- Sports 150

- Posts

- The $30B Data Play: Why Sports Analytics Is Entering Its Platform Era

The $30B Data Play: Why Sports Analytics Is Entering Its Platform Era

A decade ago, sports analytics was a back-office function—crunching numbers on shot selection, load management, or defensive efficiency.

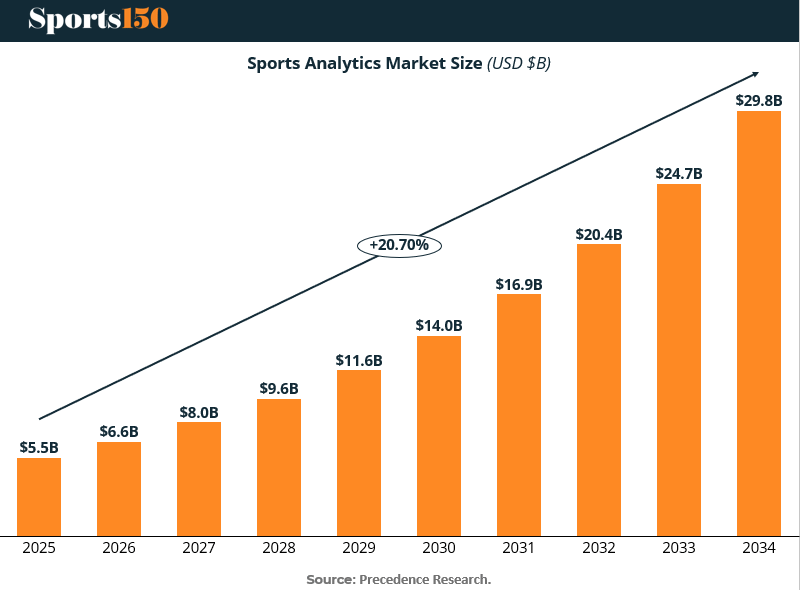

Today, it’s poised to become a $29.8B market by 2034, growing at a +20.7% CAGR from $5.5B in 2025, according to Precedence Research. That’s not just growth—it’s transformation. And for investors, team execs, and rights-holders, it signals a shift: from niche utility to enterprise infrastructure.

From Margins to Multipliers

The early thesis of analytics was incremental. Gain 2% efficiency here, prevent 1.5 injuries there, optimize game plans. But that’s changed. With capital pouring into sports, and valuations across leagues hitting record highs, teams and leagues are under pressure to unlock revenue and reduce risk. Analytics now sits at the intersection of performance, media, and monetization.

For example, player-tracking systems are no longer just for coaches—they feed data into betting models, drive second-screen experiences, and power automated highlights. AI-driven fan analytics help OTT platforms customize content feeds and advertising. Scouting software isn’t just evaluating talent—it’s standardizing due diligence for billion-dollar acquisition targets.

Who's Building the Picks and Shovels?

The market expansion is fueling a clear investment playbook. From edge hardware (e.g. Catapult, Whoop, Kinexon) to SaaS platforms (e.g. Hudl, WSC Sports, Second Spectrum), capital is chasing infrastructure. Recent M&A activity reflects this shift:

In 2024, Genius Sports acquired AI firm Spirable to enhance personalized content delivery.

Kitman Labs closed a $52M Series C to expand its Athlete Management System across leagues and federations.

Zelus Analytics, which counts MLB and NBA teams as clients, continues to draw interest from private investors eyeing long-term IP and SaaS potential.

But beyond individual tools, the real opportunity may lie in platform integration. Teams don’t want six dashboards and 12 login screens. They want interoperable systems that connect performance data, fan insights, ticketing, sponsorship, and financial modeling. Whoever solves that wins.

Risk, Regulation, and Real-Time ROI

This expansion isn’t without friction. Data privacy regulations are tightening—especially with biometric and health data. Leagues must also balance competitive integrity with transparency, particularly as gambling partnerships deepen.

Meanwhile, monetization lags usage. Teams often adopt analytics tools but underuse them due to limited staff or unclear workflows. And many startups overpromise AI functionality without delivering ROI beyond buzzwords.

But even with growing pains, the trajectory is undeniable. More sports properties are behaving like mature media companies. They want data not just to coach better, but to sell smarter, price better, and invest with precision.

The Bottom Line

The next decade will be defined by how well sports properties turn data into decisions. Analytics is no longer a tactical tool—it’s becoming a core operating system. And with nearly $30B in projected market size, we’re entering the platform era of sports intelligence.

For private equity, VCs, and strategics, this isn’t about backing the next dashboard—it’s about building the connective tissue of the modern sports economy.