- Sports 150

- Posts

- Australian Open Media Rights: The Engine Powering Record Prize Money

Australian Open Media Rights: The Engine Powering Record Prize Money

The Australian Open has entered a new commercial era in which media rights, more than any other revenue stream, are reshaping the economics of the tournament and directly underwriting the sharp rise in player prize money.

The record-breaking prize pools announced for 2025 and 2026 are not simply the product of higher ticket sales or sponsorship growth. They are the visible outcome of a long-term broadcast and streaming strategy that has turned the Australian Open into one of the most valuable media properties in global sport.

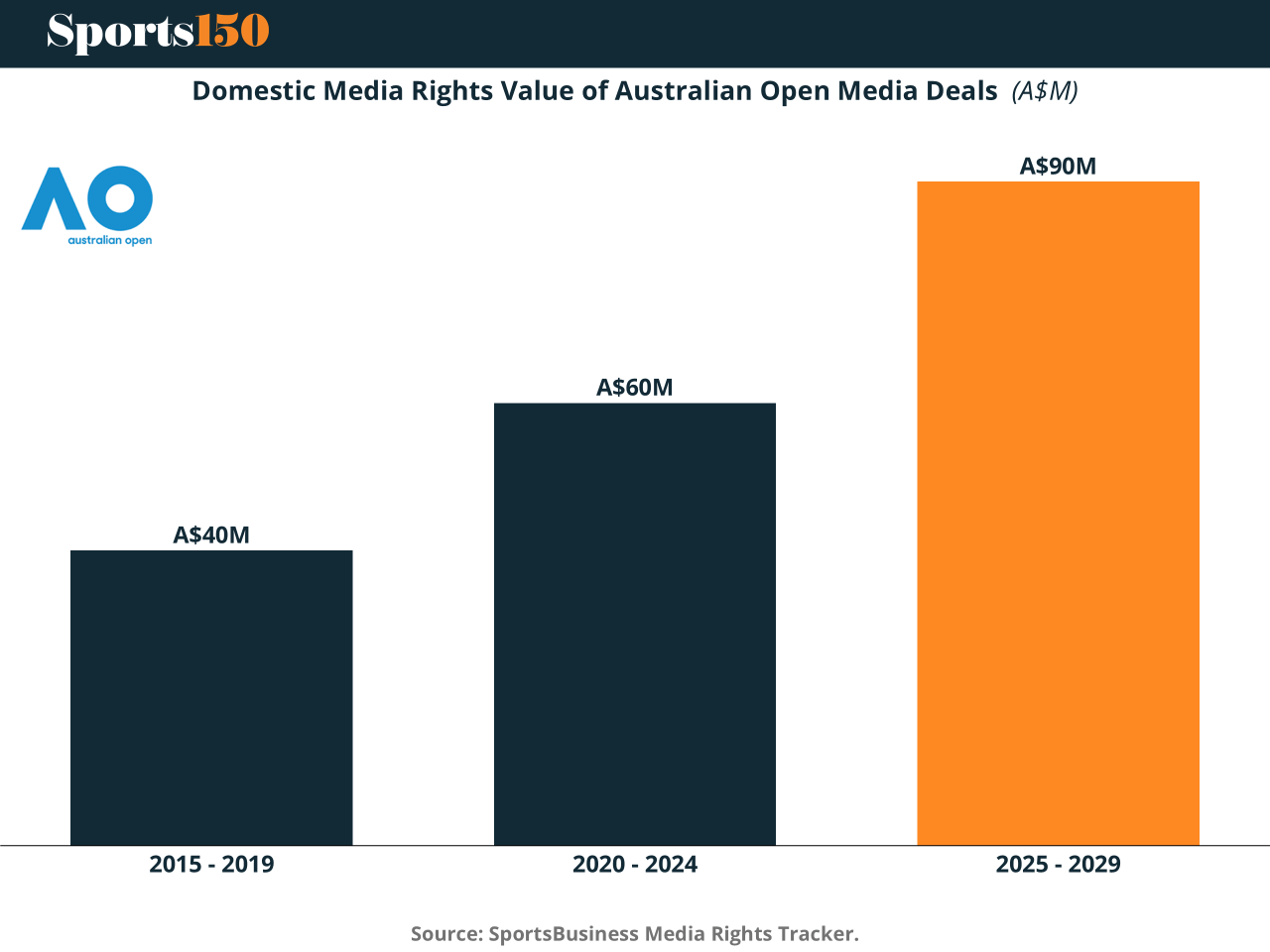

Over the past decade, domestic media rights have climbed in powerful steps. The progression from roughly A$40 million per year in the 2015–2019 cycle to A$60 million in 2020–2024, and now to approximately A$90 million annually from 2025 to 2029, illustrates a fundamental shift in how the tournament is valued by broadcasters. This escalation reflects not only inflation in sports rights, but the strategic repositioning of the Australian Open as a premium, multi-week content platform rather than a two-week tennis event.

