- Sports 150

- Posts

- $1B Franchises, 640M Fans & the New Sports Playbook

$1B Franchises, 640M Fans & the New Sports Playbook

This week we’re looking at how sports is being built, sold, and scaled—from LA28’s Hollywood-style Olympics powered by existing venues.

Good morning, ! This week we’re looking at how sports is being built, sold, and scaled—from LA28’s Hollywood-style Olympics powered by existing venues, to the Drive-to-Survive effect turning storytelling into fan-growth infrastructure. We break down KKR’s $1B move into sports ownership, the rise of esports to 640M global viewers (+47% since 2020), and how David Beckham’s $25M MLS clause became a $1B franchise blueprint.

Sponsor spotlight: Affinity helps deal teams capture relationship signals automatically and map firm-wide connections—so you can source and move faster. Book a demo →

eSPORTS

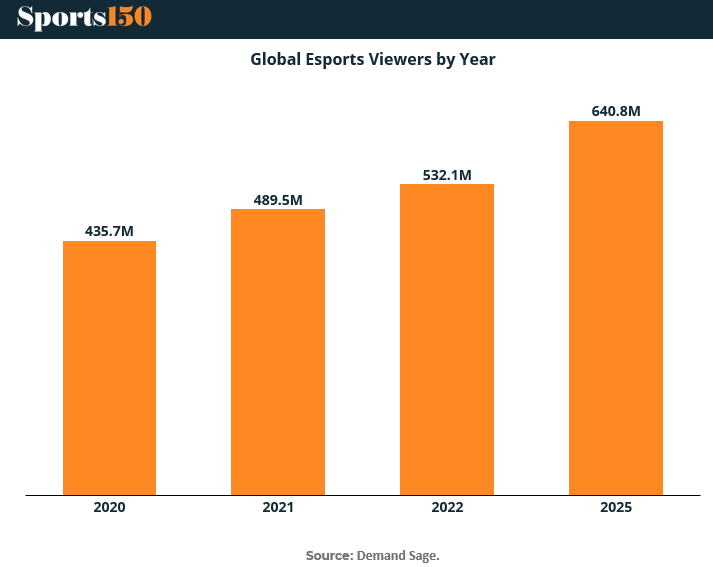

Global Viewership Clocks In at 640M, Up 47% Since 2020

eSports isn't just growing—it’s compounding. According to Demand Sage, global esports viewership is expected to hit 640.8M by 2025, up from 435.7M in 2020. That’s a 47% increase in just five years, with annual gains accelerating post-pandemic.

This surge tracks with the platform shift: mobile-first formats, Twitch-native leagues, and hybrid event models are expanding the reach well beyond legacy PC and console games. Titles like League of Legends, Valorant, and Mobile Legends are pushing consistent 7–8 figure live audiences across major tournaments.

Why it matters: At nearly two-thirds of a billion viewers, esports is no longer a niche—it’s a parallel universe to traditional sports. For media buyers, sponsors, and investors, the demographic skew (young, global, digital-native) makes this one of the most underpriced attention markets in sports. Expect valuations, rights deals, and monetization infrastructure to follow the eyeballs. (More)

