- Sports 150

- Posts

- College Sports Hit $1.3B Valuations as NIL Market Nears $2.5B

College Sports Hit $1.3B Valuations as NIL Market Nears $2.5B

College sports are turning pro. Top programs now top $1B valuations, media rights surge past $1B, and NIL deals near $2.5B—rewriting the playbook for athletes and universities alike.

Good morning, ! This week we’re looking at the US college athletics market, Liga MX being a giant powerhouse in the US media landscape, updated sports tech deals in 2025, and SouthEast Asia e-sports consumption levels

Want to advertise in Sports 150? Check out our self-serve ad platform, here.

Know someone who would love this? Forward it their way! Here’s the link.

— The Sports150 Team

DATA DIVE

The Billion-Dollar Campuses

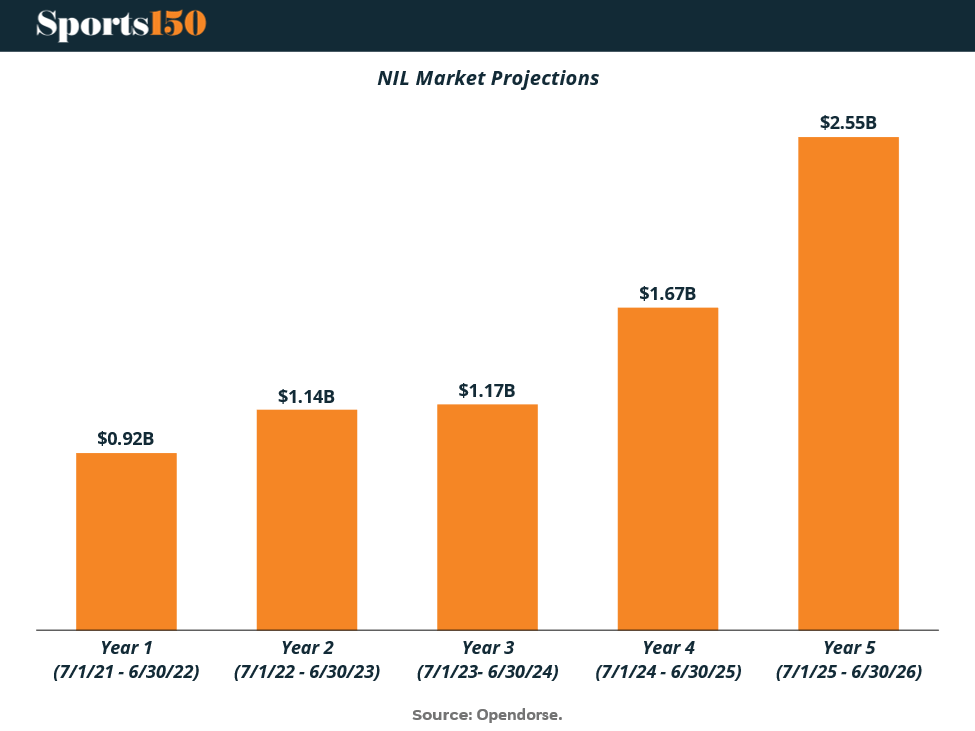

The line between college athletics and the pros keeps blurring—and not just on the field. Top programs like Ohio State ($1.32B valuation) and Texas ($1.28B) are now worth as much as pro franchises, fueled by football-heavy revenues and media rights that are set to top $1B by 2027. Add the rise of NIL deals ($1.67B market by 2025) and athletes are finally sharing in the upside. The kicker? Revenue-sharing models could push that number past $2.5B in the first year of adoption. With SEC and Big Ten dominance and women’s basketball surging in commercial NIL, the business of college sports looks less like higher ed and more like the NFL with homework.