The most recent broadcast renewal with Nine Network anchors this transformation. The agreement secures near-continuous free-to-air and digital exposure across linear television, streaming and social platforms through 2029. The commercial impact is immediate. In 2025 alone, domestic media revenue reached a new high, providing a predictable and scalable revenue base that Tennis Australia could confidently allocate toward player compensation and long-term investment.

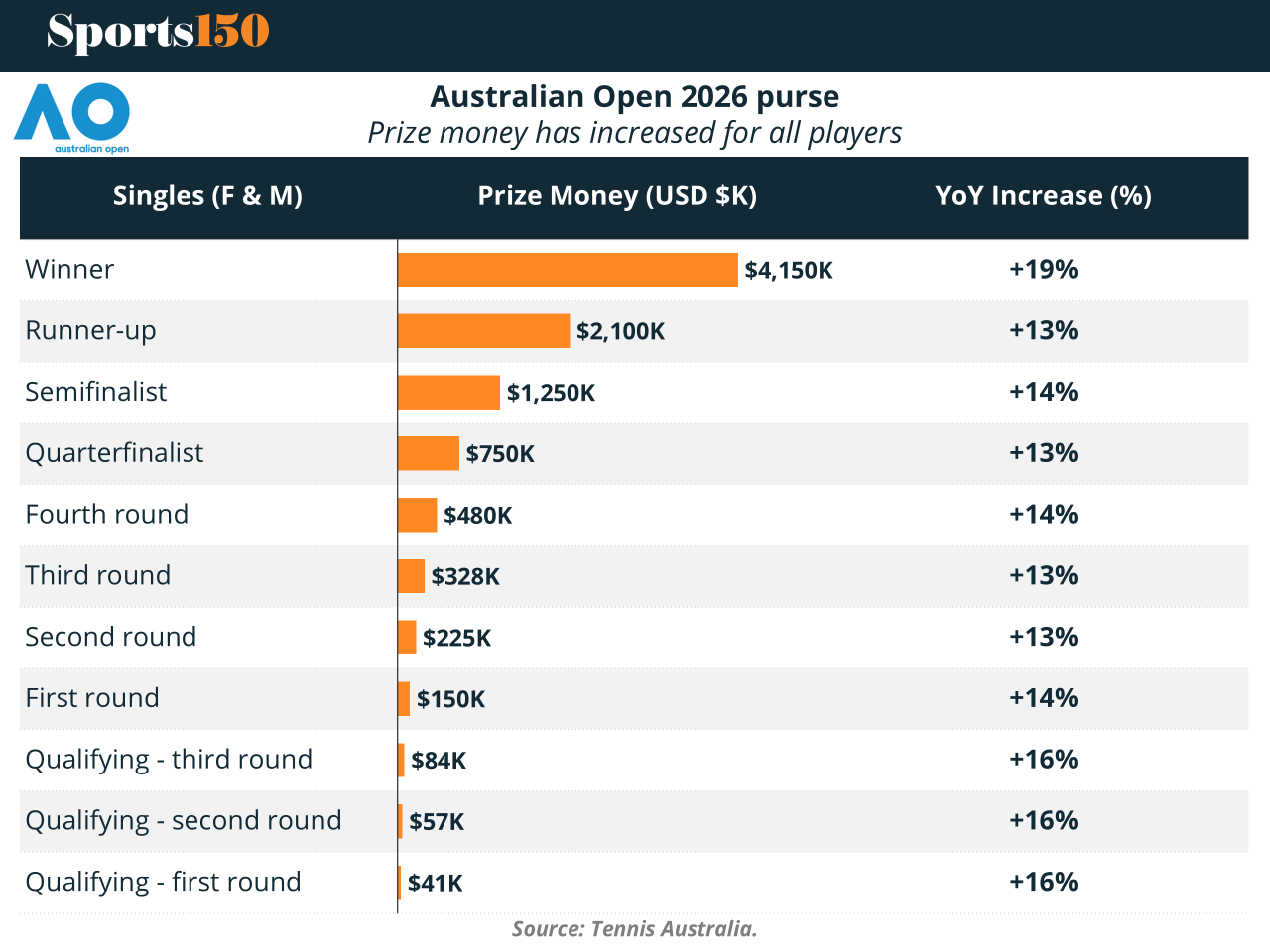

That media revenue surge is now clearly visible in the prize money structure. The Australian Open’s total prize pool reached more than $111 million for 2026, a 16 per cent increase year-on-year and the largest in tournament history. The winners’ cheques climbed to $4.15 million each, while qualifying and early-round payments recorded double-digit percentage increases. These gains are not symbolic gestures; they are systemic reallocations made possible by broadcast cash flow.

The distribution chart tells the story vividly. Every round benefits, from champions to first-round qualifiers. In some qualifying stages, year-on-year increases reach 16 per cent. This broad-based uplift mirrors Tennis Australia’s stated objective of sustainability across the professional ecosystem, but it also reflects commercial logic. Higher prize money deepens competitive fields, enhances star power, and improves storytelling — all of which feeds back into broadcast ratings and rights valuations.

Media rights are now the keystone in a broader monetisation strategy that blends content, scheduling and audience expansion. The introduction of “Opening Week” extended the tournament to nearly three weeks, generating additional broadcast inventory and programming windows. Qualifying rounds, once peripheral, are now premium live content. This expansion strengthens negotiations with broadcasters who seek long-form, appointment viewing at the start of the sporting calendar.

At the same time, international rights amplify the domestic engine. Distribution agreements across Europe, Asia, the Americas and the Middle East ensure that the Australian Open is delivered into dozens of markets simultaneously, driving cumulative value well beyond Australia’s borders. These global deals underpin sponsorship demand, as brands increasingly buy into worldwide exposure rather than single-market reach.