MEDIA & SPORTS

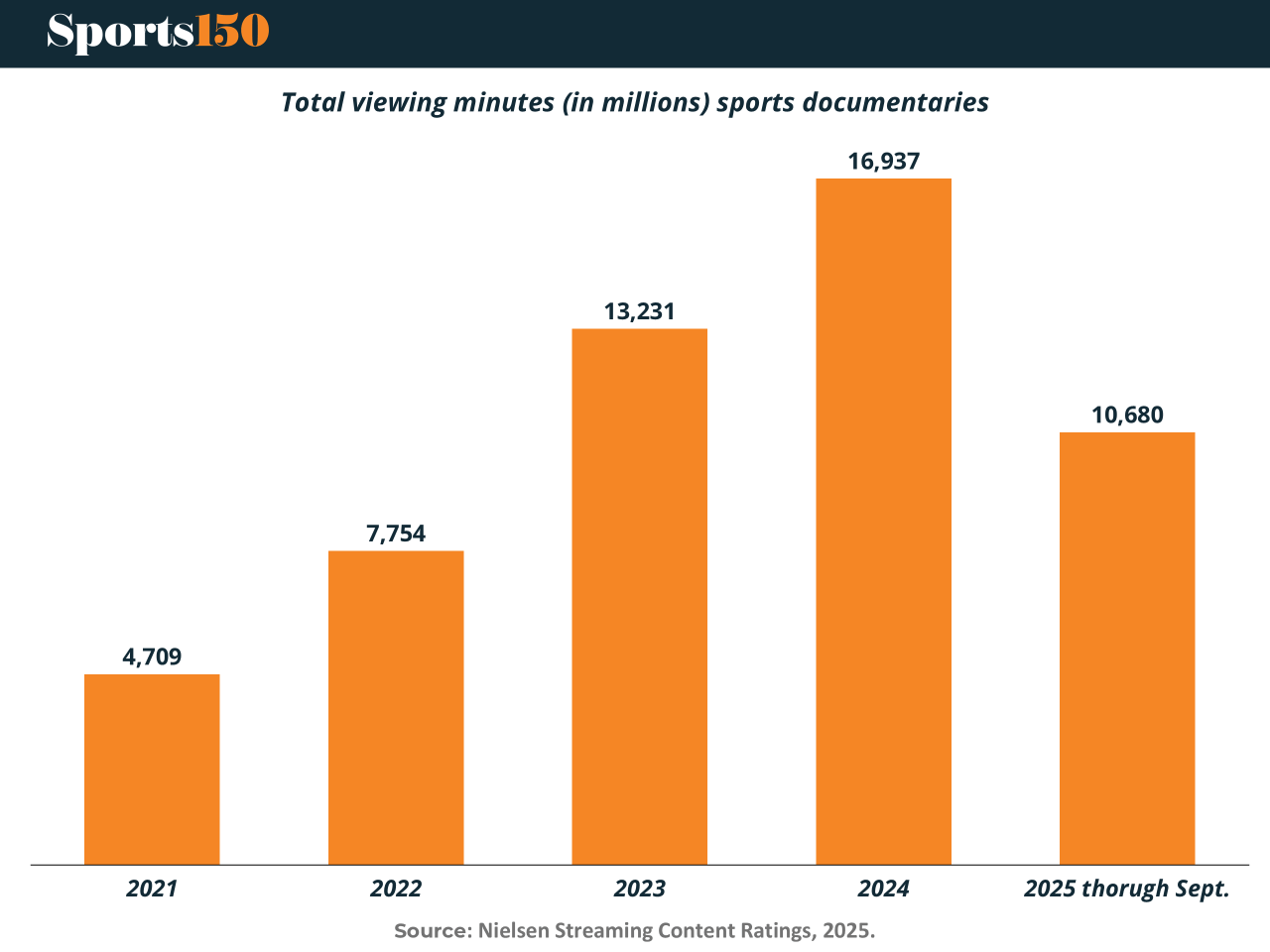

The Drive-to-Survive Effect

Sports documentaries have quietly become one of the most effective fan acquisition tools in media. Since Netflix launched Formula 1: Drive to Survive in 2019, average U.S. viewership for F1 Grand Prix races on Disney’s linear networks has more than doubled. Correlation isn’t causation—but it’s not a coincidence either.

Streaming turned documentaries from one-off programming into always-on engagement engines. Total viewing time for streaming sports documentaries jumped from 4.7 billion minutes in 2021 to nearly 17 billion minutes in 2024, with 2025 tracking at similar levels.

The halo is now spilling into scripted content. Apple’s F1, starring Brad Pitt, became the platform’s biggest theatrical hit and Pitt’s highest-grossing film, before heading to Apple TV+ this December.

The takeaway: storytelling isn’t just marketing—it’s infrastructure for fandom. (More)

PRESENTED BY AFFINITY

Affinity is the CRM built for private equity teams. Emails and calendar activity are captured automatically, with firm-wide relationships mapped to target companies and intermediaries so deal teams can see existing connections without manual data entry.

