- Sports 150

- Posts

- End of Year Special Issue:A 2025 Review and key Topics for 2026 in Sports

End of Year Special Issue:A 2025 Review and key Topics for 2026 in Sports

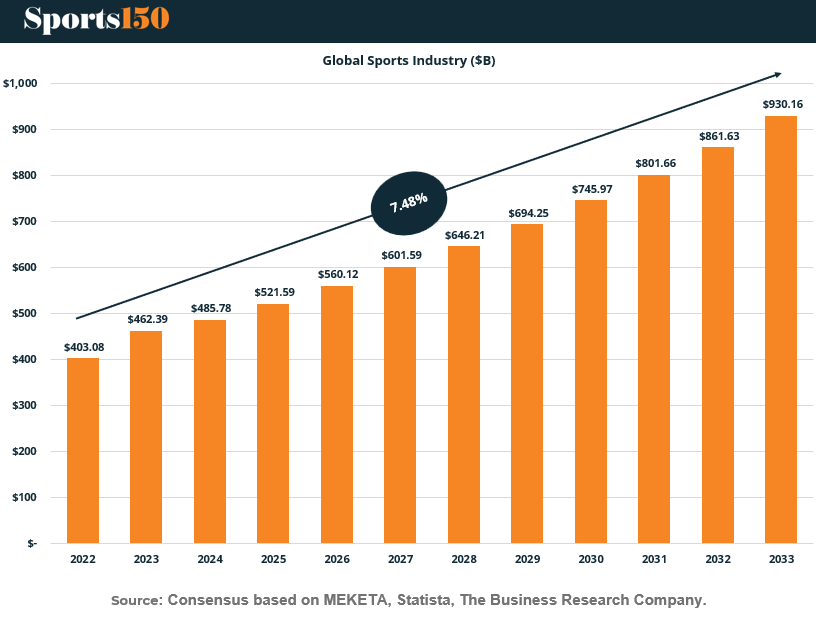

Private equity backs 60+ pro teams and European football hits $39B, while the global sports market races toward $1T.

Good morning !,

Before the calendar flips, we’re bringing you one final deep cut on the business of sports—what shaped 2025, and what’s setting the pace for 2026.

This year was defined by institutional capital getting deeper into sports, from PE-backed franchises to sovereign wealth-backed stadiums. College athletics continued its quasi-professional transformation, AI moved from hype to workflow, and European football proved it’s not just a sport—it’s a financial engine.

Next year, the trends go macro. Sports is hurtling toward a trillion-dollar market cap, athlete health is now a growth sector, and the NCAA's media footprint is finally breaching the $1B mark—just as scrutiny around its revenue model heats up.

Whether you’re allocating capital or attention, the game is changing. Let’s close the year with signal, not noise.

Want to advertise in Sports 150? Check out our self-serve ad platform, here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