Crucially, the media model also stabilises tournament finances. While ticketing and sponsorship fluctuate with attendance and economic cycles, broadcast contracts deliver multi-year certainty. That stability explains why Tennis Australia has been willing to commit aggressively to prize money growth, player welfare programs, and travel assistance. It also explains the tournament’s ability to outpace Wimbledon in recent prize pool rankings and narrow the gap with the US Open.

The feedback loop is now firmly established. Higher rights fees fund higher prize money. Higher prize money attracts deeper fields and stronger narratives. Stronger narratives lift audiences. Larger audiences justify the next cycle of rights inflation.

In this model, the Australian Open is no longer just a tennis tournament. It is a year-opening global content franchise, designed for broadcasters and streamers as much as for fans in Melbourne Park. The record prize pools of 2025 and 2026 are therefore not anomalies. They are the first visible dividends of a media-first strategy that has repositioned the “Happy Slam” at the center of the international sports rights economy.

Sources & References

Australian Open. (2026). Australian Open announces record $111.5 million prize pool. https://ausopen.com/articles/news/australian-open-announces-record-1115-million-prize-pool

Sportcal. (2026). Preview: Australian Open ready to serve up commercial success. https://www.sportcal.com/features/preview-australian-open-ready-to-serve-up-commercial-success/?cf-view&cf-closed

Sports Business. (2026). Net gains: Unpacking the Australian Open commercial strategy. https://www.sportbusiness.com/2026/01/net-gains-unpacking-the-australian-open-commercial-strategy/

Sports Mint. (2026). Australian Open expands commercial portfolio with new wave of major brand partners. https://sportsmintmedia.com/australian-open-expands-commercial-portfolio-with-new-wave-of-major-brand-partners/

The Guardian. (2026). Australian Open prize money increased to record high thanks to Tennis Australia boost. https://www.theguardian.com/sport/2026/jan/06/australian-open-prizemoney-after-tennis-australia-boost

Yahoo Sports. (2026). How Australian Open’s clever marketing for Opening Week has led to $500 million growth. https://sports.yahoo.com/articles/australian-open-clever-marketing-opening-173000953.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAGGFIBfw2cG2iQjh9ioNQSkQuqjjsPlVZxuV8tR8buoqswed8kOuBvEj_7YzH_6YA5BJGAPTXcCUyQp0JjCHlWseIDTjqWWrz-wjOqyEDvfN9mzxhUR5MoJsYG6-QB5DkdmAc8c_ZyJ_Bn0cc0Em7T4hTK_l_gpSTExMueEnCZDC