- Sports 150

- Posts

- $13B in Sports Medicine | Mayweather $63M Nationwide Fitness Empire

$13B in Sports Medicine | Mayweather $63M Nationwide Fitness Empire

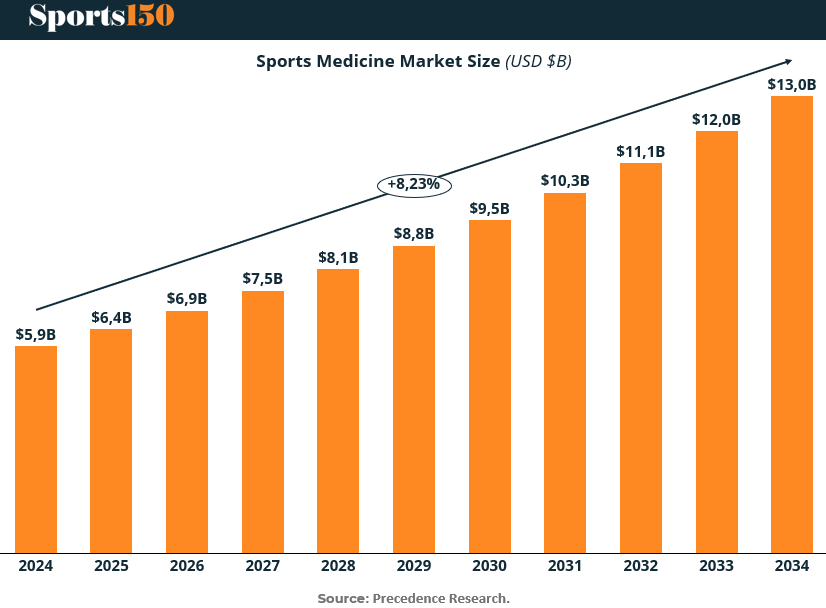

The $13 billion sports medicine market is annually growing 8.23%, Mobile Legends: Bang Bang reaches 4.1 million viewers in 2025.

Good morning, ! This week we’re diving in the $13B space of Sports Medicine, Floyd Mayweather fitness empire at a $68M valuation, FOX acquires one third of Penske entertainment, and Mobile Legends: Bang Bang is winning the 2025 esports viewership race.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

DATA DIVE

The $13B Question: Why Sports Medicine Is Outpacing Healthcare

Sports medicine is now a $13B global market, growing at 8.23% annually—outpacing many traditional healthcare sectors. Once reserved for elite athletes, it's now driven by aging but active populations, wearables, and a culture of fitness. The industry is set to more than double by 2034, from $5.9B to $13B. North America leads with 47% market share, while Asia-Pacific, Latin America, and MEA offer growth potential. EU injuries are soccer-heavy (71%), while U.S. activity is more diverse—calling for broader product strategies. Arthrex and Smith & Nephew control 61% of the market, but the 18% held by “Others” hints at disruption opportunities in biologics, diagnostics, and wearables.

The takeaway: Sports medicine is no longer niche—it’s a high-growth, performance-driven healthcare frontier.

MEDIA & SPORTS

Super League Expansion Risks Sky Exit

Rugby league’s bid to grow its footprint may cost it its broadcast lifeline. The Super League’s move to expand from 12 to 14 teams next season has triggered immediate friction with Sky Sports—its long-time media partner and financial backbone.

The issue? Sky’s current £21.5M deal was negotiated under a 12-team structure. Adding another game per round means 27 extra broadcasts—but no additional compensation from Sky, which is reluctant to fund matches it didn’t agree to. Each extra match could cost £500K in production, and Sky isn’t budging.

With one year left on the current contract and renewal talks looming, expansion without new media funding looks risky. Sky has halved its rights payment since 2021 (£40M to £21.5M), and its outlay on Super League now trails the £20M/year it’s investing in the Women’s Super League. Meanwhile, potential alternative bidders like TNT have committed elsewhere.

Bottom line: Super League is banking on growth, but without media buy-in, that bet may backfire. Expansion could weaken future valuations, dissuade investors like Australia’s NRL (which favors a 10-team model), and deepen the financial divide between top and bottom clubs. (More)

PRESENTED BY ELITE TRADE CLUB

Your Daily Edge in the Markets

Want to stay ahead of the markets without spending hours reading?

Elite Trade Club gives you the top stories, trends, and insights — all in one quick daily email.

It’s everything you need to know before the bell in under 5 minutes.

Join for free and get smarter about the markets every morning.

