunct. More importantly, physical activity acts as a demand generator for adjacent spending: personal care products, nutrition programs, wearable devices, recovery services, mental wellness tools, and an increasing range of diagnostics and prevention offerings. As fitness becomes more data-driven and personalized, the boundary between “fitness” and “prevention” continues to blur, pushing the addressable market beyond gym revenue into healthcare-adjacent categories.

From a macro positioning standpoint, wellness has become larger than several industries that are commonly viewed as global economic pillars. In 2024, wellness at $6.8T exceeded IT ($5.3T), tourism ($5.1T), the green economy ($5.1T), and sports ($2.7T), and it was materially larger than pharma ($1.8T). Only categories such as health expenditures ($11.2T) and manufacturing ($16.8T) are larger in the comparison set, reinforcing that wellness is now a top-tier global spending complex rather than a “consumer trend.”

The growth trajectory since 2019 underscores both resilience and upside. The market moved from $5.0T (2019) to $4.7T (2020) during pandemic disruption, then recovered quickly to $5.5T (2021) and $5.9T (2022), accelerating to $6.3T (2023) and $6.8T (2024). The forward curve indicates continued expansion to $7.4T (2025E) and then rising stepwise to $8.0T, $8.6T, $9.2T, and $9.8T across the late-decade forecast period, implying a sustained growth rate near 6.9% CAGR over the full horizon presented. This matters strategically: a near-7% growth rate at multi-trillion scale implies that wellness is adding hundreds of billions of dollars of incremental demand annually, creating room for both incumbents and challengers, and supporting robust capital formation in enabling technologies.

Regionally, recent years have been characterized by strong resilience and recovery in North America, Europe, and Middle East–North Africa, which have been among the fastest-growing wellness economies over the last five years. At the same time, sector-level rebounds have become broad-based: all eleven sectors have exceeded their 2019 levels by 2024. Two sectors stand out structurally in growth intensity: Wellness Real Estate and Mental Wellness, which expanded at average annual rates of 19.5% and 12.4%, respectively, from 2019–2024. This is a key signal for investors and operators: wellness demand is increasingly being “built into” environments (homes, communities, workplaces, hospitality assets) and “built into” daily routines through mental and emotional health tools, not just episodic spending on services.

From an operating model perspective, the wellness economy is evolving toward personalization, measurement, and outcomes. Consumers increasingly expect quantification (sleep scores, strain scores, metabolic metrics), tailored programming (adaptive training plans and nutrition), and seamless experiences across devices and channels. This shift sets the stage for the fitness tech vertical, where the monetization model is trending from one-time transactions to recurring subscriptions and platform ecosystems, and where AI is rapidly becoming a core differentiator.

The Fitness Tech Vertical

Fitness tech sits at the intersection of a massive underlying activity market and the digital infrastructure that makes behavior change scalable. The category includes smart wearables, connected cardio and strength equipment, virtual coaching, fitness apps, content platforms, corporate wellness solutions, and the data/AI stack that personalizes user experiences. The strategic driver is clear: physical activity spending is already over $1.1T within wellness, but technology can expand engagement frequency, increase retention, unlock subscription ARPU, and create outcomes-linked partnerships with employers, insurers, and healthcare systems.

Smart fitness: the operating system for consumer training

Smart fitness is scaling into a substantial standalone market. The global smart fitness market is projected at $71.9B in 2025 and grows to $186.1B by 2034, implying approximately 11.15% CAGR over the period. The growth profile is particularly attractive because it compounds over nearly a decade at double-digit rates while benefiting from multiple reinforcing adoption loops: sensor cost declines, better battery life, improved algorithms, expanding content libraries, and social/gamified features that reduce churn.

At the product level, smart wearables are currently the anchor category (with a leading share in the smart fitness product mix), reflecting their role as the primary data capture layer for heart rate, activity, sleep, and recovery. However, the fastest-growth edge is shifting toward more immersive and interactive modalities such as connected cardio systems and VR-enabled fitness experiences. This is strategically important: the market is moving from “tracking” to “training,” where real-time feedback, coaching overlays, and content ecosystems become the primary retention engine.