Key topics in 2025

1. Private Equity's Quiet Takeover of U.S. Sports

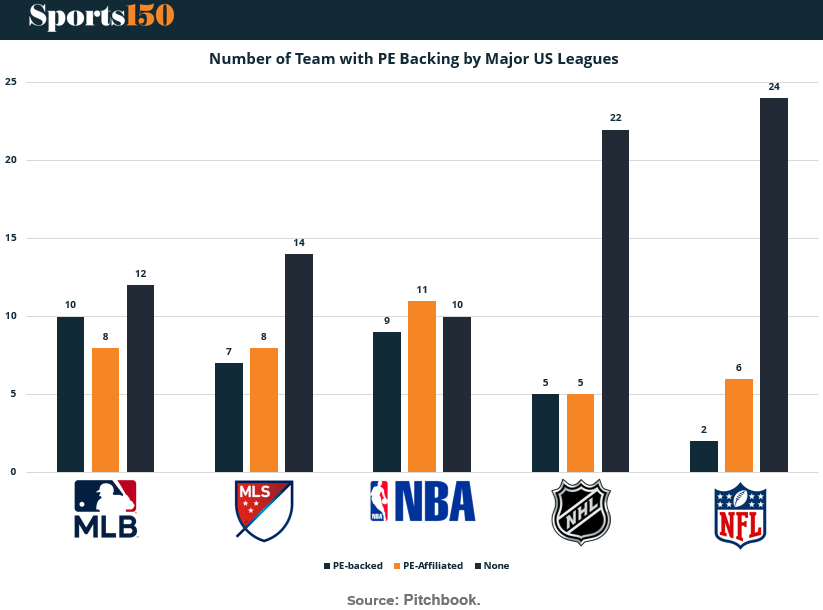

The chart tells a story most fans haven’t noticed: private equity now plays a material role in U.S. pro sports ownership. As of 2025, over 60 teams across the Big Five leagues are either PE-backed or PE-affiliated, per PitchBook. MLB leads with 10 PE-backed teams, a product of early policy liberalization. But the NBA isn't far behind, with 9 PE-backed and 11 affiliated teams, reflecting its global appeal and tech-savvy audience.

The big shift? The NFL, historically resistant, now has 2 PE-backed teams and 6 affiliated, following a 2024 rule change allowing minority fund ownership. That’s small—but it's a crack in the dam of the most valuable sports league in the world.

Why it mattered in 2025: This year was the tipping point. Private equity's footprint went from fringe to strategic, turning franchises into long-hold alternative assets. Expect this ownership model to reshape media rights negotiations, capital allocation, and long-term league strategy—especially as valuations continue to climb.

2. Europe’s $39B Football Machine Rolls On

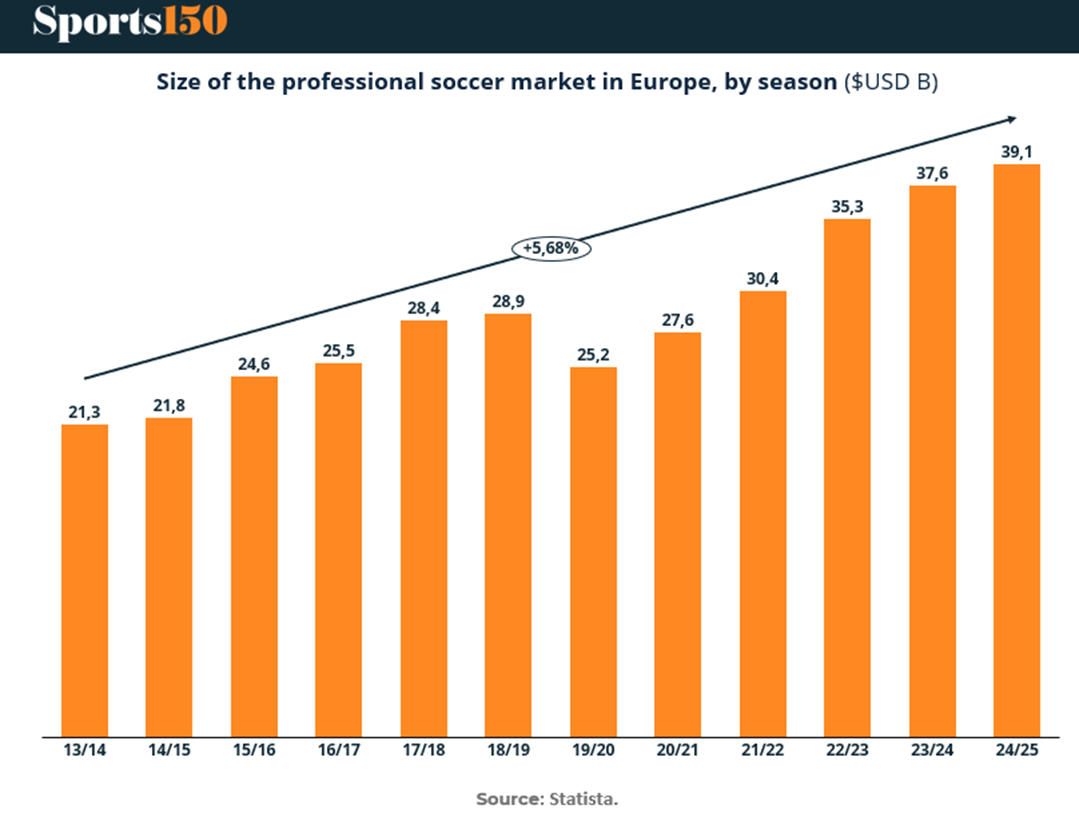

The European football market hit $39.1B in 2024/25, growing at a steady +5.68% CAGR over the past decade—even weathering a global pandemic. The real story isn’t just recovery—it’s systematic monetization. Media rights remain the backbone, but digital expansion, sponsorship scale-ups, and PE-backed infrastructure plays are pushing the sport into new revenue territory.