INVESTOR CORNER

Fox Buys Into the Fast Lane with Penske

Fox Corporation has acquired a one-third stake in Penske Entertainment, parent of IndyCar and the Indianapolis Motor Speedway—marking a rare case of a media rights holder doubling as an equity investor. The move aligns broadcast control with brand stewardship, creating deeper incentive alignment around IndyCar’s future growth.

The timing is strategic: IndyCar is enjoying a 31% year-over-year bump in U.S. viewership, its 2025 season debuting on Fox platforms under a new multi-year media deal. By pairing rights ownership with a capital stake, Fox gains levers to influence not just what airs—but how the sport evolves.

For investors, the message is clear: media companies are rethinking traditional rights models. Fox is betting not just on advertising yield, but on ecosystem value—spanning content, events, and sponsorship. With over 3,300 global locations, Penske offers operational heft far beyond racing, from logistics to leasing.

Bottom line: Expect more hybrid deals where broadcasters become builders. Fox’s bet on IndyCar suggests motorsports—with its elite competition, loyal fan base, and all-season story arcs—remains under-monetized relative to other U.S. leagues. (More)

ENTREPRENEURS

The Mayweather Gym Gamble

Mayweather Boxing + Fitness launched in 2017 as the heavyweight contender in boutique fitness—backed by Floyd’s 50-0 record and an ambitious entrepreneur, James Williams. By 2023, it had 200+ franchise licenses sold and $35M in lifetime revenue. But by 2025, more than half the U.S. gyms had shut down. Why? Lawsuits, unmet promises, and what franchisees claim was a mismatch between hype and operational muscle. The brand’s celebrity cachet couldn't shield it from accusations of misrepresentation and business misfires.

Bottom line: even with “The Best Ever” behind you, scaling a franchise takes more than star power and sizzle—it demands substance. (More)

COLLEGE ATHLETICS

The Professional Turn

College athletics is shedding its amateur badge. With NIL‑driven commodification turning athletes into marketable brands and billion‑dollar media contracts reshaping departments into mini-professional organizations, the amateur era is ending.

According to PwC, private equity firms are investing in everything from multimedia rights to athletic departments themselves, drawn by the revenue upside in ticketing, sponsorships, and licensing. The concern? Profit priorities may crowd out academic missions—especially as investments flow into high-earning sports like football and basketball.

Translation: college sports are evolving into sleek businesses. Whether that’s progress or peril depends on whether schools can balance education with EBITDA. (More)

TOGETHER WITH GO-TO-MILLIONS

Your boss will think you’re a genius

Optimizing for growth? Go-to-Millions is Ari Murray’s ecommerce newsletter packed with proven tactics, creative that converts, and real operator insights—from product strategy to paid media. No mushy strategy. Just what’s working. Subscribe free for weekly ideas that drive revenue.

TECH & INFRASTRUCTURE

The €1.5B Spotify Stadium Bet

FC Barcelona is dropping a cool €1.5 billion to reinvent Spotify Camp Nou — a high-stakes play to future-proof both venue and club. Of that, €900 million is earmarked for actual stadium construction, bumping capacity to 105,000 and integrating 5G, immersive media, and upgraded VIP zones.

How’s it funded? A reported €815M loan from Goldman Sachs plus a £237M naming rights deal with Spotify. The latter puts a pop anthem on a business model aiming for year-round monetization: more seats, more events, more revenue.

For a club with messy balance sheets, this is a moonshot with WiFi. But if it pays off, matchday income, digital fan engagement, and hospitality revenue could put Barça back in the financial Champions League. (More)

eSPORTS

Mobile Legends Tops 2025 Viewership Charts

The 2025 esports leaderboard is in — and Mobile Legends: Bang Bang has claimed the crown with 4.1M viewers, powered by its mobile-first strategy and Southeast Asian dominance. Right behind is League of Legends, the enduring PC titan pulling in 3.4M viewers on the strength of its deep pro ecosystem.

Elsewhere, Counter-Strike holds its tactical turf with 1.8M, while Valorant cracks 1.3M as it matures into a major FPS contender. Notably, PUBG Mobile, Arena of Valor, and Honor of Kings each hover near the 1M mark, solidifying mobile esports’ grip on global audiences.

The big picture: mobile titles now dominate the top 10, with Fortnite, Free Fire, and others showing there’s still juice in the battle royale boom. Bottom line? Esports viewership is increasingly mobile, tactical, and borderless. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

FIFA is facing a class-action lawsuit that could involve every pro footballer in the EU or UK since 2002, per @TheAthletic.

The suit claims FIFA’s transfer rules violated competition law, costing 100,000+ players up to 8% of their career earnings.

MORE: ow.ly/131L50WA0pw

— Sports Business Journal (@SBJ)

1:25 PM • Aug 5, 2025

"You build great companies by solving real problems."

Marcos Galperin