A firm's network is its edge. Relationship intelligence turns that network into action with purpose-built AI that maps firm-wide connections to accelerate deal sourcing, strengthen diligence, and deepen portfolio oversight.

By centralizing relationship context across the deal lifecycle, firms can act earlier, stay aligned, and avoid paying fees for connections they already have.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

When Roles Only Exist on Paper (Value Creation)

What breaks teams before it shows up on a dashboard? According to Shiv Narayanan, Founder of leading PE growth consultancy, How To SaaS, dysfunction rarely starts with a blowup, it creeps in through misaligned incentives, ghost roles, and busyness masquerading as strategy.

In this week's featured episode, Narayanan outlines familiar yet dangerous failure modes:

Marketing and sales running parallel instead of together, “leaders” without true ownership, and teams producing at full tilt without knowing why. The diagnosis is blunt: these aren’t tool problems, they’re structural ones. And AI? It just accelerates the direction you’re already going.

The conversation is worth a listen for anyone scaling a firm, running GTM at a portco, or trying to make cross-functional teams actually function. One key quote stuck with us: “Tools don’t fix lack of clarity. They make confusion scale.”

ENTREPRENEURS

David Beckham’s $25M Clause Becomes a Billion-Dollar Pivot

When David Beckham signed with the LA Galaxy in 2007, few understood the real asset wasn't his right foot—it was a $25M expansion clause baked into his MLS contract. That clause gave Beckham the option to buy an MLS team at a fixed price. He exercised it in 2014. Today, that team—Inter Miami CF—is worth over $1B. Watch the Video Here.

It wasn’t a vanity project. Beckham built the club from scratch: assembling investors, fighting for league approval, securing land, and selling the MLS vision to global icons. His playbook combined brand leverage and business execution—culminating in Lionel Messi’s arrival in 2023, a move that exploded Inter Miami’s commercial value and turned MLS into appointment viewing.

Beckham isn’t just a co-owner. He’s the face, voice, and handshake behind the deals. His ability to translate personal equity into institutional capital is now a case study for athletes turning brand power into enterprise value.

The takeaway: For investors eyeing North American soccer, Inter Miami is proof that franchise value creation in MLS can be engineered—if you start with the right terms and global ambition. (More)

INVESTOR CORNER

KKR’s Sports Power Play: Arctos at a $1B Valuation

KKR is entering the sports franchise game in earnest, acquiring Arctos Partners at a $1 billion valuation, per Bloomberg. The deal gives the private equity giant direct exposure to one of the most aggressive consolidators in pro sports—Arctos holds minority stakes across the NBA, MLB, NHL, and MLS. Incentives could push the deal's value closer to $1.5 billion, with co-founder Ian Charles staying on to lead operations.

This is more than portfolio diversification. KKR plans to fold Arctos into its broader asset management business, a move that positions sports as a scalable, institutional-grade asset class. But first, the deal needs greenlights from major leagues, whose reviews reportedly focus on preventing endorsement-related conflicts with KKR’s existing portfolio companies.

Why it matters: The Arctos buy signals that top-tier PE firms see long-term yield in sports equity—not just as trophy assets, but as legitimate platforms for AUM growth. With the NFL now allowing PE ownership (up to 10%) and the Ross-Arctos Index showing outperformance vs. the S&P 500, sports franchises are becoming a credible alternative asset. KKR just drafted itself into the game. (More)