MEDIA & SPORTS

Liga MX: The American Power League No One’s Talking About

Liga MX is the most-watched soccer league in the U.S.—and no, that’s not a typo. While MLS grabs headlines, Liga MX captures hearts (and Nielsen ratings), particularly among America’s 37M+ Mexican-origin population. But here’s the twist: its U.S. media rights are criminally undervalued. Thanks to fragmented rights ownership, there’s no mega broadcast deal—yet. That’s where private equity steps in. Centralizing rights, launching D2C streaming, and tapping the high-CPM U.S. ad market could unlock massive upside. Add in the 2026 World Cup co-hosting bump, and you’ve got an under-monetized juggernaut sitting across the border, waiting for its turn at bat. (More)

PRESENTED BY MASTERWORKS

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

INVESTOR CORNER

$55B for Pixels: EA’s Mobile Play and the Valuation Debate

EA’s $55B take-private by Saudi Arabia’s Public Investment Fund, Silver Lake, and Affinity Partners is now the largest all-cash sponsor-led buyout in history. It also begs a question: how much of that value rides on EA’s mobile portfolio?

Mobile accounted for 17% of EA’s revenue in Q1 FY2026, up from 15% in FY2025 and 13% in FY2021. That’s roughly $1.1B annually—no small number, but far from dominant. Yet select titles, like FC Mobile (up 20% in DAUs), continue to outperform, posting $15M in August 2025 alone.

The mobile unit has also been shedding weight—EA killed off multiple titles over the past year, including Kim Kardashian: Hollywood. Still, top legacy games (e.g., Star Wars: Galaxy of Heroes, Golf Clash) have lifetime revenues north of $1B each.

The strategic bet: mobile may be down, but not out. With console revenue plateauing and mobile gaming now ~50% of global games revenue, control of EA’s catalog could be a long-term lever for monetization, international growth, and synergy with Saudi Arabia’s broader entertainment ambitions. (More)

ENTREPRENEURS

From Dunk Contest to Deal Flow

Blake Griffin’s post-NBA playbook looks less like a retirement plan and more like a growth strategy. Through Team Griffin Ventures, the six-time All-Star is investing in emerging tech, wellness, and clean consumer brands—backing names like Hyperice, Lemon Perfect, and Air Company. He’s also a Patricof Co investor in SpaceX, and recently led a seven-figure buyout of the Osos de Monterrey, signaling a shift toward team ownership and sports infrastructure.

The move mirrors the LeBron-Wade model—using brand equity to buy equity. For Griffin, the game isn’t over; it’s just moved courts. (More)