At the component level, hardware still represents the largest share (reflecting devices and equipment), but software/platforms and subscription services are positioned as the fastest-growing portion of the value chain. This is the classic platform transition: devices are necessary but increasingly commoditized, while durable differentiation shifts toward proprietary analytics, coaching content, personalization models, and community mechanics that drive recurring revenue. In practical terms, smart fitness leaders are converging toward “bundled stacks” that integrate wearables, app experiences, adaptive programs, and add-on services (nutrition, mental wellness, recovery).

Application segmentation points to where budgets are expanding. Personal fitness and wellness remains the largest use case, but corporate wellness programs are scaling quickly as employers look to reduce absenteeism, improve productivity, and manage healthcare costs. As hybrid work persists, digital delivery and measurement become essential; employers want interventions that are trackable, incentive-compatible, and inclusive across distributed workforces.

The U.S. market illustrates how large mature regions can still deliver meaningful growth. U.S. smart fitness is projected to rise from $20.1B in 2025 to $53.1B by 2034 at roughly 11.39% CAGR, indicating that penetration and monetization are still expanding even in a market with high device adoption.

From a strategic risk lens, two constraints merit attention. First, data privacy and security concerns increase as smart fitness devices collect sensitive health, location, and biometric data and integrate with healthcare and insurance ecosystems. Trust failures can directly suppress adoption and increase regulatory exposure. Second, competition and market saturation can compress hardware margins and accelerate feature imitation. The defensible path is to build proprietary datasets, sticky ecosystems, and differentiated outcomes—either through coaching efficacy, community network effects, or integration into broader healthcare workflows.

Online/virtual fitness: the scale channel for coaching and content

Online and virtual fitness is one of the fastest-growing subsegments within fitness tech. The market is $38.4B in 2025 and expands to $138.7B by 2030, implying a ~29.26% CAGR. This growth curve indicates that virtual fitness is not simply a pandemic-era substitute for gyms; it has matured into a primary distribution channel for fitness programming, especially when bundled with wearables, connected devices, and AI-driven personalization.

The adoption drivers have evolved beyond convenience. The market is increasingly fueled by interactive home workouts, better streaming and app experiences across smart TVs and mobile devices, and personalization that adapts intensity and programming to the user. A notable demand driver is increased adoption among seniors, where virtual delivery lowers barriers related to travel, intimidation, or accessibility, and where monitored programs can support safe participation. The technology stack is also intensifying: AI is moving from simple recommendations to adaptive programming and coaching that changes based on performance signals and compliance patterns. As wearables become the default input layer, virtual platforms can provide closed-loop feedback: the user performs, the system measures, and the next session updates automatically.

Business models are also expanding. Subscription remains central, but hybrid models incorporating advertising, partnerships, and bundled services are becoming more common, especially as platforms broaden into corporate, educational, and institutional end-user segments. This widening end-user base—individuals, gyms, sports institutes, defense and education institutions, corporate programs—creates multiple go-to-market pathways and reduces reliance on a single channel.

Fitness clubs: physical infrastructure becomes a tech-enabled platform

Fitness clubs remain a major revenue pool and a critical component of the hybrid fitness ecosystem. The global health and fitness club market scales from $121.2B in 2024 to $131.3B in 2025, and is projected to reach $244.7B by 2031. The forward curve reflects a market that is growing robustly while also upgrading its product: modern clubs are becoming integrated wellness venues offering training, recovery, and data-driven performance services, not just equipment access.

