- Sports 150

- Posts

- The Global Sports Media Rights Boom: A Market at Peak Momentum

The Global Sports Media Rights Boom: A Market at Peak Momentum

The sports media rights market has entered a new era of record valuations and expanding global influence.

According to data from Houlihan Lokey, the total value of sports media rights surpassed $60 billion for the first time in 2024, and is projected to reach nearly $67 billion by 2026.

This surge reflects how the intersection of sports, media, and technology continues to drive value—through digital streaming adoption, global audience expansion, and landmark rights renewals across major leagues and events.

From Pandemic Shock to Record Highs

The market’s trajectory since 2020 tells a powerful recovery story.

In the COVID-19 year, global rights dipped to $41.1 billion, as live events halted and broadcasters renegotiated deals. But by 2021, the rebound began—with growth driven by deferred contracts and the acceleration of streaming platforms eager for exclusive content.

By 2024, the market hit $62.6 billion, fueled by the Paris Olympics and UEFA Euro 2024, both of which contributed nearly $5 billion in rights value. While a cyclical dip is expected in 2025 due to the absence of global tournaments, 2026 is set to bring a new record high of $66.6 billion, thanks to the FIFA World Cup and NBA media rights renewals.

This pattern highlights how global events act as powerful demand catalysts—and how leagues and federations increasingly capitalize on multi-platform distribution.

Who Owns the Media Rights Crown?

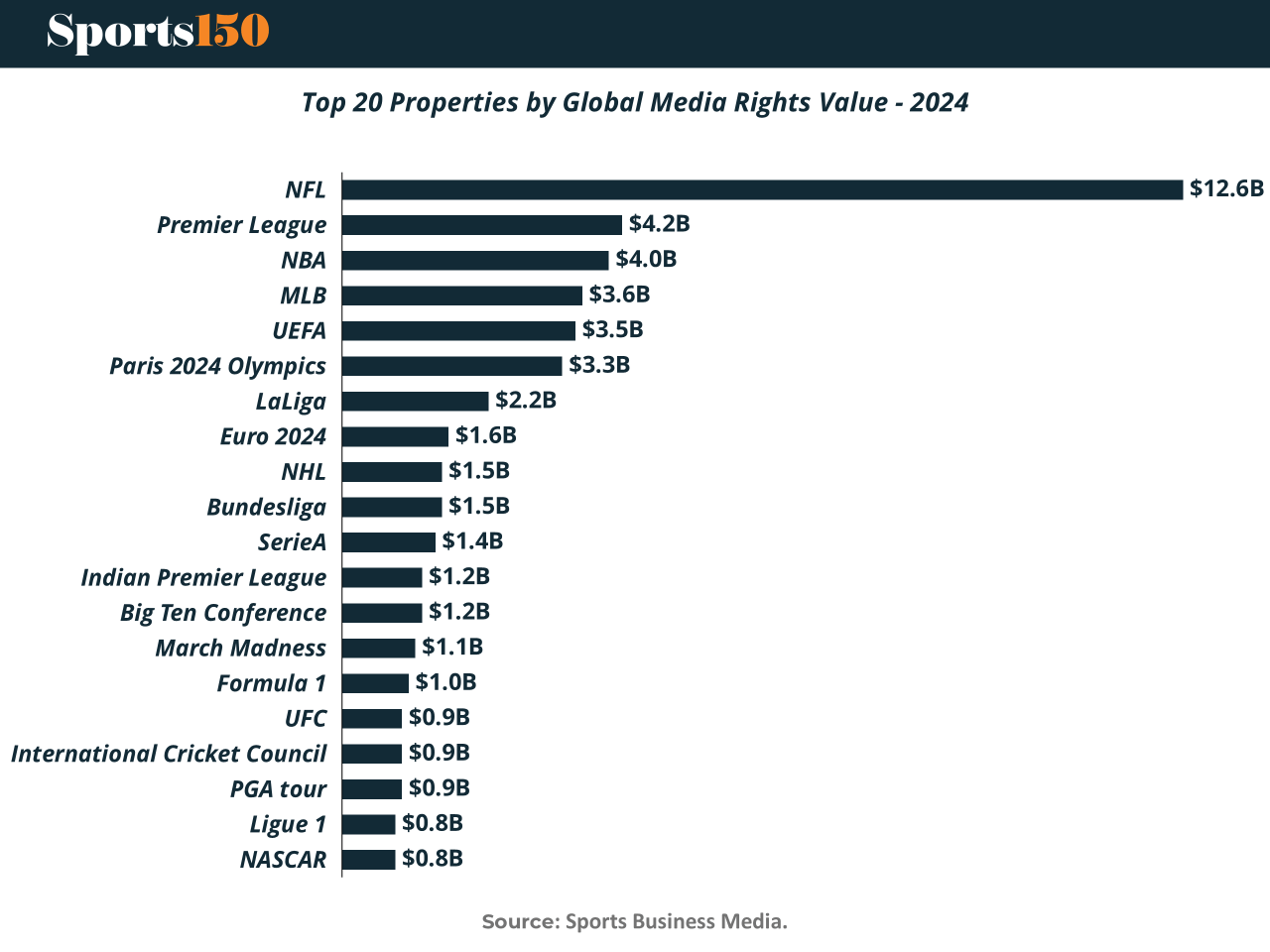

The dominance of sports properties in media rights value is increasingly concentrated among a handful of global giants.

At the top, the NFL remains untouchable with an astonishing $12.6 billion in global media rights—triple the value of its nearest rival. The Premier League follows at $4.2 billion, and the NBA at $4.0 billion, both reflecting the enormous pull of English-language broadcasting and global streaming deals.

The Paris 2024 Olympics and UEFA Euro 2024 rank next, showing how short-term, high-impact tournaments can rival the annual power of established leagues. Further down the list, properties like LaLiga, Serie A, and the Indian Premier League (IPL) showcase the growing weight of regional markets with global ambitions.

Interestingly, newer and niche properties like UFC ($0.9B) and Formula 1 ($1.0B) demonstrate how international appeal and digital-first strategies are allowing sports outside the “big three” to punch above their weight.

Why the Next Phase Will Be Global and Digital

Several structural shifts suggest that sports media rights will continue to expand globally, even amid cyclical fluctuations:

Streaming competition is intensifying, with tech giants like Amazon, Apple, and YouTube now key players in rights bidding.

Emerging markets—notably India, Southeast Asia, and the Middle East—are driving new audiences and localized rights deals.

Hybrid broadcast models, combining pay-TV, free-to-air, and digital tiers, are allowing leagues to maximize both reach and revenue.

Women’s sports are achieving record audiences, attracting sponsorship and broadcast value previously unseen in the category.

By 2027, even with a modest correction to $63 billion, the industry will remain near its historical peak—showing that media rights are not just resilient, but increasingly central to the financial engine of global sport.

Bottom Line

The sports media rights landscape is in the middle of a structural boom—fueled by digital transformation, global expansion, and a steady stream of mega-events.

While cyclical dips will occur, the long-term trend remains one of sustained value creation, as leagues, federations, and media partners reimagine how sports are distributed and monetized for the next generation of fans.