- Sports 150

- Posts

- MetLife’s $1.6B Upgrade | Club World Cup’s Split Success | $3.1B Satellite Bet

MetLife’s $1.6B Upgrade | Club World Cup’s Split Success | $3.1B Satellite Bet

Stadiums, satellites, and $70 M prize pools headline a week where capital floods every layer of the sports stack—from MetLife’s $1.6 B retrofit to SES’s $3.1 B satellite merger—signaling the new frontiers of return on investment.

Good morning, ! This week we’re diving into MetLife Stadium’s $1.6B ascent as America’s top sports venue, the Club World Cup’s split-screen success—with millions tuning in across Brazil and Saudi Arabia while Europe shrugged—SES’s $3.1B satellite sports infrastructure play, and how Team Liquid and the $70M Esports World Cup are turning gaming dominance into boardroom power.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

MEDIA & SPORTS

Club World Cup: Global Curiosity Meets Regional Obsession

FIFA’s newly expanded Club World Cup faced a cold shoulder in much of Europe, but elsewhere, it sparked localized media frenzies. In Saudi Arabia, Al-Hilal’s 4-3 win over Manchester City at 4am local time drew 1.5M+ viewers and cleared Riyadh’s freeways—cafés even charged a $30 cover just to screen the match. Across Brazil, fan-fests drew 100K+, with 10K on Copacabana Beach for Flamengo-Bayern alone.

Broadcasters saw the upside too. MBC’s sublicensed Saudi feed drew 5.1M total viewers, peaking at 2.2M for Real Madrid, while Channel 5 in the UK peaked at 1.6M for Chelsea. DAZN, the global rights holder, remained tight-lipped on viewership, but the regional sublicensing strategy seems to have worked—except in Western Europe, where transfer gossip outdrew match results.

France and Spain tuned out, citing competition from the Women's Euros or lack of marquee domestic teams. But in rising football economies like Saudi Arabia, Nigeria (thanks to betting), and Brazil, the tournament delivered the kind of engagement FIFA craves—if not uniformly, then surgically.

The bottom line: FIFA’s Club World Cup might not rival the Champions League yet, but in betting-fueled, digitally connected, and football-obsessed regions, it’s already punching above its media weight. (More)

From a $120M Acquisition to a $1.3T Market

The wealthiest companies target the biggest markets. For example, NVIDIA skyrocketed ~200% higher last year with the $214B AI market’s tailwind. That’s why investors like Maveron backed Pacaso.

Created by a founder who sold his last venture for $120M, Pacaso’s digital marketplace offers easy purchase, ownership, and enjoyment of luxury vacation homes. And their target market is worth a whopping $1.3T.

No wonder Pacaso has earned $110M+ in gross profits to date, including 41% YoY growth last year alone. Now, with new homes planned in Milan, Rome, and Florence, they’re really hitting their stride. They even reserved the Nasdaq ticker PCSO.

And you can join well-known firms like Greycroft today. Lock in your Pacaso investment now for $2.90/share.

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public.Listing on the Nasdaq is subject to approvals.

INVESTOR CORNER

SES Closes $3.1B Bet on Satellite Scale

SES is set to complete its $3.1B acquisition of Intelsat this week, following final regulatory approval from the FCC. The deal consolidates two of the largest commercial satellite operators in the world, both heavyweights in delivering sports, media, and connectivity services.

Why it matters: As streaming demand surges globally—and latency becomes a competitive differentiator—satellite infrastructure is having a moment. The SES-Intelsat combo creates one of the largest fleets of geostationary and medium Earth orbit satellites, positioning the group as a critical link in the live sports media chain, especially for underserved markets and edge distribution.

For sports investors, this is more than aerospace consolidation. It's a play on distribution resilience, bandwidth monetization, and media-rights redundancy at a time when IP-based delivery still grapples with latency and scale. Expect the combined entity to chase contracts in global sports events, mobile stadium feeds, and backup broadcast capabilities.

Bottom line: The satellite stack is getting shorter, but the pipes are getting fatter. SES is betting $3.1B that controlling more of them will pay off. (More)