TOGETHER WITH MASTERWORKS

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

TECH & INFRASTRUCTURE

Sports Tech’s M&A Marathon

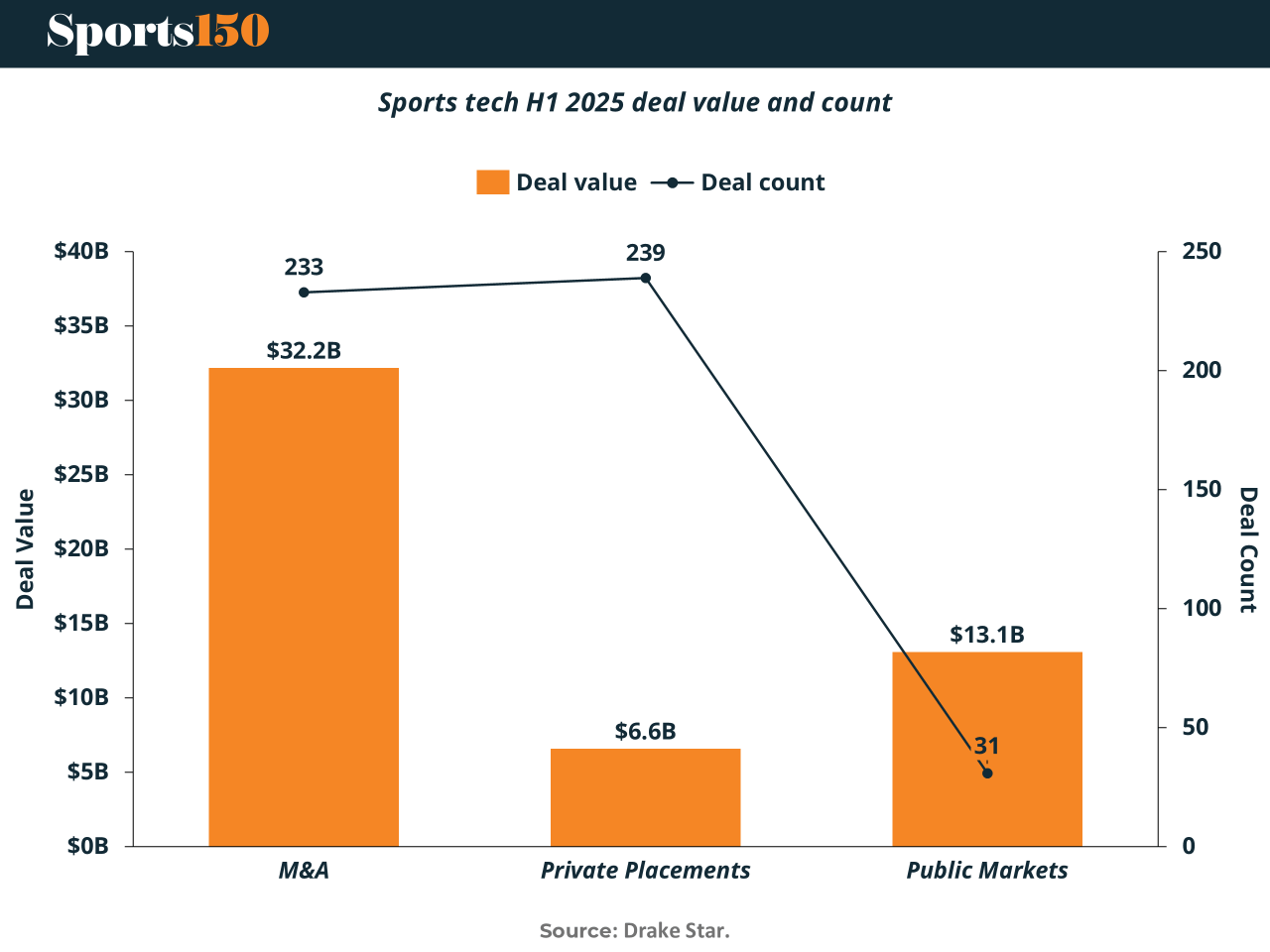

The sports tech market just clocked $52B in deal value for H1 2025 — a pace that would make even track stars jealous. With 233 M&A deals and $32B disclosed, the sector’s running on pure integration energy.

TSG’s $1.5B EōS Fitness buy led the pack, followed by RTL’s $613M Sky Deutschland grab, and Disney’s Hulu + FuboTV merger, which closed a messy antitrust chapter.

Meanwhile, private markets raised $6.6B, led by Infinite Reality’s $3B and DAZN’s $1.8B rounds. Add $3.5B in new funds from heavyweights like TPG, Mark Cuban, and Ryan Smith, and it’s clear: sports tech has become infrastructure, not a niche.

The scoreboard? 503 total deals—and counting. (More)

