- Sports 150

- Posts

- From Netflix to FIFA: Who’s Really Winning Streaming Sports?

From Netflix to FIFA: Who’s Really Winning Streaming Sports?

It’s Thursday and today we’re looking at George Foreman’s entrepreneurial story, Apollo is not landing on the moon but is landing on the Liga MX with a $1.3B move, Tennis Grand Slams infrastructure is more complex and expensive than expected, and streaming is poised to account for the 20% of global sports rights spend in 2025.

Good morning, ! It’s Thursday and today we’re looking at George Foreman’s entrepreneurial story, Apollo is not landing on the moon but is landing on the Liga MX with a $1.3B move, Tennis Grand Slams infrastructure is more complex and expensive than expected, and streaming is poised to account for the 20% of global sports rights spend in 2025.

First time reading? Join thousands of investors and executives keeping pace with the business of sports by Subscribing Here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

MEDIA & SPORTS

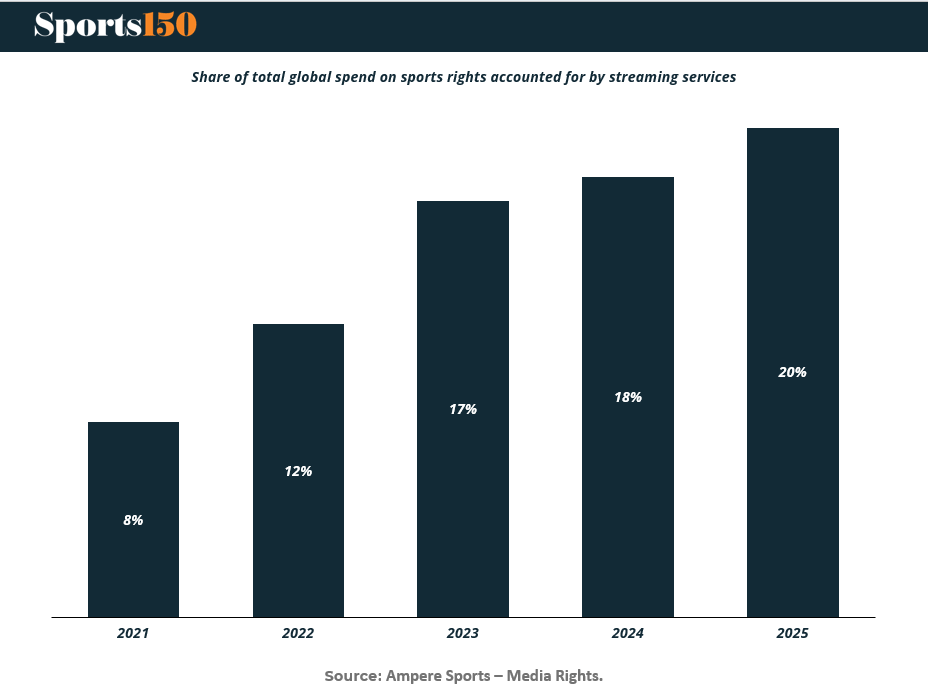

DAZN Tops $12.5B Streaming Sports Spend

Streaming will account for 20% of global sports rights spend in 2025, hitting $12.5B, per Ampere. DAZN leads the pack, owning a third of that total, buoyed by a $1B FIFA Club World Cup deal and expansion in Germany, Italy, Spain, France, and soon Australia (via Foxtel).

Amazon has leapfrogged from 18% to 23% share, thanks to landing NBA rights starting next season. It already holds NFL Thursday Night Football and Champions League rights in key European markets.

YouTube TV stays third with its $2B NFL Sunday Ticket, while Netflix crashes into fourth on the back of NFL Christmas games and a $500M/year WWE deal.

As subscription growth flattens, live sports are proving their worth in retention: Netflix, Peacock, and Paramount+ all saw major spikes from key broadcasts—and most of those subs stuck around. (More)

PRESENTED BY HUEL

You’re doing breakfast wrong

Let’s face it—most breakfast options just don’t cut it.

Toast? Too light. Cereal? Mostly sugar. Skipping it altogether? Not ideal.