ENTREPRENEURS

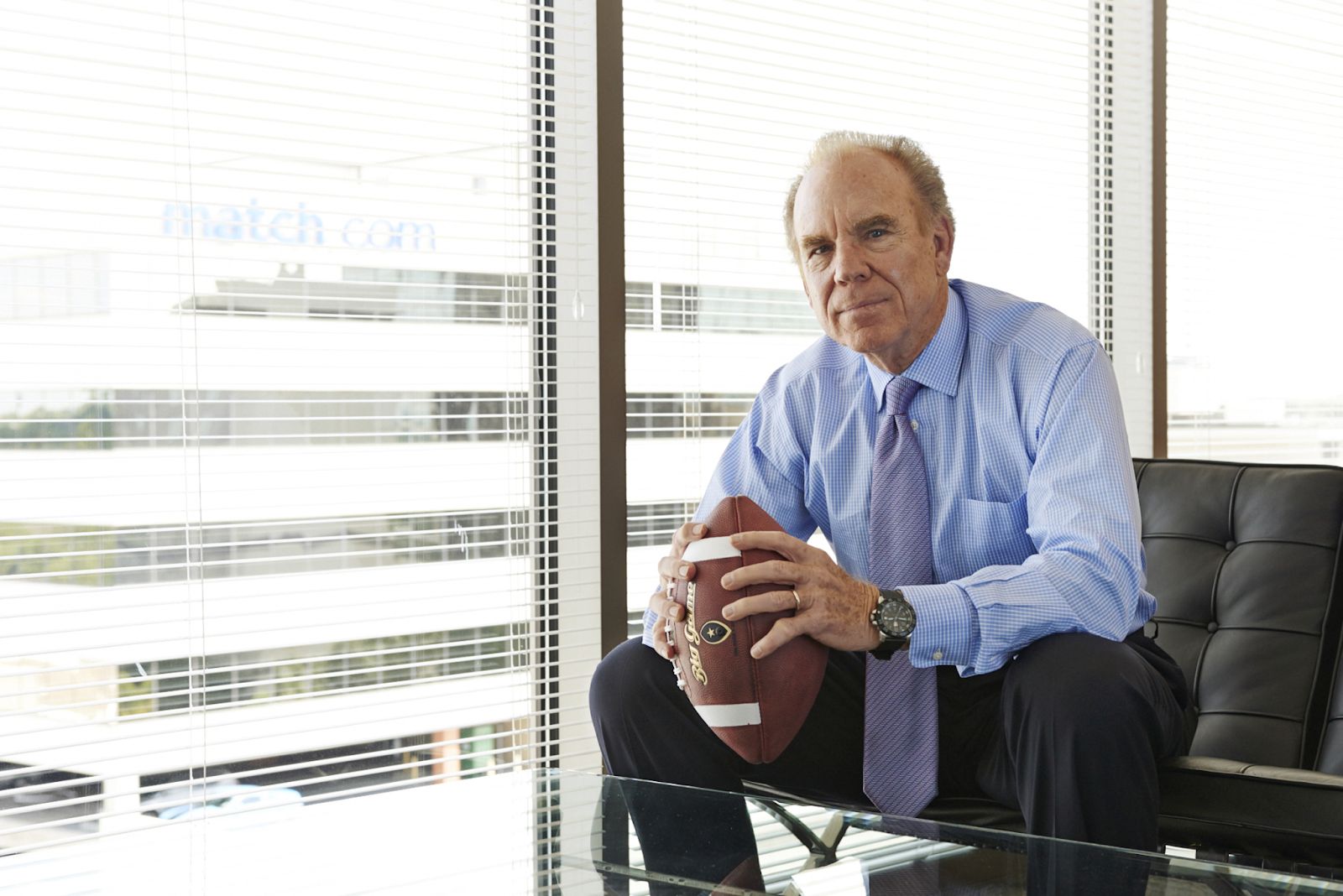

From Hail Marys to High Rises

Roger Staubach didn’t just win Super Bowls—he dominated commercial real estate. The former Cowboys QB launched The Staubach Company in 1977, building it into a 1,600-person empire before selling to JLL for $613M in 2008. That deal alone made Staubach wealthier than almost any NFL contract could. He still pulls in $10M+ annually as JLL’s executive chairman and holds NASCAR equity on the side. The kicker? He built the business while playing, working real estate deals in NFL off-seasons. Staubach’s playbook: get in early, scale smart, and stay in the game. (More)

COLLEGE ATHLETICS

NIL Whiplash: Who’s Paying Whom, and How?

The College Sports Commission (CSC) has started rejecting NIL deals it says don’t meet the threshold for a “valid business purpose.” That includes anything that looks like a cash loop—collectives paying athletes to raise money… to pay athletes. Deals for autograph signings and merch sales are suddenly off-limits if they exist solely to circulate NIL cash, and schools like Georgia, Alabama, and Notre Dame are already shutting collectives down. Enter the lawyers: attorneys behind the $2.8B House settlement say the CSC is violating the agreement they signed and are threatening to take it back to court.

Meanwhile, schools are pivoting to partners like Learfield to broker compliant deals. And Congress is chiming in with a bill to ban student fees from funding athletics—just as some schools were banking on those fees to fill a $20M+ gap. Everyone agrees athletes should get paid. No one agrees on how. (More)

TOGETHER WITH THE DAILY UPSIDE

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

TECH & INFRASTRUCTURE

MetLife’s Billion-Dollar Makeover”

MetLife Stadium just added another feather to its event-hosting cap: the inaugural FIFA Club World Cup final, where Chelsea steamrolled PSG.

Next stop? The 2026 FIFA World Cup Final.

Built for $1.6 billion, MetLife has long been a money-printing fortress with $400 million in naming rights, 200+ luxury suites, and concession stats that’d make Madison Square Garden blush—$95 per fan during the Super Bowl.

To meet FIFA specs, 1,700 seats got axed and natural grass swapped in, signaling how serious the U.S. is about football (the other kind).