eSPORTS

Vietnam Levels Up in Southeast Asia

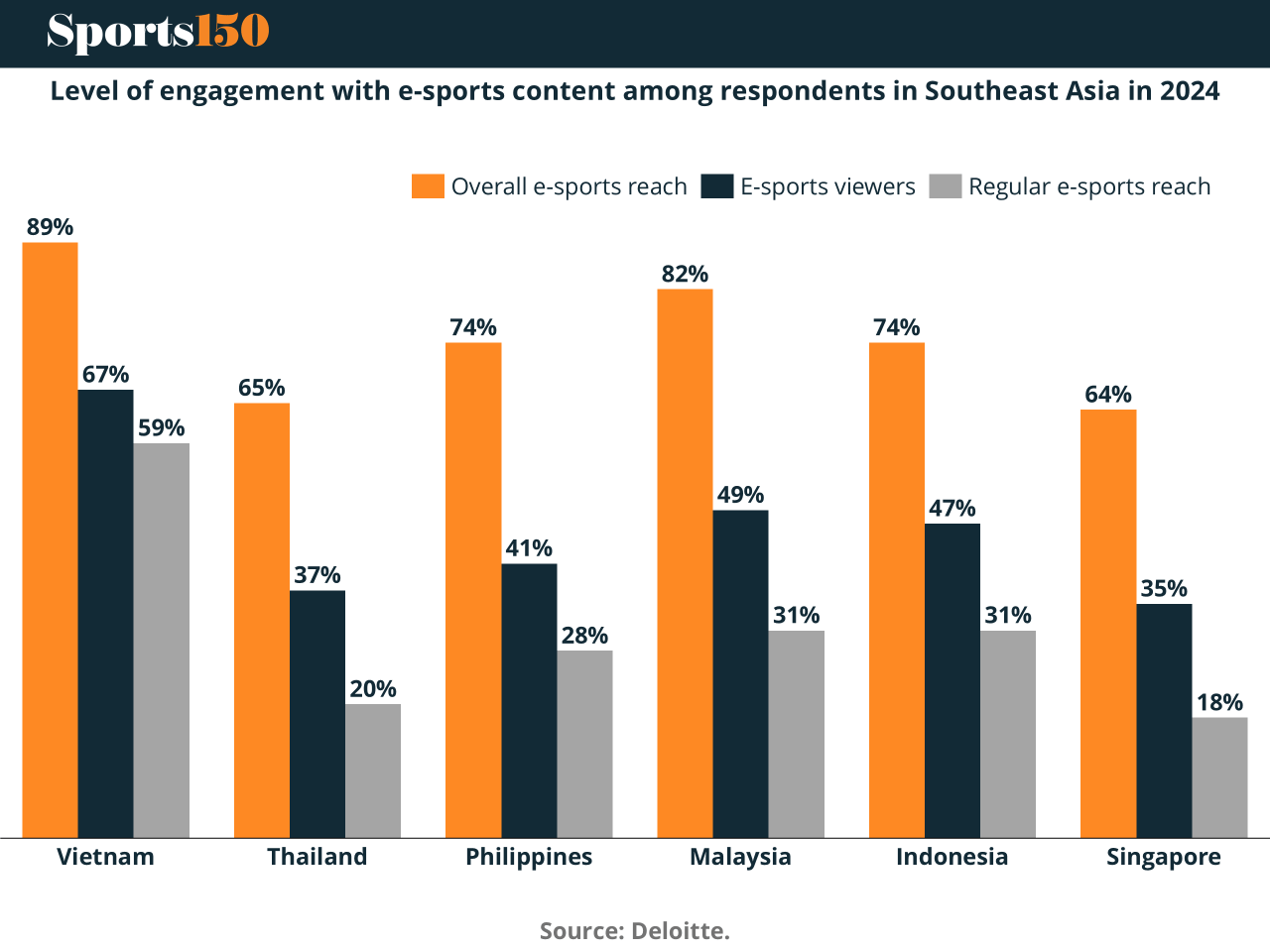

Vietnam is officially Southeast Asia’s eSports boss fight. According to a Deloitte survey of 14,250 global respondents, 89% of Vietnamese participants have consumed eSports content, and nearly 60% do so weekly—the highest “regular reach” across all markets. Compare that with Singapore, where just 18% watch weekly, and it’s clear: Vietnam isn’t just tuned in, it’s logged on. Other heavy hitters include Malaysia (82% overall reach) and Indonesia (74%), but Vietnam leads in every metric: reach, viewership, regularity. For brands and leagues, the signal is clear: the future of fandom isn’t just digital—it’s Vietnamese and watching on repeat. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

EXCLUSIVE: A new bill has been introduced to block private equity deals with athletic departments or conferences, according to a draft of the bill obtained by FOS.

No school or conference would be permitted to sell ownership stakes to a sovereign wealth fund, PE, or hedge fund.

— Front Office Sports (@FOS)

12:54 PM • Oct 7, 2025

"The secret of business is to know something that nobody else knows."

Aristotle Onassis