Why it mattered in 2025: This year locked in football’s position as the most bankable sports ecosystem in the world. From CVC’s league-level investments to Middle Eastern sovereign wealth funds snapping up assets, institutional capital isn’t betting on wins—it’s betting on football’s unmatched ability to scale cash flow. For investors, Europe isn’t just where football is played—it’s where sports capital compounds.

3. College Sports: More Athletes, Same Pie

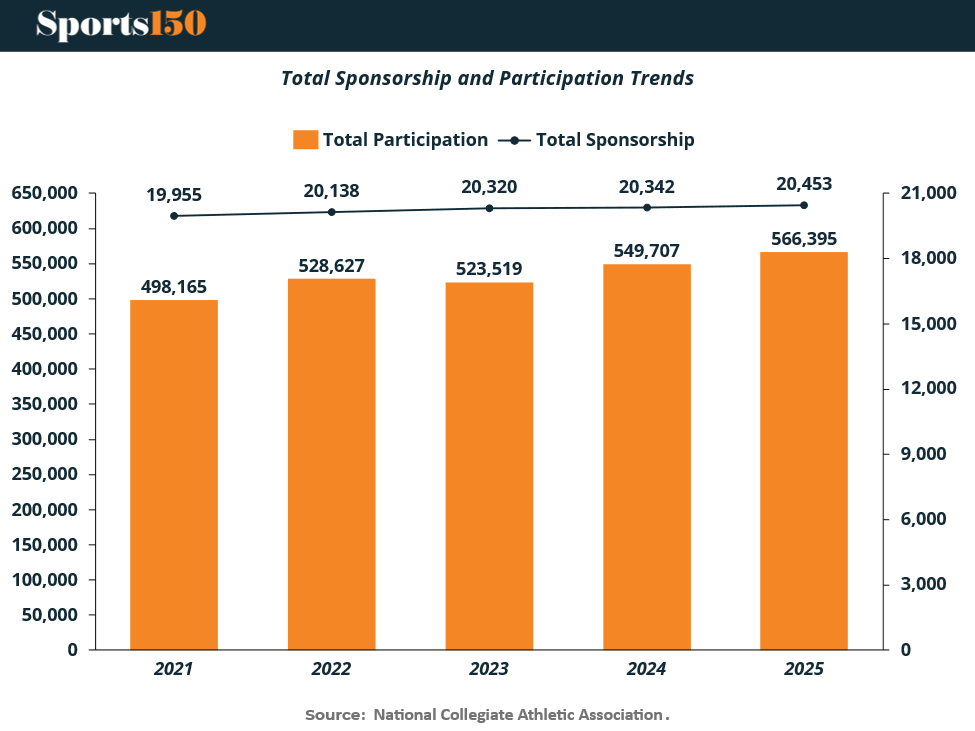

NCAA participation surged to 566,395 athletes in 2025, up 13.7% since 2021. But sponsorship opportunities—an imperfect proxy for financial support—have barely moved, growing from 19,955 to just 20,453. That’s a widening gap between opportunity and monetization.

Why it mattered in 2025: With the House v. NCAA settlement coming into play and schools allowed to pay athletes directly, the economics of college sports are shifting fast—but unevenly. The headline growth in participation masks a core issue: resources aren’t scaling with talent. That imbalance will shape Title IX debates, NIL equity, and whether non-revenue sports can survive a quasi-professional era. Investors eyeing NIL platforms, collectives, or licensing plays should watch where this delta narrows—or widens.