If you want real fuel to power your day, it’s time to upgrade to Huel Black Edition. This ready-in-seconds shake is packed with 40g of plant-based protein, 27 essential vitamins & minerals, and 0 artificial sweeteners—just science-backed nutrition to support your muscles, digestion, and more.

Oh, and did we mention? It’s delicious.

Right now, first-time customers get 15% off, plus a free t-shirt and shaker with code HUELSPRING, for orders over $75.

INVESTOR CORNER

Private Equity’s Favorite Formation: 4-4-2 (Four Billion in AUM, Four Decades of Control, Two Decades of Lock-in)

Apollo’s $1.3B bet on Liga MX is nearing the goal line—but it's not a done deal. While most of the 18 club owners support the investment, dissent over details like revenue sharing delayed a vote and triggered the resignation of commissioner Juan Carlos Rodriguez, the deal’s top backer. Apollo’s proposal? A new media entity that centralizes rights, backed by NFL partnership, and reshapes Mexican soccer’s biz model. Critics like Grupo Pachuca’s owner want more clarity, not another U.S.-style carveout. With $498B AUM and a playbook from LaLiga and Ligue 1, Apollo’s gunning for the most-watched soccer league in the U.S. The ball’s now in interim commissioner Mikel Arriola’s court. (More)

ENTREPRENEURS

Entrepreneur Spotlight: George Foreman’s Knockout Business Pivot

George Foreman’s story isn’t just about heavyweight titles, it’s about heavyweight reinvention. After becoming the world heavyweight boxing champion (twice) and earning Olympic gold in 1968, Foreman shocked the sports world by reclaiming the title at age 45, becoming the oldest champion in boxing history.

But his biggest win came outside the ring. Foreman turned a casual endorsement into an entrepreneurial masterstroke with the George Foreman Grill, a health-focused kitchen appliance that’s sold over 100 million units worldwide.

Foreman didn’t just lend his name, he leaned into the brand, making grilling and clean eating part of his public persona. His reported $138 million buyout deal for naming rights alone is one of the most lucrative in sports-endorsement history. (More)

COLLEGE ATHLETICS

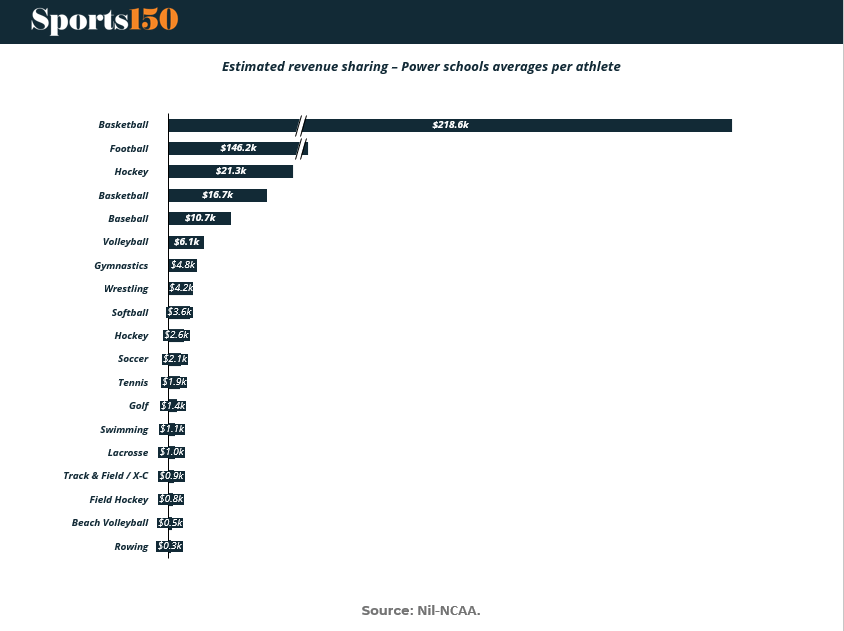

College athletes are getting paid—and not evenly.

Starting in 2025, schools can share up to $20.5M/year directly with athletes, thanks to the House v. NCAA settlement. Power 5 schools will distribute near the cap, and nearly 90% of it is earmarked for football and men’s basketball.

