- Sports 150

- Posts

- From Match Point to Board Meeting Point

From Match Point to Board Meeting Point

Ion Țiriac’s tennis résumé—French Open doubles champion and multiple Davis Cup finals—was only a prelude to a rarer achievement:

Ion Țiriac’s Playbook for Building Enduring Wealth

Introduction

architecting one of Eastern Europe’s most successful post-communist business empires. Over three decades, he converted first-mover instinct, brand credibility, and disciplined execution into a diversified portfolio spanning finance, insurance, auto retail, real estate, aviation, and sports assets. His trajectory illustrates how to professionalize early, scale through partnerships, and balance liquidity events with recurring cash flows to create durable, compounding wealth.

The Strategic Pivot: Enter Early, Professionalize Fast

The fall of communism in the early 1990s created a once-in-a-generation opening in Romania. While many waited for regulatory clarity, Țiriac prioritized speed and institutional quality. In 1990, he established Ion Țiriac Bank, widely recognized as the first private bank in the newly liberalized market. The move served as a beachhead: it built trust with regulators and customers, created distribution, and generated optionality for adjacent financial services. His approach reflected a core belief: capture the earliest stage of market formation, then raise standards to Western levels to compress perceived risk and expand valuation multiples.

Building Financial Pillars: Bank and Insurance as Force Multipliers

Țiriac’s early bets in financial services delivered both strategic leverage and eventual liquidity. The bank matured from a frontier franchise into a modern institution and, after a series of partnerships and rebrandings, culminated in a major exit when a European banking group consolidated control in 2015.

In parallel, Țiriac launched Asigurări Ion Țiriac (ASIT) in 1994, addressing rising demand for risk transfer products in a market shifting from state provision to private responsibility. Bringing in a global insurer as a controlling partner six years later accomplished two goals: it crystallized part of the value created and infused the business with global actuarial capabilities, capital depth, and operational know-how. In both cases, the pattern held: local build, international partnership, premium valuation.

Operating Platforms: Cash Engines in Autos and Real Estate

Beyond finance, Țiriac sought businesses with repeat purchase cycles, service revenues, and defensible local moats. Țiriac Auto scaled into one of Romania’s most comprehensive dealership and service networks, representing premium and mass-market marques. The value lay as much in after-sales economics—parts, maintenance, financing—as in showroom margins. Operational discipline around inventory turns, working capital, and service throughput turned the platform into a reliable cash generator.

Real estate followed the same logic. Through Țiriac Imobiliare, he developed income-producing assets tailored to a consumer economy in catch-up mode. Tenanted properties provided long-duration cash flows and inflation protection, anchoring the portfolio against cyclicality in deal-making. Together, auto retail and real estate formed the ballast of the group—steady, local, and execution-intensive.

Monetizing Scarcity: Sports Rights as Financial Assets

Tennis never left Țiriac’s business model; it evolved into a distinct asset class. By developing and owning the Mutua Madrid Open through Super Slam Ltd., he controlled a scarce, globally marketable property—the kind that commands sponsorship, media, and hospitality premiums. Years of professionalizing operations and elevating the brand culminated in a sale to a global sports operator in 2022. The sequencing was characteristic: identify a unique, defensible right; compound its commercial footprint; exit to a consolidator when scale economics, global distribution, and cost of capital advantages are most potent.

Portfolio Architecture: The Three-Part Playbook

1) Anticipate demand surges. Post-communist Romania promised step-change growth in banking, insurance, mobility, and urban property. Țiriac focused on categories where latent demand would surface quickly as incomes rose and institutions matured.

2) Attach to global credibility. Partnering with world-class operators in banking, insurance, and sports brought capital, governance, and brand equity. This reduced counterparty risk and enabled multiple expansion that local peers without such partnerships could not easily replicate.

3) Balance liquidity and annuity. The portfolio mixed episodic liquidity events (banking consolidation, tournament sale) with recurring, operational cash flows (auto servicing, real estate leases). This blend financed new bets, cushioned cycles, and kept optionality high.

Management Style: Discipline Over Glamour

Țiriac’s choices favored durability over flash. Dealership networks, service bays, tenant rosters, and regulated financial businesses demand process rigor, not celebrity. The common denominator across his holdings is execution: compliance-first cultures in finance and insurance; KPI-driven operations in auto retail; and asset management discipline in real estate. Returns came less from heroic timing than from compounding mid-teens operating economics over long horizons, periodically punctuated by strategic exits.