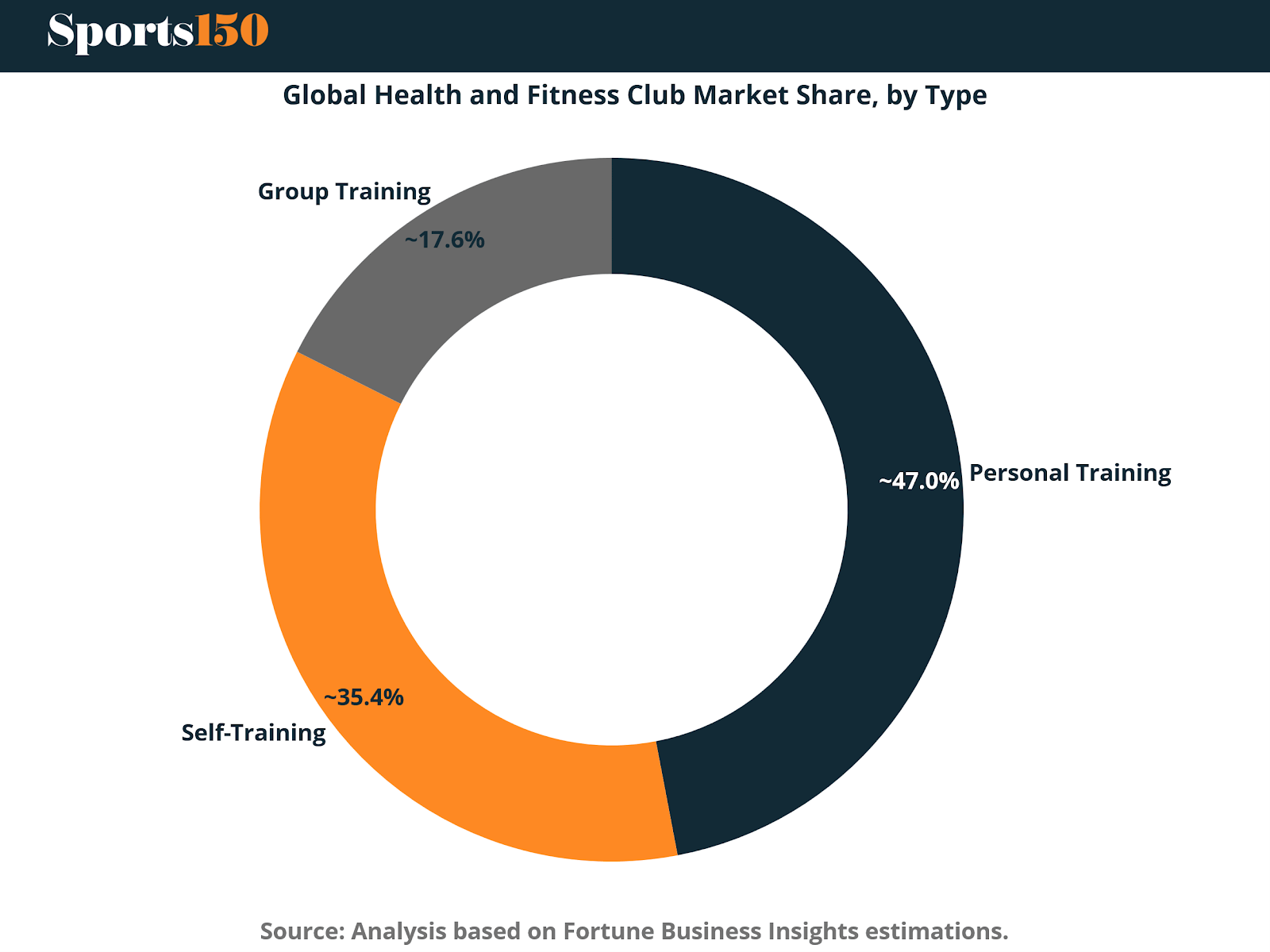

Service mix illustrates where value concentrates. Personal training accounts for approximately 47.0% of market share by type, reflecting strong willingness to pay for expert guidance and outcomes. Self-training represents about 35.4%, capturing consumers who want flexibility and affordability, while group training at roughly 17.6% remains meaningful but structurally smaller in share. This distribution signals that gyms are increasingly monetizing expertise and personalization, and that tech enablement (wearables, AI coaching tools, real-time progress tracking) is becoming an amplifier for trainer productivity and member retention.