TECH & INFRASTRUCTURE

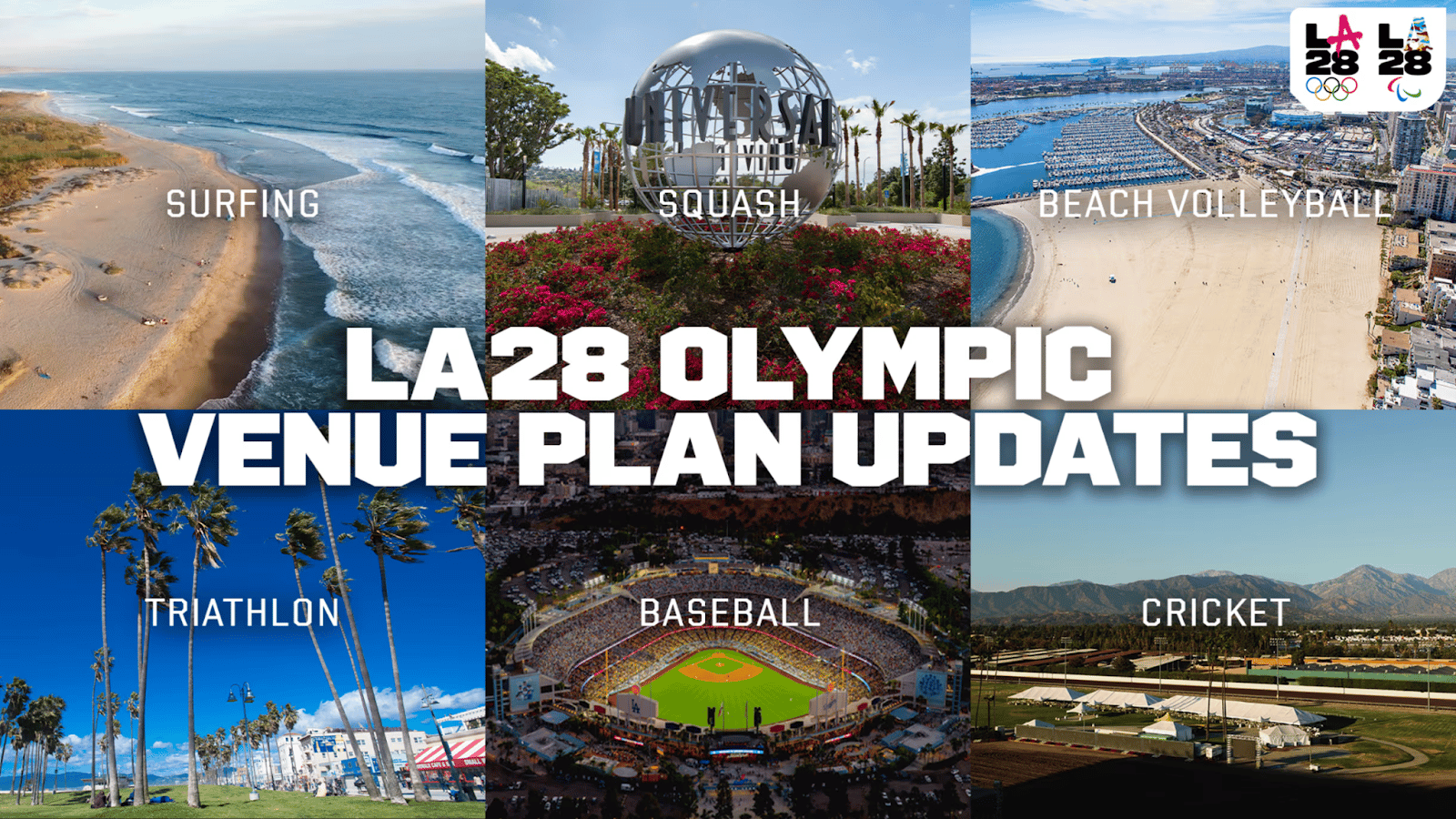

LA28’s Venue Plan: Lights, Cameras, Olympic Action

Los Angeles is pitching the 2028 Olympics as a Hollywood blockbuster—minus the billion-dollar construction budget. The newly unveiled LA28 venue plan reads like a location scout’s dream, featuring Dodger Stadium, the Rose Bowl, and even Universal Studios’ Courthouse Square, where squash will debut in front of a literal movie set. Meanwhile, flag football, lacrosse, and coastal rowing are making their Olympic comeback, hosted at legacy stadiums from the 1932 and 1984 Games.

Instead of building shiny new arenas, LA28 is flexing LA’s existing infrastructure like it’s got a six-pack of sports architecture. Downtown LA becomes a dense Olympic hub, while Long Beach, Venice, and even San Fernando Valley get a piece of the action. Zero new permanent venues. Full Hollywood flair. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Do not be embarrassed by your failures, learn from them and start again."

Richard Branson