The chart tells the tale: Basketball players could pull in $278.6K, and football players $146.2K. By comparison, volleyball earns $6.1K, and rowing is under $1K.

Add in NIL money, unlimited scholarships, and a $30M+ forecasted ceiling, and we’ve officially entered the quasi-professional era. Non-Power 5 schools, meanwhile, will struggle to hit $2.5M in total payouts—widening a talent gap that already looks unbridgeable.

The market has spoken: amateurism is branding, not policy. (More)

TOGETHER WITH SCOTTS TENNIS

EXPERIENCE | Where Tennis Meets Strategy

Two luxury events. One clear takeaway: elite experiences are becoming a new channel for high-level networking and brand alignment in the PE ecosystem.

The Stuttgart Experience (June 12–15) places you at the center of the BOSS Open with VIP access, fine dining, and a once-in-a-lifetime ProAm match alongside Tommy Haas. Off the court, expect curated cultural perks—private museum tours (Porsche, Mercedes-Benz), and a tailored shopping session at the BOSS flagship in Metzingen.

The Mallorca Championships (June 25–28) double down on tennis and tranquility. Watch world-class players from premium seats, tour behind-the-scenes with tournament insiders, and cruise the Balearic coast by private boat. The itinerary includes a visit to the Rafa Nadal Academy and a rare audience with Toni Nadal—plus a stay at the 5-star Kimpton Mallorca.

More than a hospitality package, each experience creates space for meaningful conversations, strategic connections, and lasting impressions—on and off the court.

To learn more or reserve your spot, email: [email protected]