Outcomes and Legacy

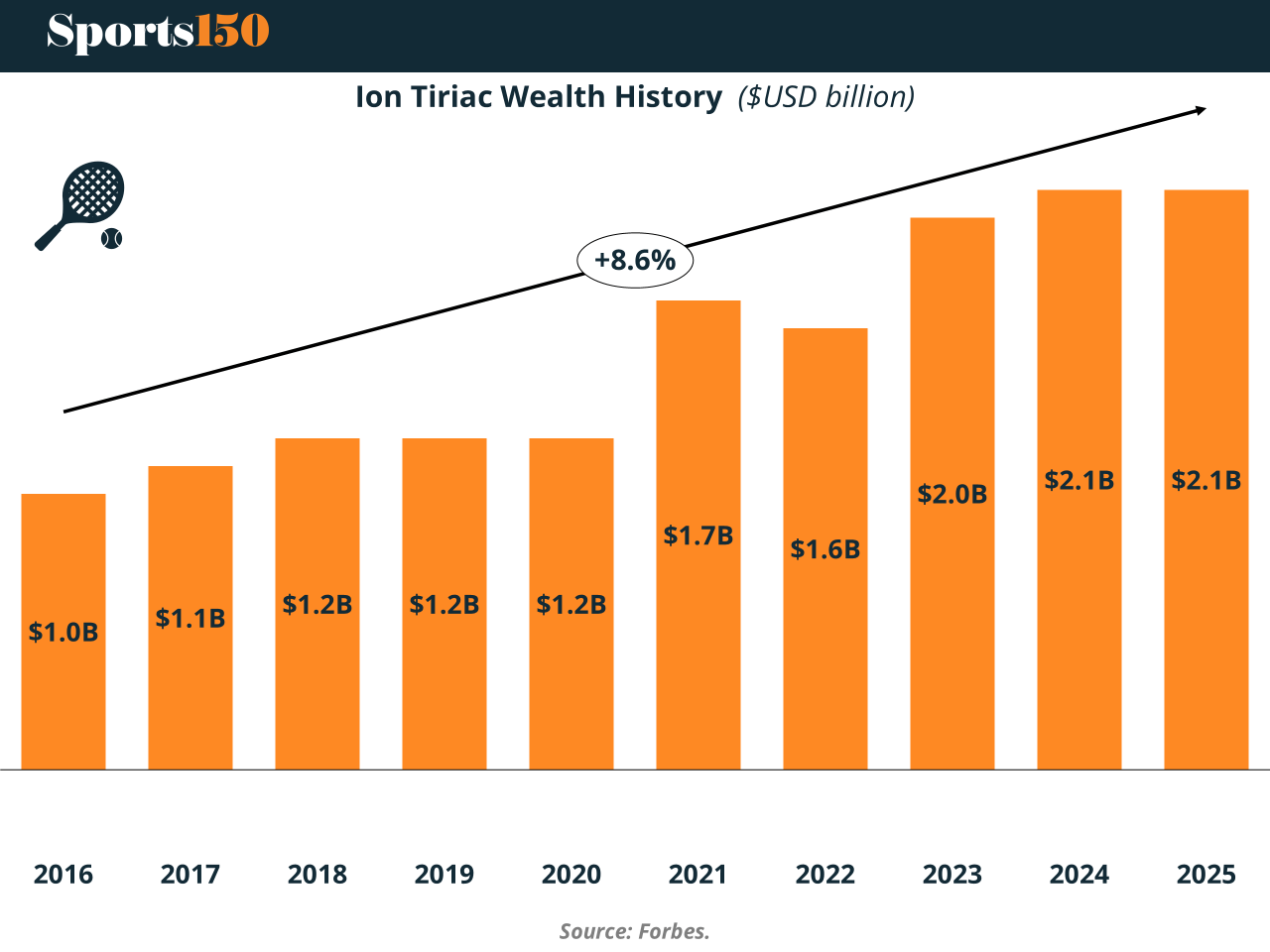

Measured by wealth alone, the results are unambiguous, but the more instructive legacy is methodological. Țiriac translated competitive instincts from sport—reading momentum, managing risk, thriving under pressure—into a repeatable business system suited to transitional markets. He proved that credibility is an asset class, timing is a capability, and partnerships are accelerants when regulation and scale matter most.

Conclusion

Ion Țiriac’s journey from pro athlete to portfolio architect is a case study in post-transition value creation. He moved first, built to international standards, and knew when to partner or sell to scale. By pairing scarce, monetizable assets with cash-generating operating platforms, he engineered both resilience and upside. Decades after leaving the court, his name is synonymous not only with tennis but with banks, insurers, dealerships, and trophy sports properties—evidence that disciplined execution, compounded over time, is the most reliable champion in business.

Sources & References

Business Wire. (2022). IMG Completes Purchase of Mutua Madrid Open. https://www.businesswire.com/news/home/20220331006027/en/IMG-Completes-Purchase-of-Mutua-Madrid-Open

Business Wire. (2021). IMG Acquires the Mutua Madrid Open. https://www.businesswire.com/news/home/20211206005215/en/IMG-Acquires-the-Mutua-Madrid-Open

Forbes. (2025). Ion Tiriac. https://www.forbes.com/profile/ion-tiriac/

Insurance Journal. (2000). Allianz Acquires Majority Interest in Romania’s Tiriac Insurance. https://www.insurancejournal.com/news/international/2000/08/28/10474.htm

Reuters. (2015). Bank Austria buys out Tiriac stake in Romanian unit. https://www.reuters.com/article/markets/bank-austria-buys-out-tiriac-stake-in-romanian-unit-idUSL5N0YP507/

Tiriac Group. https://www.tiriacgroup.ro/despre-noi/

Tiriac Imobiliare. (2025). Tiriac Real Estate. https://tiriacimobiliare.ro/about-us