4. In Sports AI, Distribution Beats Data

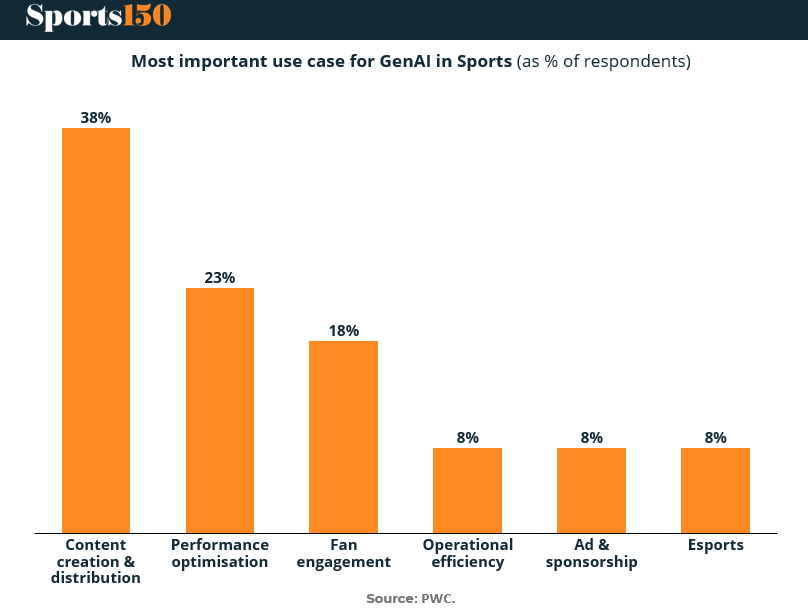

According to PwC, 38% of sports execs see content creation and distribution as the top use case for GenAI—outranking performance, engagement, or ops. That’s a signal: AI in sports isn’t starting on the field—it’s starting in the feed.

Why it mattered in 2025: This year marked the shift from AI hype to adoption. Leagues and rights-holders used GenAI to automate highlights, localize commentary, and A/B test thumbnails at scale. It wasn’t just about saving costs—it was about owning more surfaces, faster. For investors, this reframes GenAI as a media multiplier in sports, not just a tech feature. The battleground is attention, and GenAI’s first job is helping sports content get seen.

Trends going into 2026

1. Sports Is on a $1T Collision Course

The global sports industry is projected to hit $930B by 2033, growing at a 7.48% CAGR, per MEKETA and Statista. In 2026, that means crossing the $560B mark, solidifying sports not just as an entertainment vertical—but as a macroeconomic force.

Why it matters for 2026: Growth isn’t just organic—it’s compounding. Media rights, infrastructure megaprojects, GenAI monetization, and sovereign capital inflows are reshaping sports into a platform economy. And investors are treating it accordingly. As we move into 2026, expect capital to chase vertical integration plays—teams, content, data, commerce—under the same roof. The $1T milestone isn’t a dream. It’s a roadmap.

2. The $13B Body: Sports Medicine’s Investment Moment

The global sports medicine market is set to grow 8.23% annually, topping $13B by 2034, up from $6.4B in 2025. In 2026, the sector crosses $6.9B, as elite performance, youth participation, and aging weekend warriors converge on a single thesis: the body is the asset.

Why it matters for 2026: Sports medicine isn’t just a healthcare story—it’s a performance economy play. As franchises invest in recovery tech, bio-analytics, and injury prevention, venture and PE firms are following with capital. Expect 2026 to be a breakout year for wearable-integrated rehab, team-owned clinics, and athlete-backed medtech startups. Health is wealth—and increasingly, it’s investable.

3. March Madness Pushes NCAA Media Over $1B

In 2026, the NCAA is projected to cross $1.02B in annual TV and licensing revenue, with 2027 set to hit $1.05B, per NCAA data. That’s a 20% jump from 2024, driven primarily by March Madness rights escalators and renewed interest in women’s sports broadcasts.

Why it matters for 2026: Amid NIL upheaval and athlete revenue sharing, the NCAA’s biggest moat remains its media machine. But as broadcast contracts grow, so does scrutiny over where that money flows. In 2026, rights buyers will push for bundled women’s inventory, athletes will push for a cut, and private equity will circle adjacent monetization models (e.g. NIL exchanges, media collectives). The billion-dollar ceiling just became a floor—and the real game is now off the court.

"Get busy living or get busy dying."

Stephen King