This isn’t MetLife’s first rodeo: Super Bowls, WrestleMania, Copa América finals, and Beyoncé have all tested its infrastructure. Verdict? Still standing—and still cashing in. (More)

eSPORTS

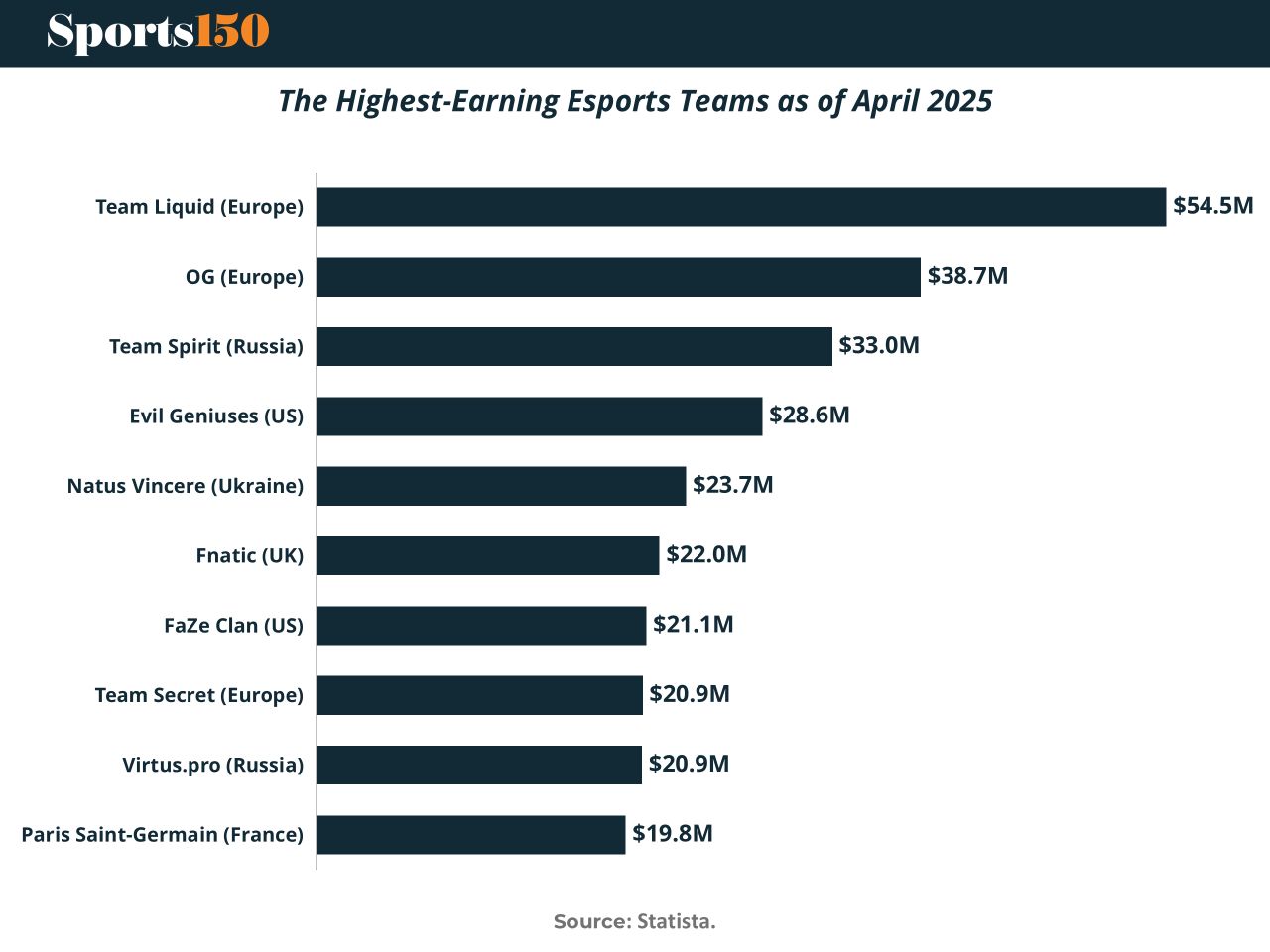

The $54M Bracket

Esports isn’t fringe—it’s cash-rich and global. As of April 2025, Team Liquid has racked up $54.5M in prize money, outpacing rivals like OG ($38.7M) and Team Spirit ($33M). These numbers aren’t just leaderboard candy—they’re a proxy for how big the game has gotten. Tournaments like the Esports World Cup are offering $70M prize pools, and the teams cashing in are those fielding cross-game rosters across Dota 2, Valorant, and Fortnite. With Evil Geniuses, FaZe Clan, and PSG all deep in the mix, esports earnings are no longer a sideshow—they’re a business model. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

🚨💰 Manchester City's record breaking kit deal extension with Puma could end up being worth £1billion. It is valued at £100m a season. 🤯

It's believed to be the highest value Premier League kit deal in history, reports @TyMarshall_MEN.

— EuroFoot (@eurofootcom)

7:23 AM • Jul 16, 2025

"The only place where success comes before work is in the dictionary."

Vidal Sassoon