TECH & INFRASTRUCTURE

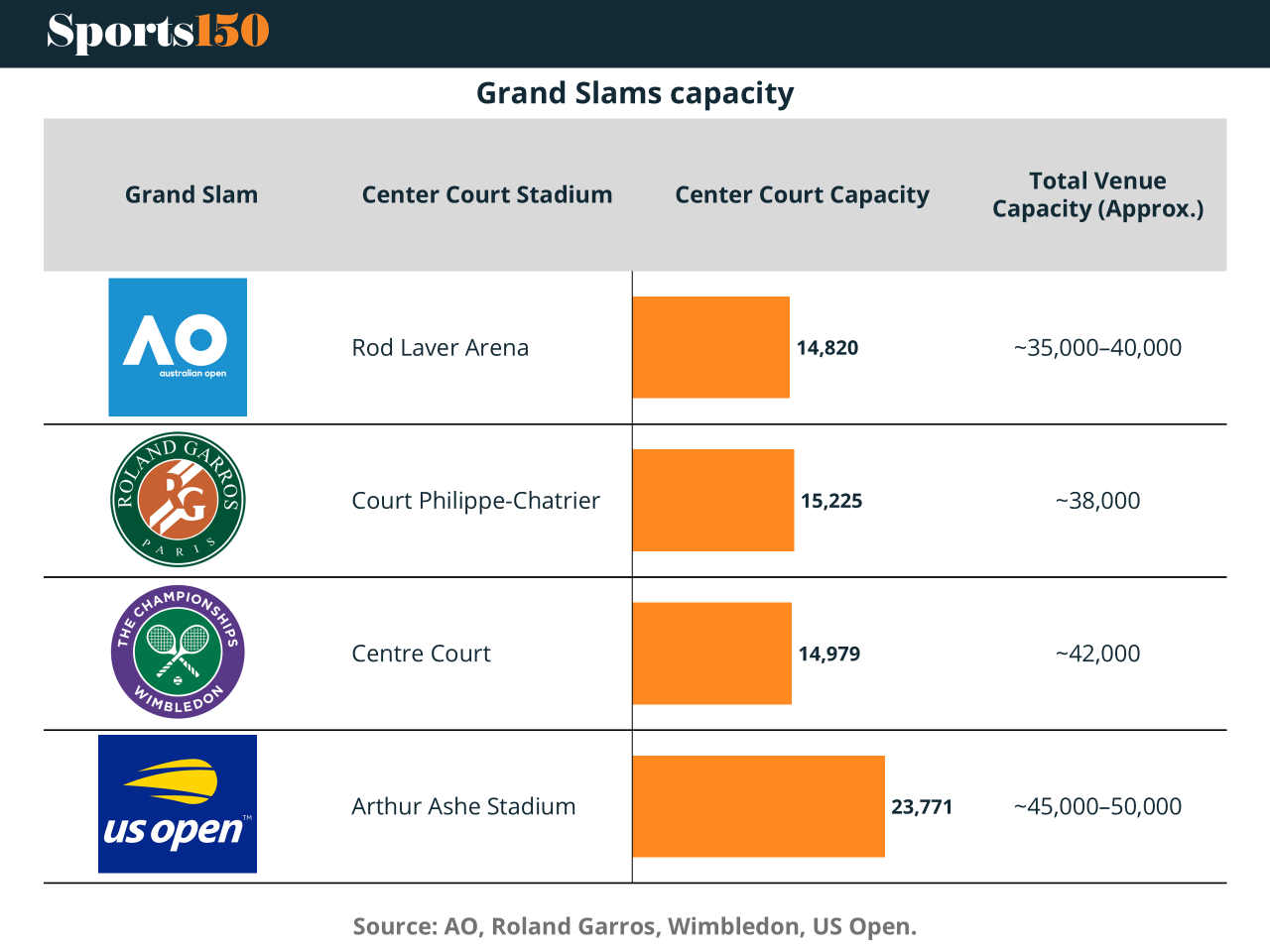

Tennis' $2B Real Estate Flex

Tennis’ Grand Slam venues are upgrading like they’re pitching to sovereign wealth funds. Melbourne Parl clocked nearly $1B AUD in redevelopment; Wimbledon is monetizing exclusivity via £116K debenture seats; and Arthur Ashe Stadium—still the largest—justifies its $500M+ in upgrades by being the top-grossing seat in tennis. But this isn’t just about aesthetics. These investments unlock multi-use returns: conferences, concerts, and year-round hospitality. Wimbledon’s new 8,000-seat court, the Kia Arena in Melbourne, and New York’s bond-funded roof all signal one thing: capacity is capital. The bigger the crowd, the bigger the wallet—merch, media, food—all scaling alongside. Bottom line: tennis is teaching a PE masterclass in sports real estate monetization. (More)

CONSUMER & SPORTS

The Great Recalibration: Sporting Goods Industry Faces a New Reality

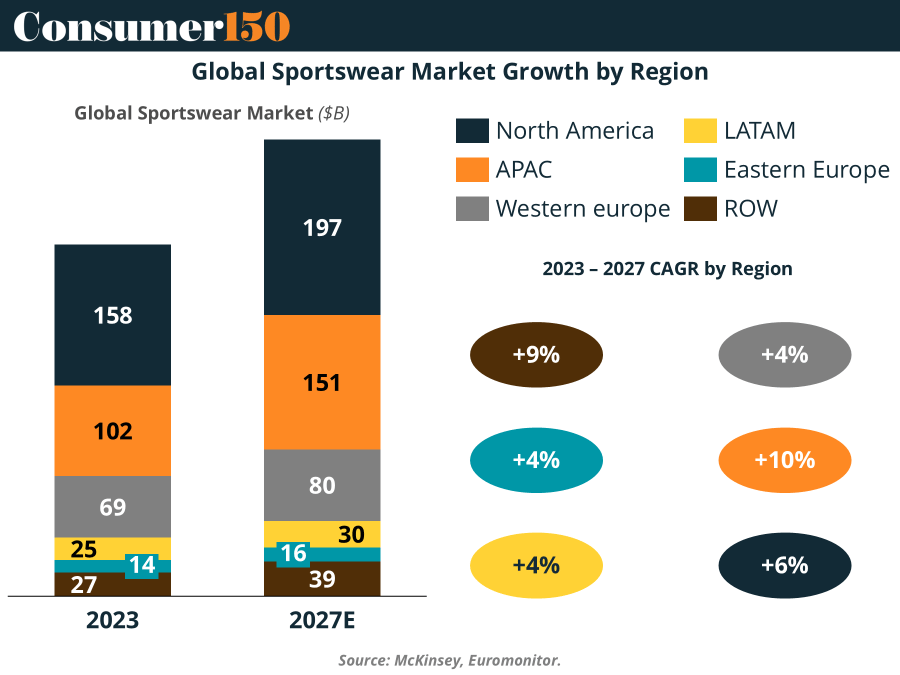

After a robust 7% annual growth from 2021 to 2024, the sporting goods industry is bracing for a tempered 6% CAGR through 2029. This deceleration is attributed to slowing momentum in Asia–Pacific, Western Europe, and Latin America.