North America remains a core profit pool with a distinctive recovery-and-growth trajectory. The market moves from approximately $40.6B in 2019 into a sharp pandemic contraction, then rebounds strongly through $44.0B (2022), $47.9B (2023), $51.9B (2024), and $55.7B (2025), before scaling in the forecast to ~$106.0B by 2032, implying ~9.49% CAGR across the multi-year horizon shown. This underscores both resilience and monetization capacity: high spending on memberships, established fitness culture, and strong uptake of wearables and tracking apps that support personalized programs.

Operationally, health clubs are expanding their value proposition through premium amenities (recovery zones, metabolic testing, performance optimization) and through digital member engagement layers such as apps, virtual coaching add-ons, and real-time tracking. They are also pushing into corporate partnerships, where structured wellness programs—including nutrition guidance, recovery, and mental well-being—are used to drive membership volumes and stabilize revenue. This is a critical bridge between the traditional services model and the tech-enabled ecosystem: clubs provide physical infrastructure, while digital layers increase utilization and reduce churn.

At the same time, clubs face structural challenges. High fixed operating costs (electricity/utilities, wage pressure for qualified trainers, continuous capex for equipment upgrades) can compress margins if not matched with pricing power and retention. Competitive intensity is also rising, particularly from budget chains and independent studios offering lower-cost access and localized programming. Finally, at-home workout trends can restrain growth if clubs fail to articulate a differentiated hybrid value proposition. The winning model is therefore less about “gym vs home” and more about a seamless continuum: facility-based experiences for equipment, community, and services; and at-home digital programming for convenience and frequency.

Key cross-cutting drivers and trends shaping the vertical

The fitness tech vertical is being shaped by a set of reinforcing structural drivers:

Preventive health urgency is increasing as obesity and lifestyle-related disease prevalence pushes consumers and employers to prioritize activity, weight management, and continuous health monitoring.

Personalization at scale is becoming a baseline expectation, enabled by AI models that convert raw sensor data into adaptive programs and actionable insights.

Hybrid delivery is now the default consumer behavior: users mix gym-based training, home workouts, and mobile-first coaching depending on schedule and motivation.

Platform economics are strengthening as recurring subscriptions and content ecosystems generate more predictable revenue than one-time hardware purchases.

Corporate wellness acceleration is expanding B2B demand for measurable programs, especially for distributed workforces where digital engagement and incentives are critical.

Immersive and social experiences—including gamification, challenges, leaderboards, and VR/AR—are expanding the addressable audience and increasing retention, particularly among younger demographics.

Healthcare integration is emerging as the next growth frontier, as real-time fitness data can support chronic disease monitoring, telemedicine workflows, and outcomes-based partnerships.

Across these trends, the unifying shift is that fitness is becoming measurable, personalized, and embedded into daily systems—devices, workplaces, and digital routines—rather than limited to a physical venue or a scheduled class.

M&A and Deal landscape

M&A activity in health, wellness, and fitness reflects how strategic buyers and financial sponsors are repositioning portfolios toward scalable platforms, data-rich ecosystems, and hybrid service models. Deal activity shows cycles of consolidation and re-acceleration. In 2017, total deal value reached $114.8B with 526 deals, suggesting a year characterized by large transactions. Value then normalized to $33.7B (2018) and $16.5B (2019), with deal counts remaining in the mid-500s. The market regained momentum in 2020 ($30.0B) and 2021 ($41.8B), with a sharp increase in deal count to 899 in 2021, reflecting a wave of transactions likely driven by digital adoption, platform roll-ups, and post-pandemic repositioning. Deal count remained high at 877 in 2022, then adjusted to 730 in 2023 and 768 in 2024. In 2025, total deal value increased materially to $77.2B with 736 deals, signaling renewed appetite for larger-scale strategic moves even as deal volume stayed below the 2021–2022 peak.

The pattern suggests a market where buyers are willing to pay for scaled assets and strategic capabilities, but where execution discipline and integration potential matter. The most consistent strategic logic is moving “up the stack” from standalone products to ecosystems: platforms that combine tracking, coaching, content, and community; or physical service networks that can be tech-enabled and expanded geographically. Acquisitions that strengthen personalization capabilities, especially through AI-driven training plans, are increasingly rational because they directly improve retention and lifetime value. Similarly, consolidation among fitness operators can create economies of scale in marketing, real estate selection, technology procurement, and member engagement systems.

Notably, the virtual fitness segment itself is already producing targeted acquisitions designed to deepen coaching and personalization. This type of transaction illustrates how large platforms are seeking to own more of the “programming layer” rather than relying on third-party content. In parallel, fitness clubs and premium operators are partnering with or acquiring tech-enabled wellness services that differentiate the in-club experience—such as AI-driven recovery and performance solutions—because these features support premium pricing and improve member stickiness.

Overall, the M&A environment reinforces a clear market direction: winners are assembling integrated capabilities that connect data capture (wearables and sensors), engagement (content and community), personalization (AI coaching), and distribution (clubs, direct-to-consumer, and employers). The strategic premium increasingly accrues to businesses that control the user relationship and can prove measurable outcomes.

Conclusion

The wellness economy has reached a level of scale and stability that places it among the world’s most consequential markets. At $6.8 trillion in 2024, and with a pathway to nearly $9.8 trillion by 2029, wellness is not a trend—it is a structural spending complex that is growing faster than the overall global economy. Its sector mix shows both breadth and depth: trillion-dollar categories like personal care, nutrition, and physical activity anchor demand, while fast-growing segments like wellness real estate and mental wellness demonstrate how wellness is becoming embedded into environments and daily routines.

Within this landscape, fitness is evolving from a services category into a technology-enabled ecosystem. Fitness clubs are expanding strongly on a global basis, with the market projected to reach $244.7B by 2031, and service mix skewing toward personalization, where personal training holds about 47% share. At the same time, online/virtual fitness is scaling at exceptional velocity, rising from $38.4B (2025) to $138.7B (2030), reflecting the permanence of hybrid behavior and the maturity of digital coaching and content models. Smart fitness further strengthens the long-term outlook, expanding from $71.9B (2025) to $186.1B (2034), supported by wearables penetration, AI personalization, connected equipment, and subscription economics.

Strategically, the central theme is convergence. Fitness is converging with wellness; wellness is converging with healthcare; and devices are converging with platforms. The companies best positioned to win will be those that translate data into outcomes, deliver personalization at scale, and maintain trust through privacy and security discipline. They will also need to operate across channels—home, gym, and workplace—because consumer behavior is now inherently hybrid. Finally, M&A signals that capital is flowing toward integrated ecosystems and scalable platforms, with deal value rebounding to $77.2B in 2025, suggesting continued consolidation and capability-building ahead.

For operators, investors, and strategic buyers, the opportunity is not simply to participate in market growth, but to capture disproportionate value by owning the personalization layer, deepening engagement loops, and integrating fitness into broader preventive health and wellness systems. The next decade of fitness tech will be defined less by standalone devices or isolated apps and more by end-to-end ecosystems that can prove measurable improvements in performance, health, and well-being—at global scale.

Sources & References

Fortune Business Insights. (2026). Health and Fitness Club Market Size. https://www.fortunebusinessinsights.com/health-and-fitness-club-market-108652

Global Wellness Institute. (2025). Wellness Economy, Statistics & Facts. https://globalwellnessinstitute.org/press-room/statistics-and-facts/

Precedence Research. (2025). Smart Fitness Market Size, Share and Trends 2025 to 2034. https://www.precedenceresearch.com/smart-fitness-market

The Business Research Company. (2026). Online/Virtual Fitness Market Report 2026. https://www.thebusinessresearchcompany.com/report/online-virtual-fitness-global-market-report

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.