Consumer behaviors are shifting towards more accessible and social sports, such as pickleball and off-course golf, which have seen participation surges of 159% and 57% respectively from 2019 to 2022. This trend underscores a move away from traditional, organized sports towards activities that are easier to pick up and require less commitment.

As the industry navigates this new landscape, companies are focusing on integrated business planning, sustainability initiatives, and ecosystem strategies to maintain growth and meet evolving consumer demands. (More)

TOGETHER WITH 1440 MEDIA

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

eSPORTS

Mobile eSports: A Viewer Juggernaut in the Making

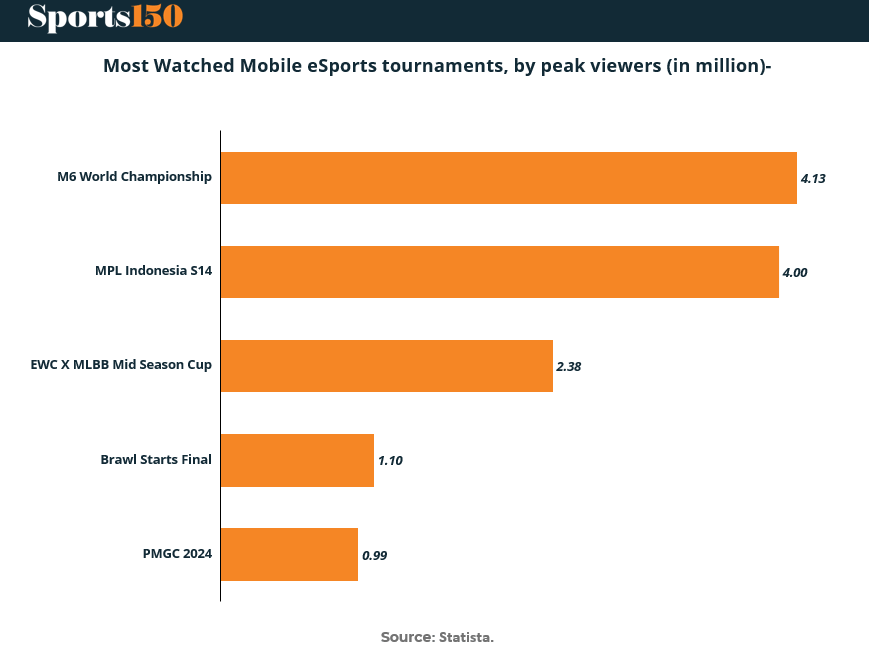

Forget consoles and PCs, mobile eSports is now commanding millions of eyeballs, with tournaments like the M6 World Championship (4.13M peak viewers) and MPL Indonesia S14 (4.00M) proving that the phone in your pocket might be the world’s next major sports arena.

These numbers aren’t just impressive, they’re disruptive. Tournaments like the EWC x MLBB Mid Season Cup (2.38M viewers) and the Brawl Stars Final (1.10M) show that titles optimized for mobile are delivering broadcast-level engagement. Meanwhile, even relative newcomers like PMGC 2024 cracked the 1M mark.

For investors and brands, the message is loud and clear: mobile-first eSports isn’t a niche, it’s a rapidly scaling content category. With low hardware barriers and massive Gen Z engagement, this segment is a sleeping giant, one highlight reel away from a mainstream tipping point.

INTERESTING ARTICLES

TWEET OF THE WEEK

Amazon reveals its NBA on Prime logo, created by CAA Brand Consulting, inspired by a basketball court to divide the two markings 🏀

The $1.93B deal for 2025-26 includes 66 regular season games, NBA Cup coverage, Play-In Tournament, and more.

— Sports Business Journal (@SBJ)

9:00 PM • May 12, 2025